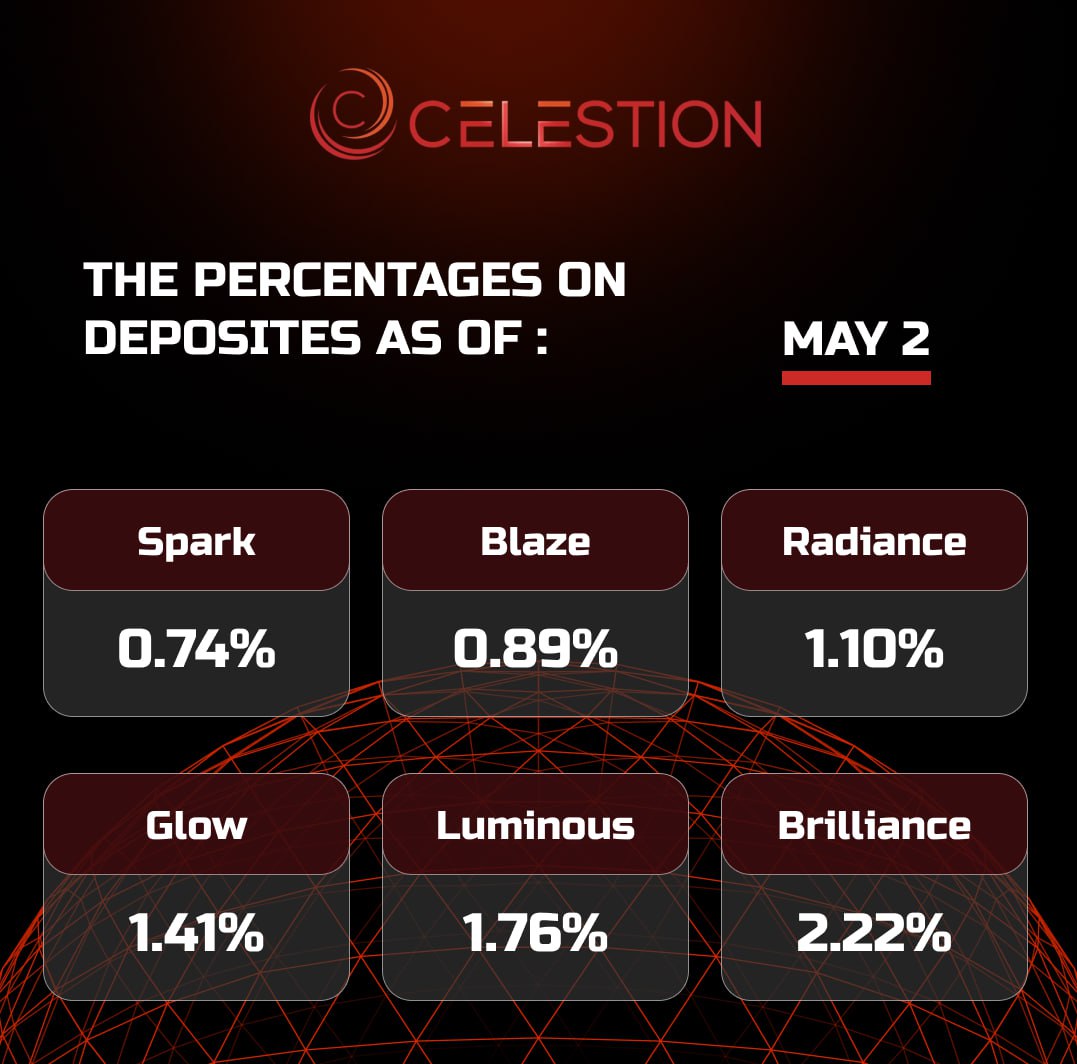

The percentages on deposits as of May 2️⃣

May-2-2025

Read more

FIFA to Move Its NFT Collection to Its Own Blockchain ✔️

May-2-2025

The International Federation of Football Associations (FIFA) has announced the launch of its own FIFA blockchain, compatible with the Ethereum Virtual Machine (EVM), to provide “higher performance, new features and improved scalability.”

As part of the transition, FIFA Collect, the official NFT collection, will be migrated from the Algorand blockchain to the new blockchain. FIFA launched its non-fungible tokens ahead of the 2023 Club World Cup in Saudi Arabia in partnership with blockchain company Modex.

There is no immediate action required at this stage. Once the migration process begins, we will provide clear step-by-step instructions on what you will need to do, the announcement says.

The collection will be transferred no earlier than May 20, FIFA said, adding that they will announce the exact date later and provide clear instructions for NFT owners.

Following the migration, external Algorand-based wallets such as Pera and Defly will no longer be supported. Instead, users will be able to connect to FIFA Collect via MetaMask or other EVM wallets that support WalletConnect.

Read more

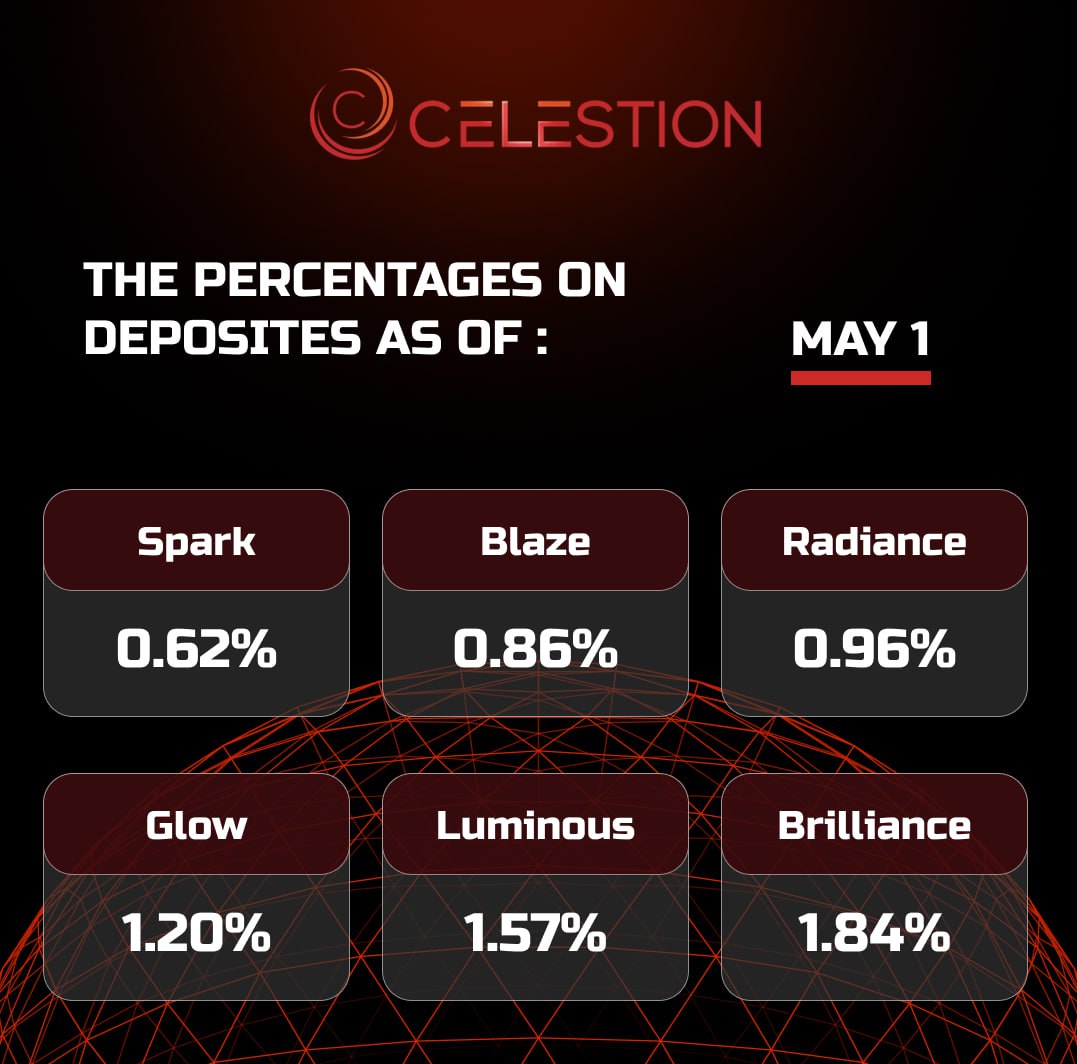

The percentages on deposits as of May 1️⃣

May-1-2025

Read more

Solana Trading Volume Exceeds Ethereum and BNB ✔️

May-1-2025

Solana is back in the spotlight, overtaking Ethereum and Binance Smart Chain ( BNB ) in pure transaction volume. According to CryptoRank, the Solana blockchain has processed $28.07 billion in transactions over the past 30 days, second only to Tether (USDT) , which has recorded nearly $300 billion in transactions over the same period.

Solana has seen $4.72 billion in capital inflows in the last week alone, according to Glassnode. This brings its total active capital to $9.46 billion, the highest since March 2025.

This suggests that investor confidence is returning. Historically, such capital infusions tend to precede broad growth cycles.

From a technical perspective, Solana’s price action also supports the bullish sentiment. Chart analyst AMCryptoAlex noted that Solana broke out of a falling wedge, a classic reversal pattern.

This breakout, supported by strong volume and momentum, suggests that the downtrend may be over. Currently trading around $147.59, Solana is eyeing short-term price targets in the $170-$180 range. If the bullish sentiment continues, new highs could be set as early as Q3.

Solana's market cap is currently $76.4 billion, with a circulating supply of 520 million SOL.

Read more

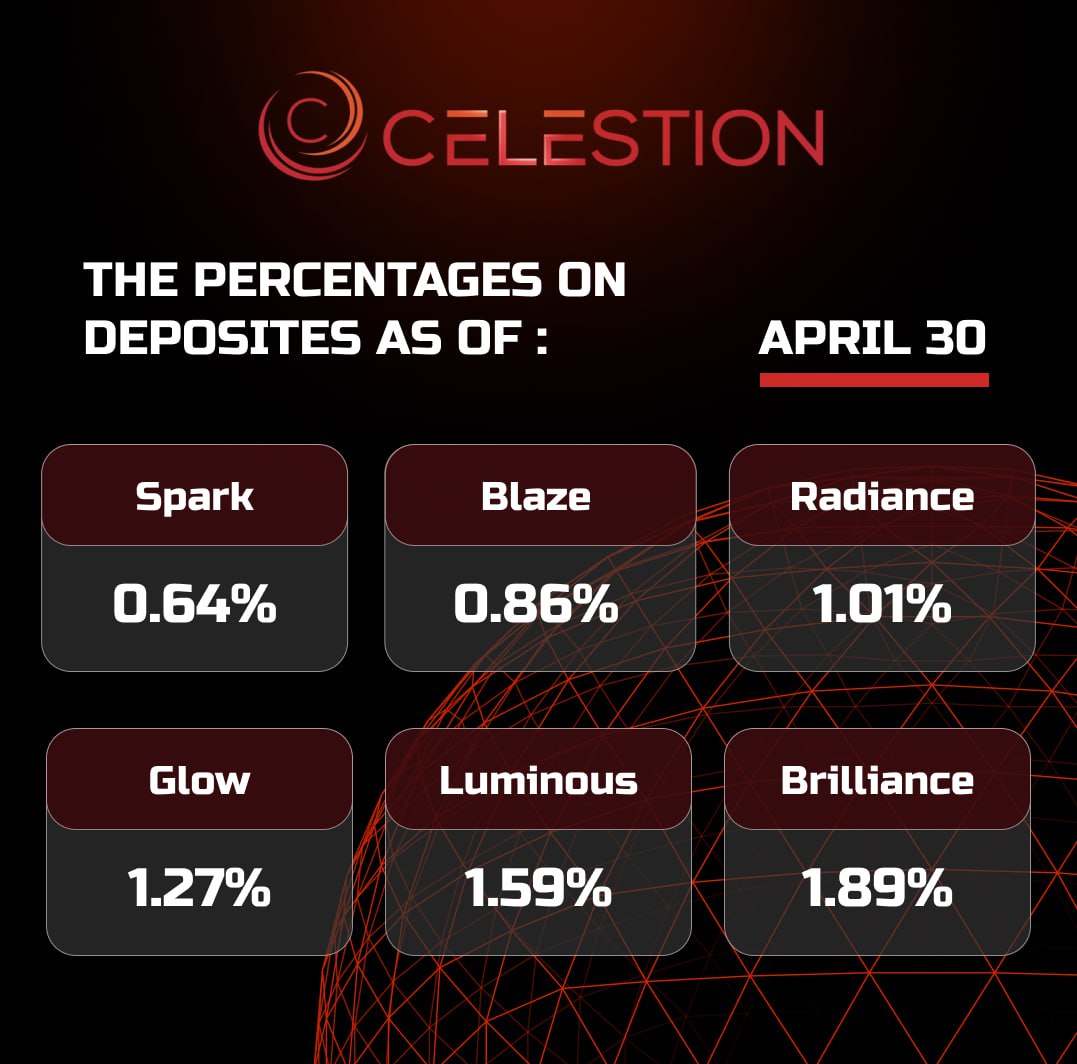

The percentages on deposits as of April 3️⃣0️⃣

Apr-30-2025

Read more

Buterin is working to expand Ethereum's use and sustainability ✔️

Apr-30-2025

The Ethereum Foundation has unveiled a new governing body with co-founder Vitalik Buterin. Its two main goals are to guide the foundation's work toward achieving maximum use of Ethereum while maintaining decentralized operations and network sustainability.

Buterin is prioritizing expanding the use of Ethereum (ETH), which he plans to do by allowing developers to build a wide range of applications on the blockchain.

Buterin's second strategic goal is related to sustainability - the network requires additional efforts to increase decentralization and strengthen security measures. The foundation will address vulnerabilities that the network structure faces and that threaten its reliability in the future.

The change in approach to the development of the Etherem ecosystem is due to the fact that the Foundation has come under heavy criticism due to practices that raise questions among the community. The new leadership aims to address the Foundation’s current issues by establishing technical expertise as an organizational standard.

Along with the new initiatives, market sentiment towards Ethereum has improved . In particular, expectations are growing that the ETH price will soon exceed the $2,000 level and return to an upward trajectory. At the same time, it is obvious that this rise will be supported by the positive dynamics of Bitcoin.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI