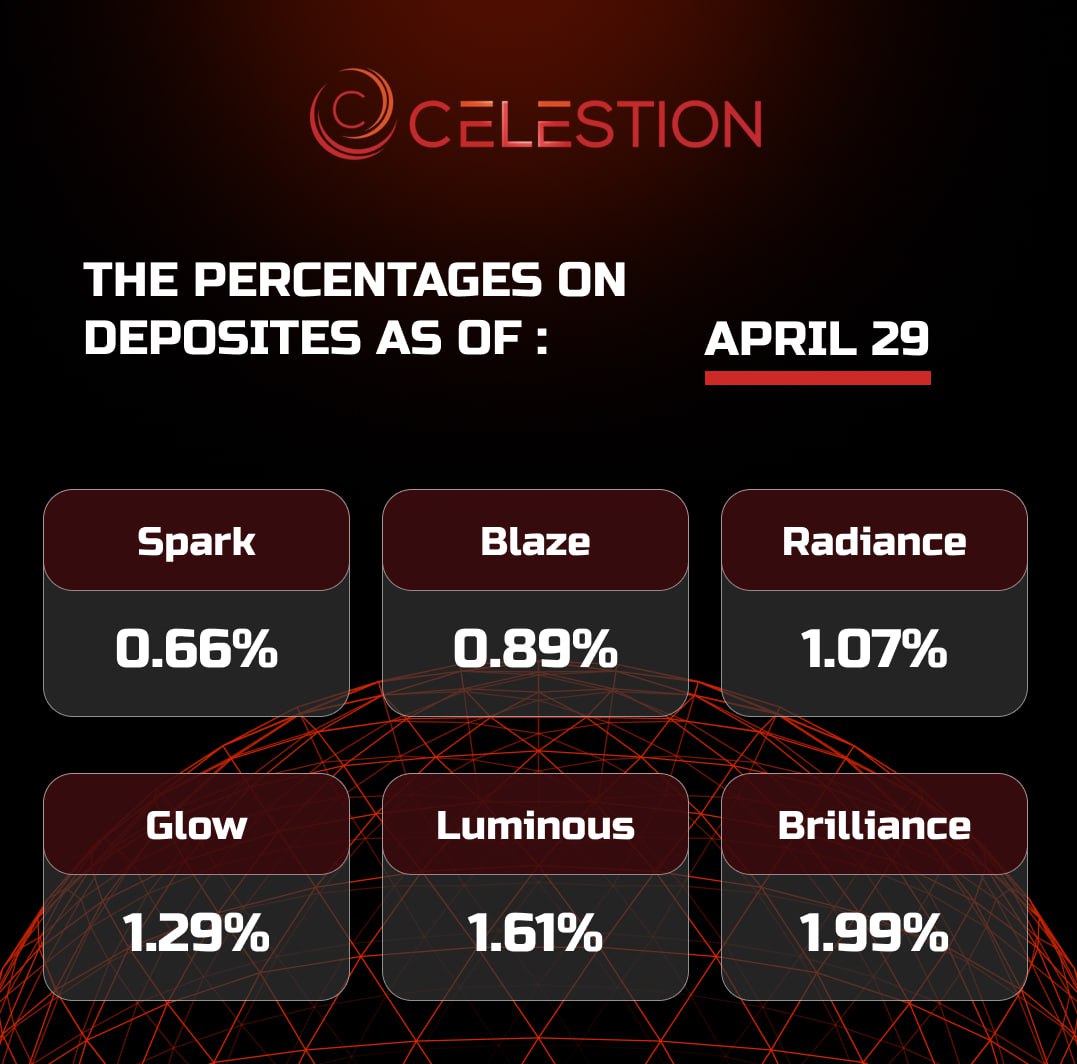

The percentages on deposits as of April 2️⃣9️⃣

Apr-29-2025

Read more

Bitcoin to rise to $120,000 in Q2, to $200,000 by year-end ✔️

Apr-29-2025

Jeffrey Kendrick of Standard Chartered (LON: STAN ) predicts that Bitcoin will reach $120,000 in the second quarter of 2025 and grow to $200,000 by the end of the year.

He cited the strategic redistribution of assets by large investors and the growth in the inflow of funds into spot Bitcoin ETFs as key catalysts for this.

The premium on U.S. Treasuries, which historically closely correlate with Bitcoin price movements , has reached a 12-year high, Kendrick said, suggesting that U.S. investors may be shifting capital out of domestic bonds and into alternative assets like BTC.

The expert also recalled the dynamics of the Bitcoin price in previous cycles, when periods of sideways movement often preceded sharp rises.

Bitcoin is currently trading at $94,500, about seven times higher than its November 2022 low and adding to optimism for an imminent rally.

If the flagship cryptocurrency rises to $120,000 in the second quarter, as Kendrick predicts, it would be a new all-time high that would surpass previous peaks in late 2021 and early 2022. Standard Chartered expects the rally to eventually take Bitcoin to $200,000 by the end of 2025.

Read more

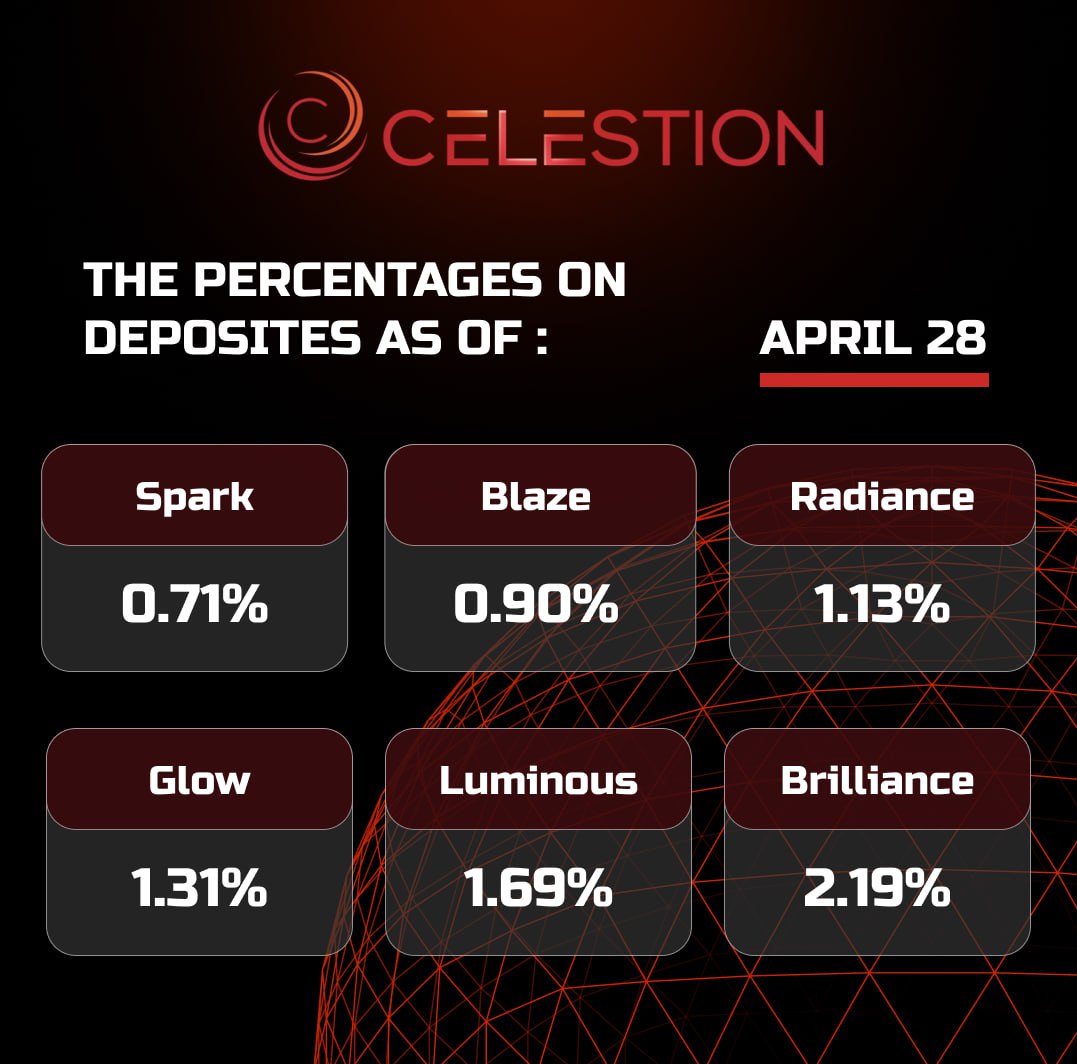

The percentages on deposits as of April 2️⃣8️⃣

Apr-28-2025

Read more

Solana Ecosystem Invested Nearly $1 Billion Last Week ✔️

Apr-28-2025

Thanks to Bitcoin's success, Solana has been on the rise lately - last week, several organizations and venture capital firms announced investments in the Solana ecosystem totaling $1 billion.

Three organizations have announced $100 million in Solana cryptocurrency purchases. Investment firm GSR has made a $100 million private investment in brand developer and distributor UPEXI. Most of the funds are intended to accumulate Solana-based assets.

Seoul-based cryptocurrency payment provider BAstra Fintech has launched a $100 million fund to accelerate innovation initiatives built within the Solana ecosystem. The fund aims to “identify and support high-potential builders, startups, and innovative projects within the rapidly expanding Solana network.”

Finally, Michael Novogratz's Galaxy Digital exchanged $100 million ETH for SOL on the Binance crypto exchange, the transactions took two weeks.

On April 23, Canada's SOL Strategies announced that it had received up to $500 million from New York-based investment firm ATW Partners, which will be used to purchase SOL tokens and earn staking rewards.

On April 24, Prague-based venture capital firm RockawayX launched another fund to provide Solana developers with another $125 million. The funds will finance revenue-generating projects, with two-thirds of the funds going to early-stage seed startups.

Read more

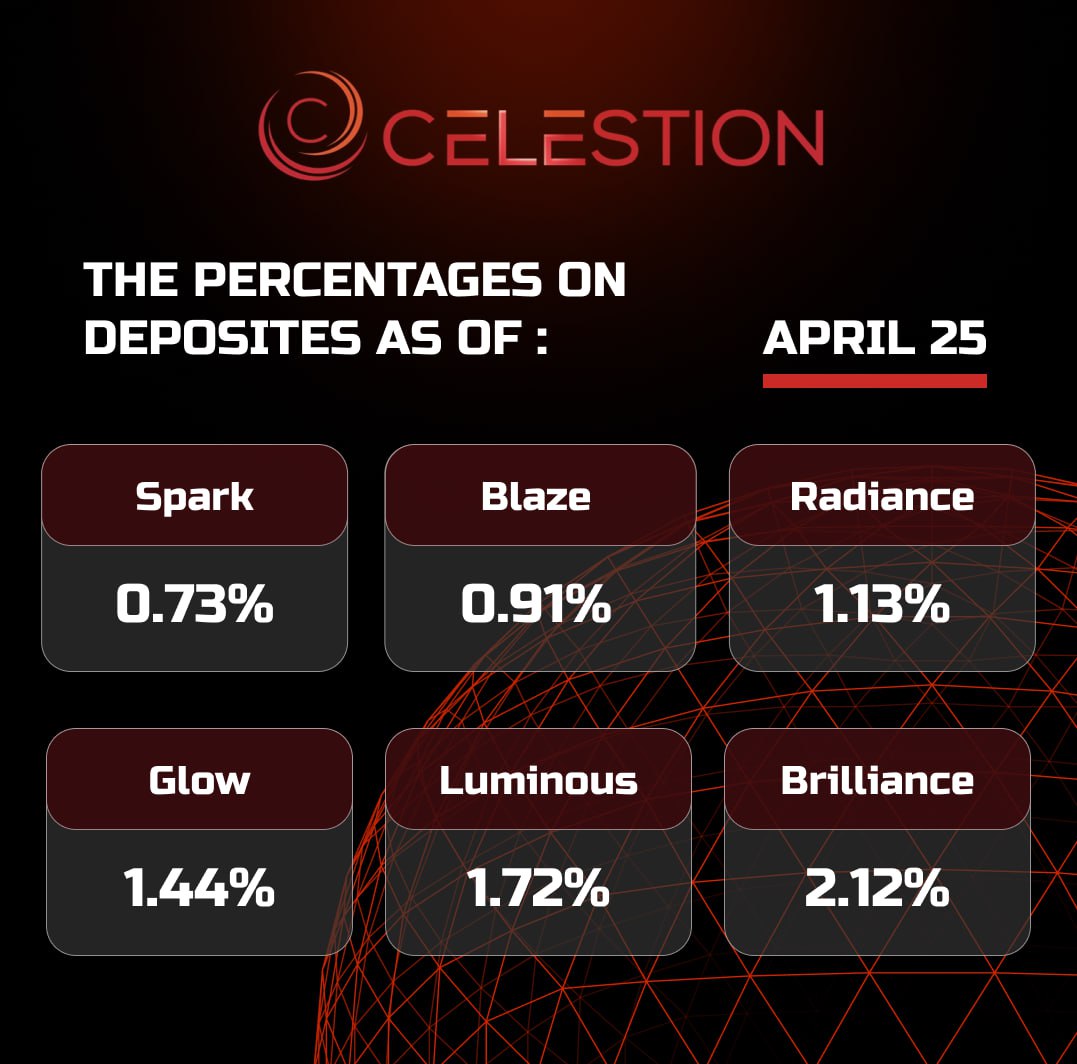

The percentages on deposits as of April 2️⃣5️⃣

Apr-25-2025

Read more

Bitcoin stocks on crypto exchanges fall to November 2018 levels ✔️

Apr-25-2025

Bitcoin holdings on cryptocurrency exchanges have fallen to their lowest level in more than six years, according to Fidelity Digital Assets, as public companies ramp up their accumulation of the flagship asset following the US presidential election.

We are seeing a decline in the supply of Bitcoin on exchanges due to purchases by public companies and expect this process to accelerate in the near future, Fidelity analysts said.

The amount of Bitcoin on exchanges has fallen to around 2.6 million BTC, the lowest since November 2018. Since that month, more than 425,000 BTC have been withdrawn from trading platforms, which is often seen as a sign of long-term investment rather than short-term trading.

Over the same period, public companies have purchased nearly 350,000 BTC, Fidelity said, with Strategy making up the bulk of the accumulation. Since November, Michael Saylor's company has purchased 285,980 bitcoins, or 81% of the total.

Outside the US, public companies in Asia are also investing heavily in Bitcoin. Metaplanet currently holds 5,000 BTC, and CEO Simon Gerovich has said management aims to double its Bitcoin balance this year.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI