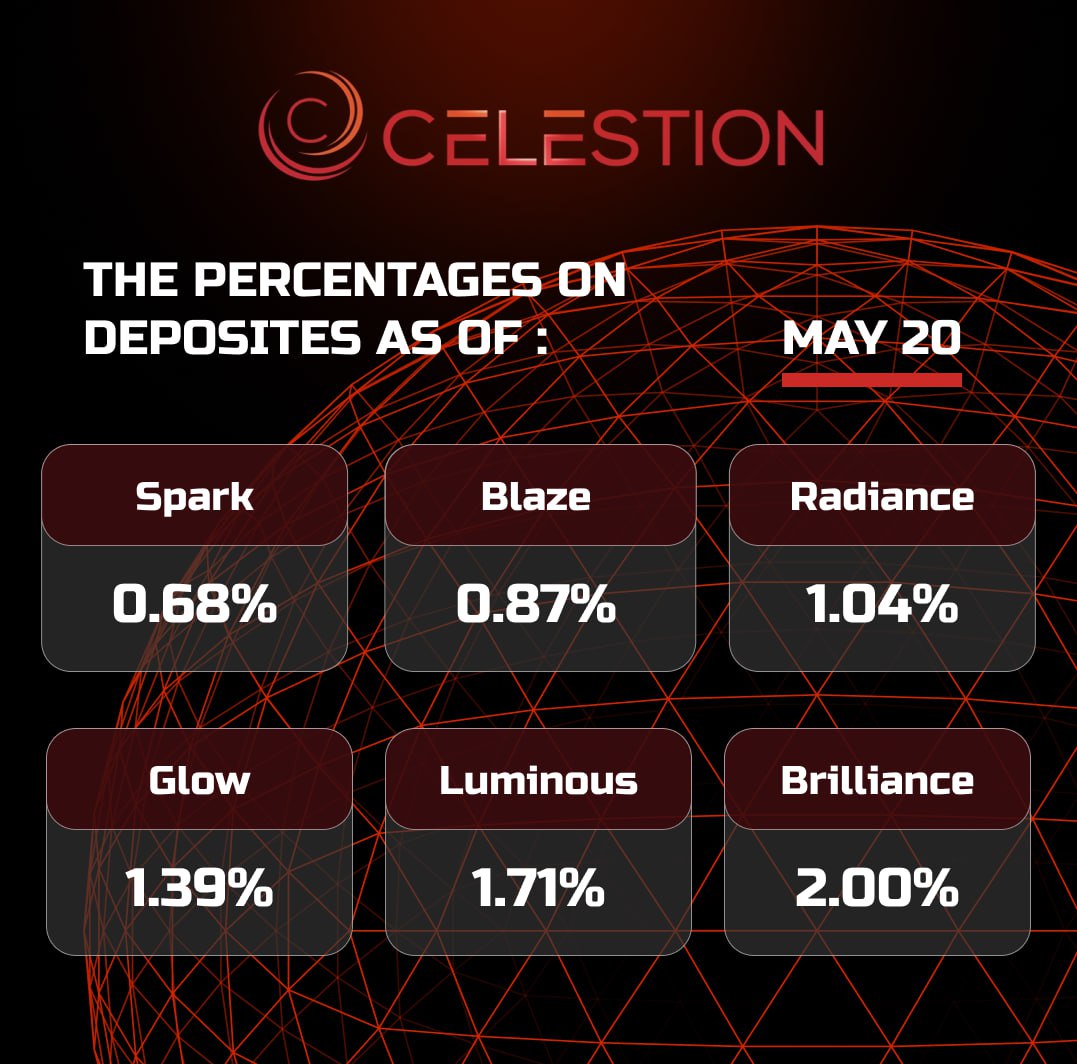

The percentages on deposits as of May 2️⃣0️⃣

May-20-2025

Read more

Federal Court of Australia rules Bitcoin is a form of money ✔️

May-20-2025

The plaintiff was crypto investor David Kale, who challenged the Australian Taxation Office's (ATO) approach to treating bitcoin as an asset, taxing the proceeds from its sale with Capital Gains Tax (CGT) at a rate of up to 45%. Kale argued that bitcoin should be classified as money, not property, which would automatically exempt bitcoin investors from paying tax.

Justice Keil upheld the plaintiff's position, saying that Australian tax law did not provide for CGT to be paid on money that was treated as a medium of exchange rather than as something capable of generating capital gains.

"Because Bitcoin has the characteristics of a currency, such as a medium of exchange and a unit of account, it is simply another form of money. Therefore, Bitcoin may be exempt from capital gains tax," federal Judge Mark Moshinsky ruled.

In an interview with AFR, tax lawyer Adrian Cartland said the ruling "completely upends" the ATO's approach to taxing bitcoin and could potentially pave the way for not only a review of the tax liabilities of crypto investors who have been paying tax since 2011, but also multi-million dollar tax refunds. Cartland estimates that the amount of tax refunds could be between $640 million and $1 billion.

Earlier, the Australian Financial Transactions and Reports Analysis Centre (AUSTRAC) reported that more than 400 registered exchanges and over 5,000 money transfer services in Australia do not fully comply with requirements to prevent the use of digital assets for money laundering, fraud and terrorist financing.

Read more

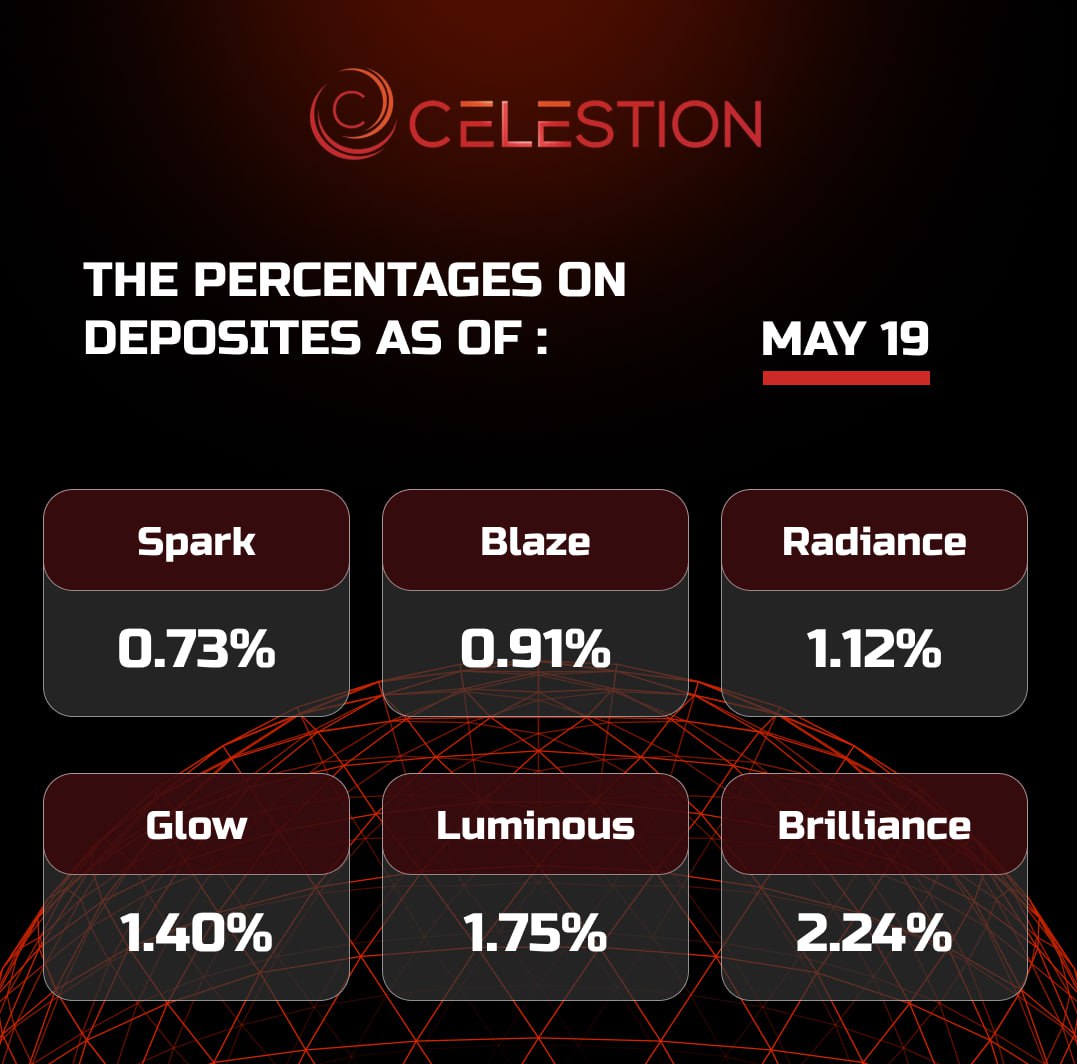

The percentages on deposits as of May 1️⃣9️⃣

May-19-2025

Read more

itcoin to Continue Rising Along with Gold as Stocks Fall ✔️

May-19-2025

The majority of participants in a survey conducted by economist Peter Schiff believe that Bitcoin will continue to rise in price along with gold amid falling stock prices.

Gold has gained $45 and is trading just below $3,250. Nasdaq financial futures are down 1%. But Bitcoin is not falling in value along with other risk assets, instead it is rising in value, just like gold. If gold continues to rise and Nasdaq futures continue to fall, what will happen to Bitcoin? Schiff wrote.

Peter Schiff

Peter's question was answered by 2,154 people. 60.5% of them believe that the price of BTC will continue to grow along with the value of the precious metal. It is obvious that the status of digital gold assigned to the cryptocurrency makes it attractive during market turmoil and economic problems. Therefore, it is not surprising that most people are betting on the correlation between the dynamics of the change in the rate of both assets.

Since the beginning of 2025, Bitcoin has been lagging behind gold in terms of price growth. The coin has risen in price by 12%, while the precious metal has risen by 23%. However, investor Robert Kiyosaki advises buying BTC because he believes in the upcoming bull rally. He recently raised the predicted price of the cryptocurrency this year to $250,000 and called on all members of the crypto community to HODL Bitcoin. If Kiyosaki's forecast comes true, the BTC rate will increase by 140% from its current value.

Read more

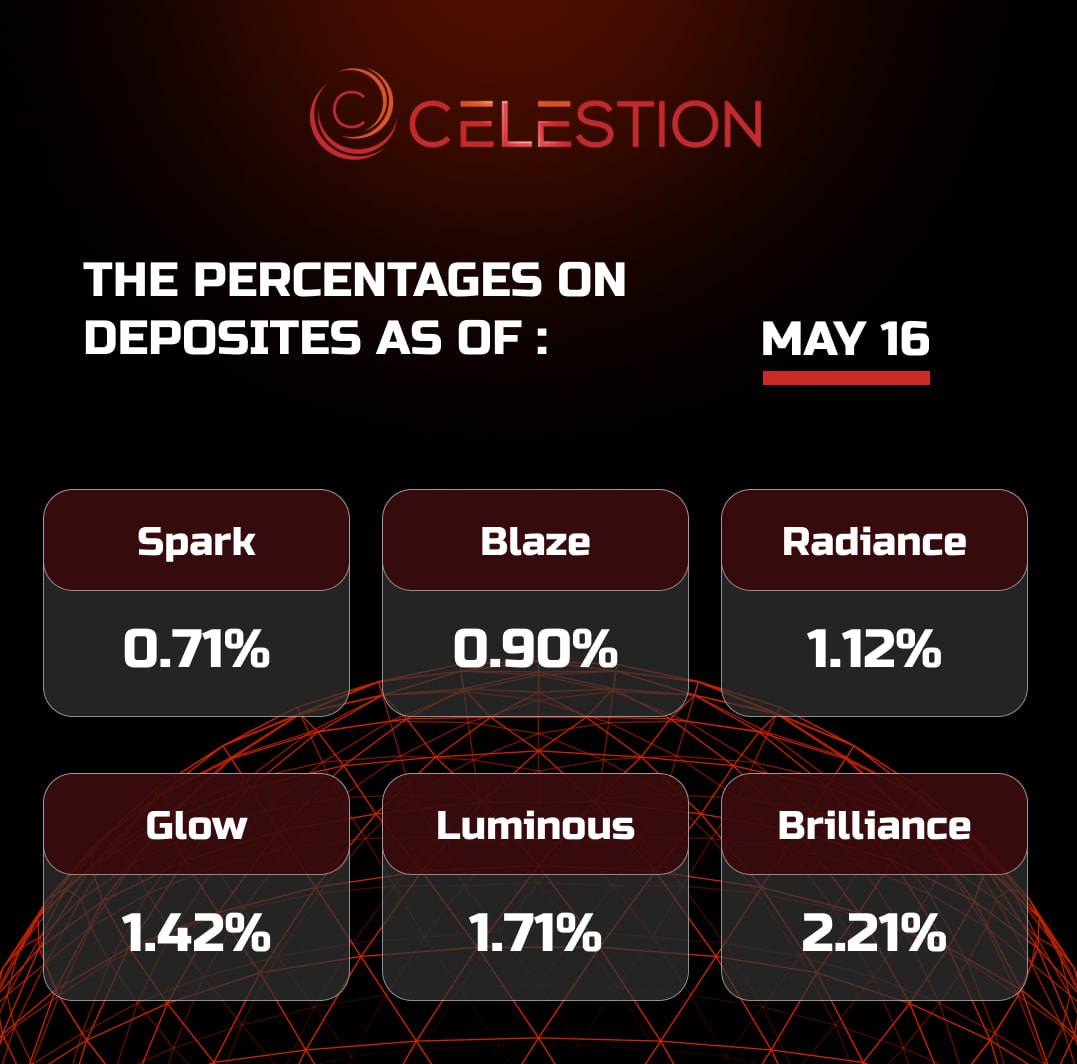

The percentages on deposits as of May 1️⃣6️⃣

May-16-2025

Read more

Bitcoin Price Today: Price Reaches $104,000 Amid Change in Fed Forecasts

May-16-2025

Bitcoin rebounded on Friday as investors weighed the outlook for U.S. Federal Reserve interest rates following muted inflation figures released this week.

Meanwhile, crypto markets remained cautious as leading US cryptocurrency exchange Coinbase Global said it could suffer financial losses of up to $400 million due to a cyberattack.

The token surged nearly 10% last week to above $105,000, but profit-taking and a cautious US economic outlook put the rally on hold.

However, Bitcoin remained above the key $100,000 level amid optimism that trade tensions will ease.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI