The percentages on deposits as of April 2️⃣4️⃣

Apr-24-2025

Read more

📢 Official Announcement from Celestion

Apr-24-2025

We are pleased to inform all users of the Celestion platform that CELESTION FOUNDATION PTY LTD has successfully passed its annual compliance audit conducted by the Australian Securities and Investments Commission (ASIC). (https://connectonline.asic.gov.au/RegistrySearch/faces/landing/panelSearch.jspx?searchType=OrgAndBusNm&searchText=676830014)

As a result of meeting all regulatory requirements, our ASIC licence has been officially renewed and extended until 24 April 2026.

✅ What this means for you:

Continued transparency and accountability.

Ongoing compliance with Australia's strict financial and corporate regulations.

Reinforced trust in the Celestion ecosystem.

A strong foundation for future growth and innovation in the Web3 space.

This milestone underscores our unwavering commitment to operating with integrity and in full alignment with regulatory standards. We thank our community for your ongoing support and trust in Celestion.

Let’s continue to build a secure and compliant Web3 future — together.

Celestion Team!

Read more

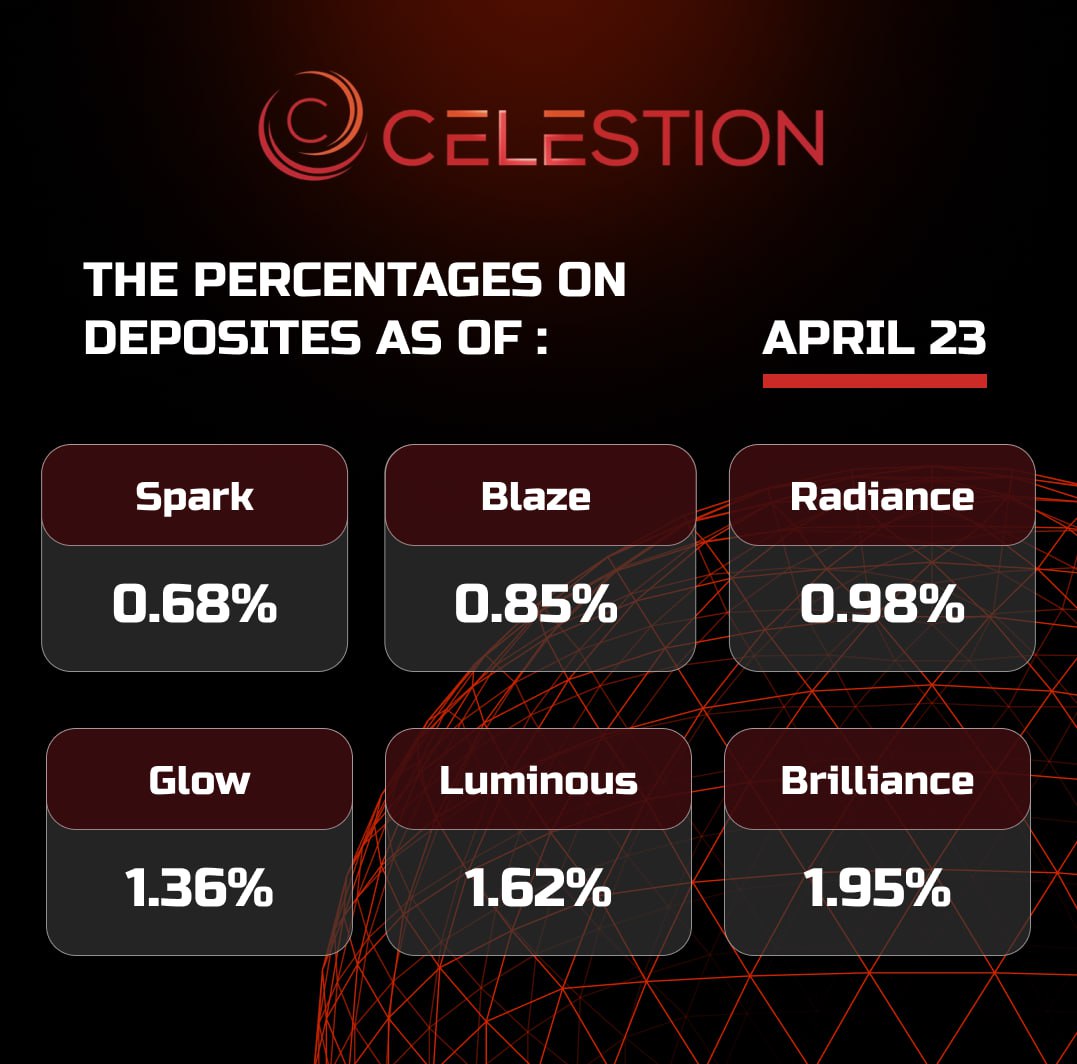

The percentages on deposits as of April 2️⃣3️⃣

Apr-23-2025

Read more

Dogecoin memecoin has every chance to grow to $0.2290 ✔️

Apr-23-2025

Over the past 24 hours, the Dogecoin (DOGE) meme token has risen in price by almost 9% to $0.1716. This is still 65% below the maximum price recorded in November last year. However, the asset has the prerequisites for further growth.

Based on the daily chart, the DOGE rate may grow by another 45% above the current level, that is, to $0.2290. Since November, the asset has been forming a “falling wedge” pattern, the upper side of which connects the highest levels since December 8, and the lower side connects the lowest levels since November last year.

These two trend lines are now approaching the intersection point where breakouts usually occur. In addition, the relative strength index has broken through the neutral level of 50, indicating that momentum is increasing.

Other technical indicators also suggest that DOGE is likely to rally in the coming days, especially if Bitcoin continues to approach the psychological $100,000 mark.

Dogecoin has a number of fundamental catalysts that could push its price higher in the coming weeks. Most notably, Paul Atkins has become the new chairman of the U.S. Securities and Exchange Commission, making it more likely that he will approve a DOGE spot ETF from Grayscale and Rex-Osprey.

Read more

USDC (TRC20) & USDC (BEP20) are now available!

Apr-22-2025

We are excited to announce that we have expanded our platform by adding new currencies! 🎉

Now you can invest, profit, exchange, and withdraw funds in USDC (BEP20) and USDC (TRC20).

💰 Minimum withdrawal limits:

🔹 USDC (BEP20) – 5 USDC

🔹 USDC (TRC20) – 10 USDC

💰 Withdrawal Fee:

🔸 USDC (TRC20) - 2 USDC

Stay tuned—many more updates and improvements are on the way! 📈

Thank you for choosing Celestion.

We wish you stable profits and successful investments.

Sincerely,

The Celestion Team !

Read more

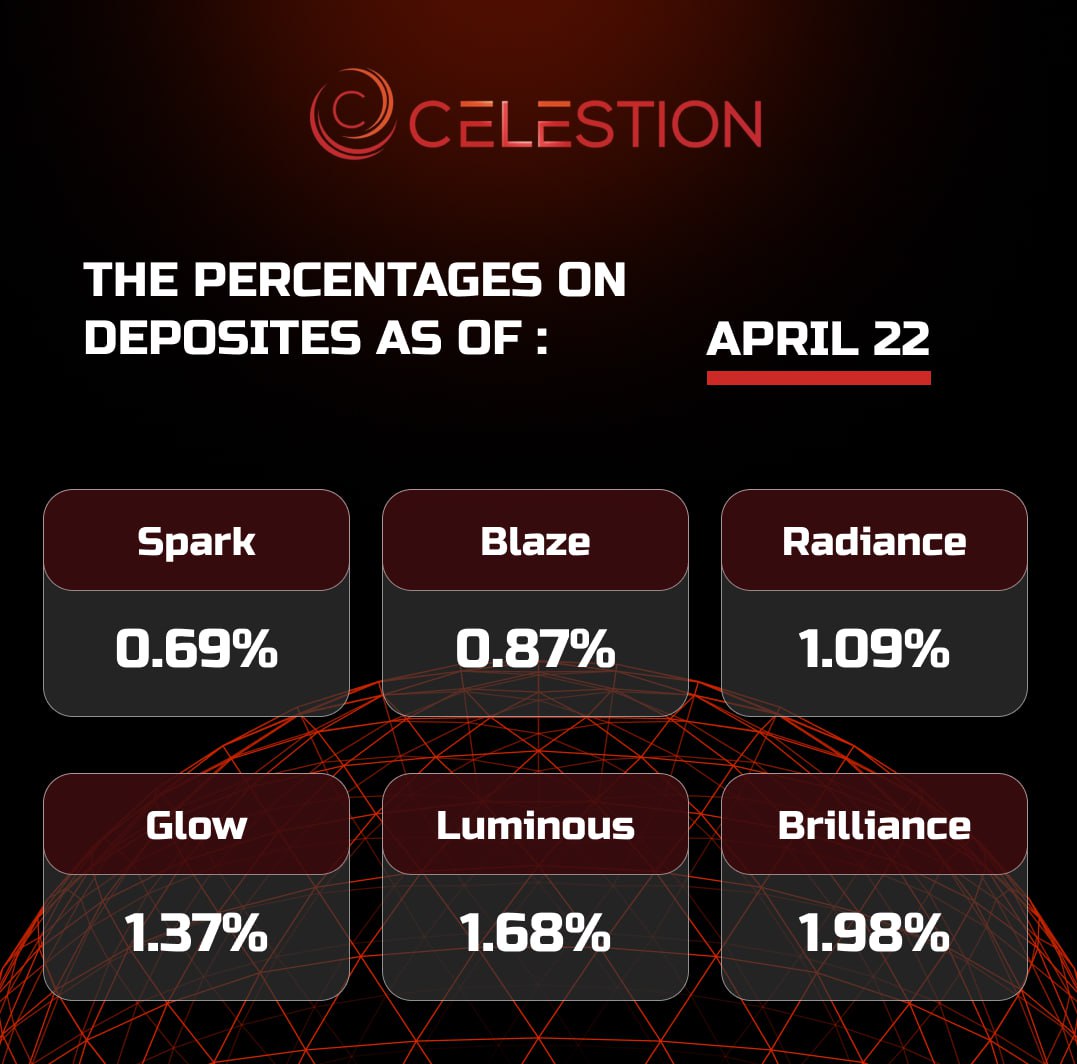

The percentages on deposits as of April 2️⃣2️⃣

Apr-22-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI