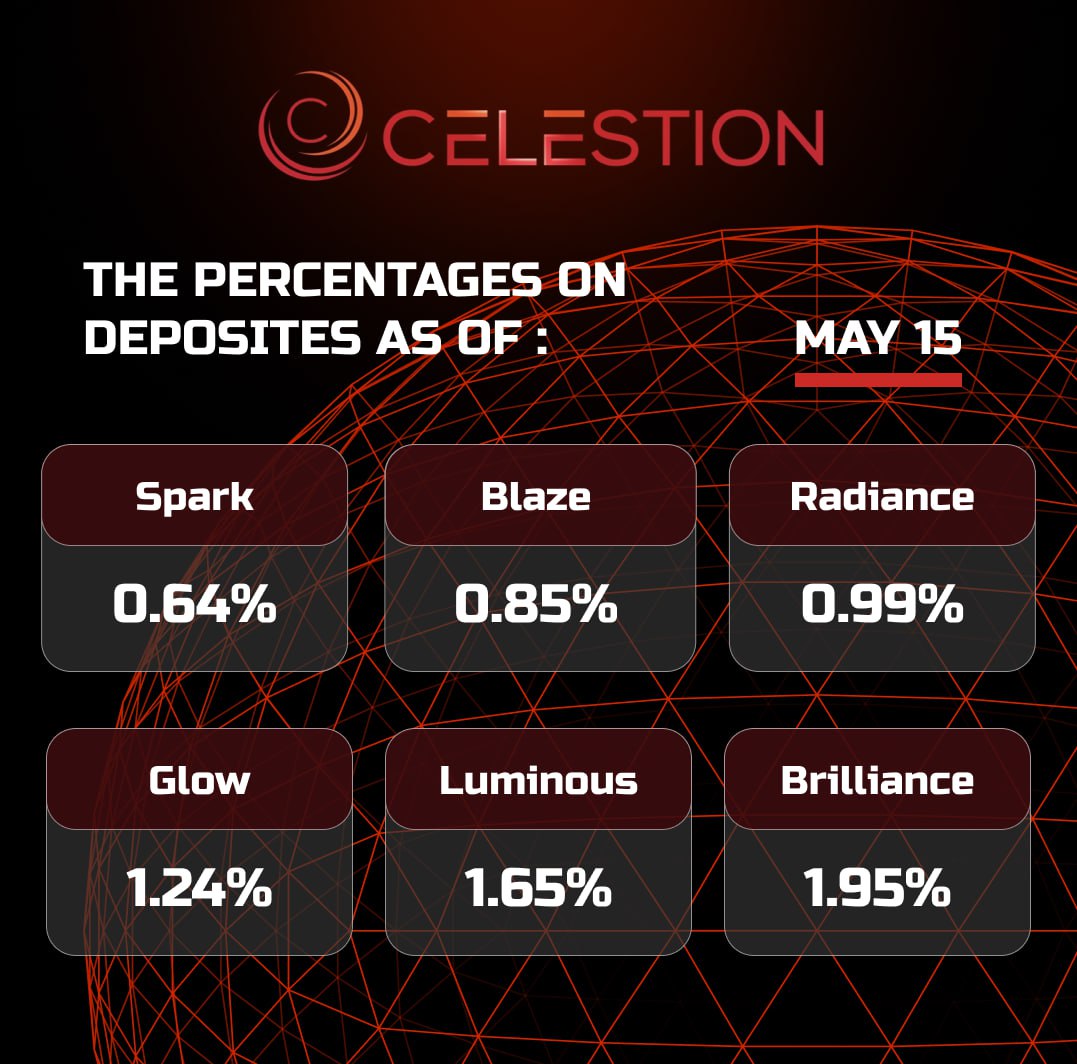

The percentages on deposits as of May 1️⃣5️⃣

May-15-2025

Read more

$1.2 billion worth of Ethereum withdrawn from crypto exchanges in seven days 🔰

May-15-2025

Sentora (formerly IntoTheBlock) reported that $1.2 billion worth of Ethereum was withdrawn from centralized exchanges over the past seven days. This indicates that the altcoin is continuing to accumulate and selling pressure is easing.

The steady trend towards outflow of funds has intensified since the beginning of May, but in the period from April 24 to May 1 this indicator was negative.

Notably, the last time centralized exchanges recorded a positive inflow of $50 million in Ethereum was on April 27. Just the day before, on April 26, these exchanges saw an outflow of $166.68 million.

Spot funds based on the leading altcoin also saw capital outflows. Lookonchain data from May 13 showed that the combined net outflow from nine ETH ETFs was 4,189,000 ETH, or $10.83 million.

Fidelity led the withdrawals with 3,247,000 ETH ($8.39 million), while its assets fell to 400,916 ETH ($1.04 billion). Grayscale's ETHE led the outflows over the past week, as investors were disappointed with its 2.5% management fee compared to BlackRock's much lower 0.25% fee.

The total net asset value of ETH spot funds has fallen to nearly $8.03 billion, representing 2.84% of the leading altcoin's market cap.

Read more

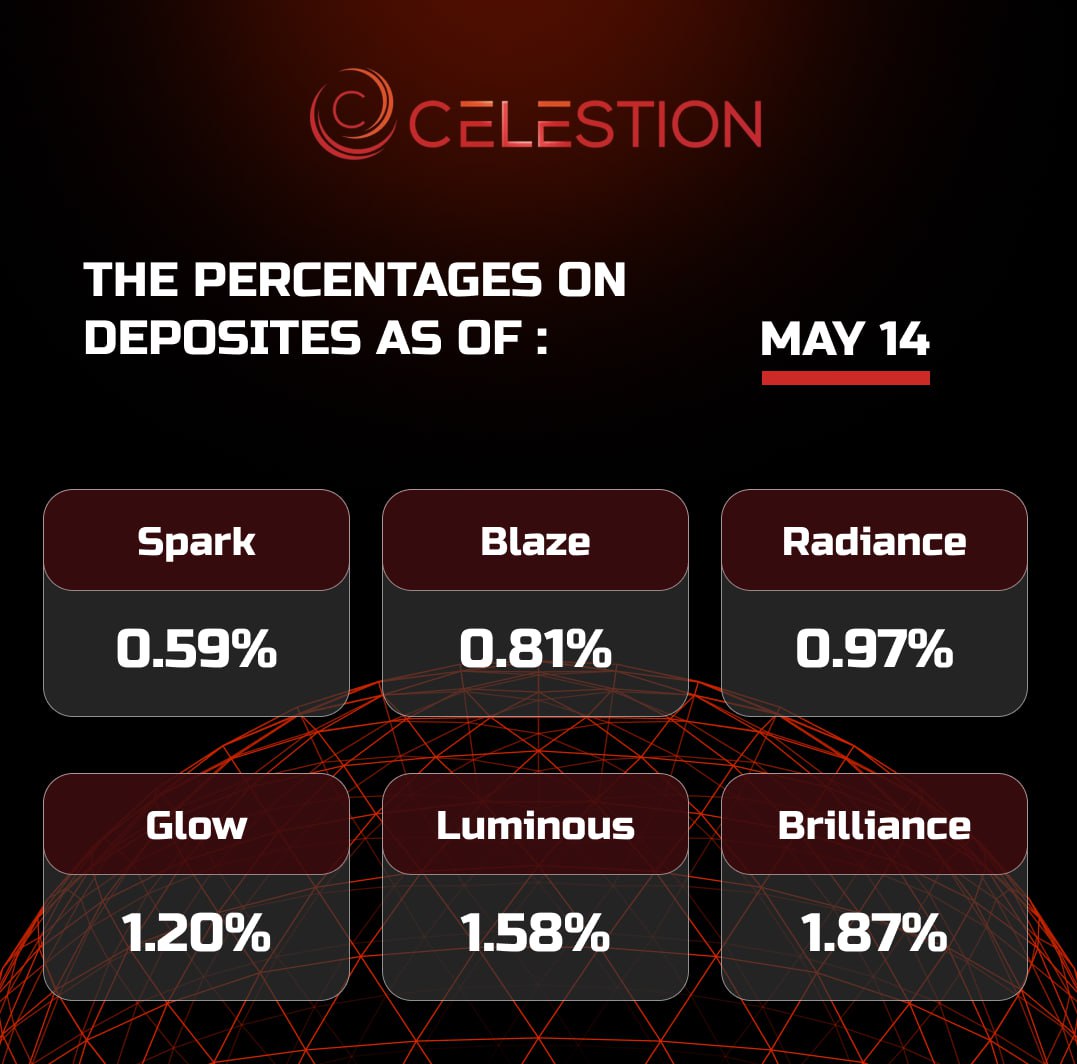

The percentages on deposits as of May 1️⃣4️⃣

May-14-2025

Read more

XRP Surpasses Bitcoin in Trading Volume on South Korean Exchanges ✔️

May-14-2025

XRP Outperforms Other Cryptocurrencies on South Korean Exchanges in Trading Volume. A short-term correction on Tuesday has seen almost all major cryptocurrencies slightly down over the past 24 hours, with the exception of XRP.

On South Korea's largest crypto exchange Upbit, XRP trading volume has surpassed $1 billion in the last 24 hours, surpassing Bitcoin and Ethereum combined, according to CoinGecko.

Apart from Upbit, the other four major crypto exchanges Bithumb, Korbit and Coinone are also seeing increased XRP trading activity.

The renewed interest in XRP in South Korea coincided with a major turning point for the token, with Ripple offering the U.S. Securities and Exchange Commission a $50 million fine to settle its case.

The agency, in turn, is ready to settle its civil lawsuit against two of the organization's executives, Chris Larsen and CEO Brad Garlinghouse.

Jeffrey Kendrick, head of digital asset research at UK bank Standard Chartered (LON: STAN ), predicts that the price of XRP could double to $5.50 this year.

He also expects XRP to rise to $8.00 in 2026 and exceed $10 in 2027. In 2029, the analyst even sees growth to $12.25, which would mean growth of 382%.

Read more

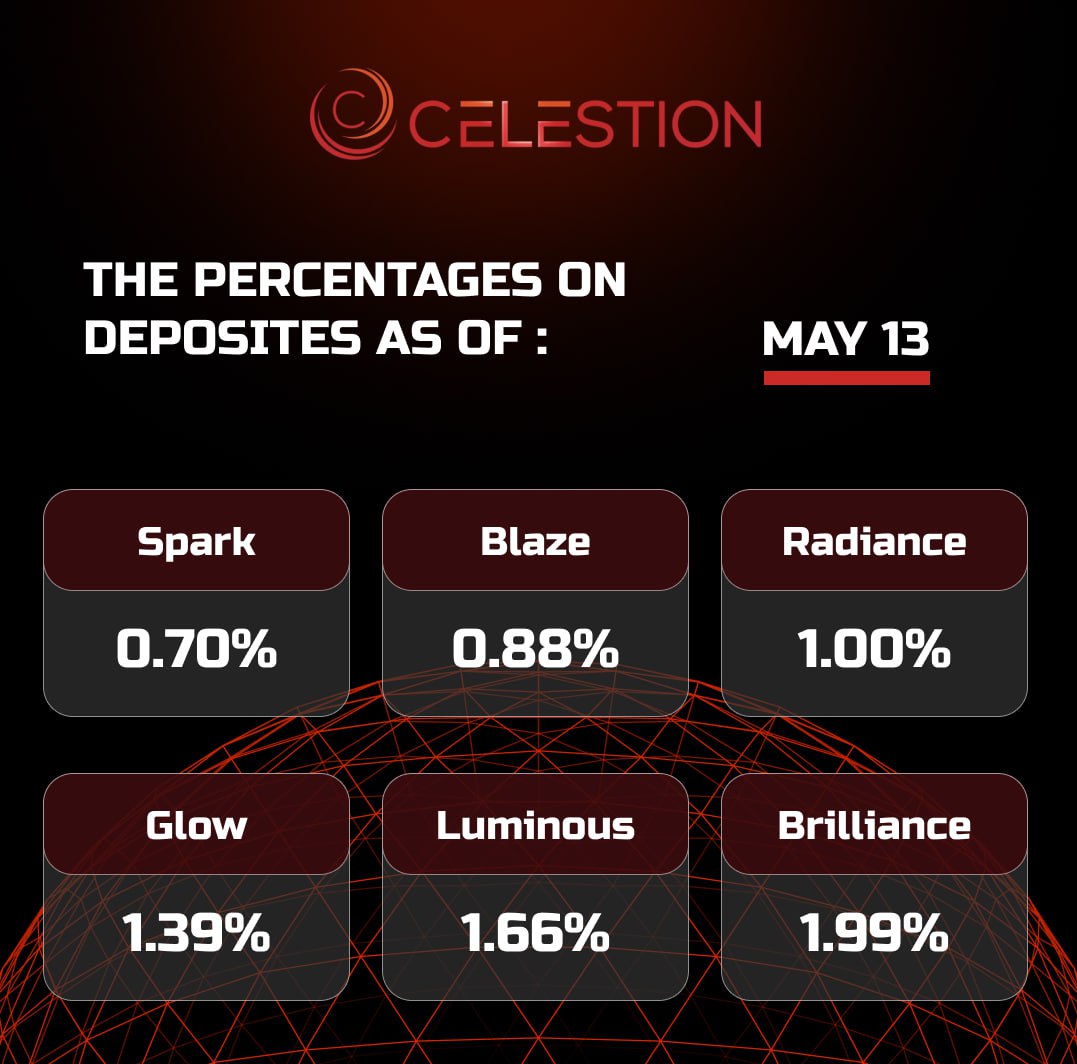

The percentages on deposits as of May 1️⃣3️⃣

May-13-2025

Read more

Ethereum Overtakes Alibaba and Coca-Cola in Market Cap ✔️

May-13-2025

In just five days, Ethereum has risen 42%, overtaking global giants Coca-Cola (NYSE: KO ) and Alibaba (NYSE: BABA ) in market capitalization. The growth follows the successful implementation of the long-awaited Pectra upgrade to the Ethereum mainnet on May 7.

According to market data from 8marketcap, Ethereum's market cap surpassed $308 billion as of Monday, putting the altcoin ahead of Coca-Cola's $303.5 billion and Alibaba's $303.7 billion. At the time of writing, Ethereum ranked 39th in the world by market cap, trailing Bank of America (NYSE: BAC ) by about $7 billion.

The altcoin's rise began almost immediately after the Pectra update, which was launched last Wednesday. The developers called the update "the most ambitious for Ethereum" since The Merge in 2022, when the network switched from a Proof-of-Work consensus algorithm to a Proof-of-Stake consensus algorithm.

Pectra has added a number of technology improvements that make the user experience more convenient and validators more flexible and scalable. Some of the changes include account abstraction now supported, validator staking limits increased, and improved data handling for second-layer scaling.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI