HashKey Capital Announces Launch of Asia's First XRP ETF ✔️

Apr-22-2025

HashKey Capital said XRP issuer Ripple was one of the fund's first investors. The HashKey XRP Tracker is designed for experienced market participants — only they will be able to access XRP, the company said.

According to HashKey Capital, XRP stands out from other cryptocurrencies due to its “exclusivity and popularity among international firms.” The exchange-traded fund will simplify access to the asset, the company assured. Investors can contribute funds in cash or digital assets.

The HashKey XRP Tracker exchange instrument is the third in the HashKey Capital line. Previously, ETFs on Bitcoin and Ethereum were launched .

Earlier, analysts from investment bank Standard Chartered (LON: STAN ) said that the price of altcoin XRP could exceed $5.5 by the end of the year and reach $10.4 in 2027.

Read more

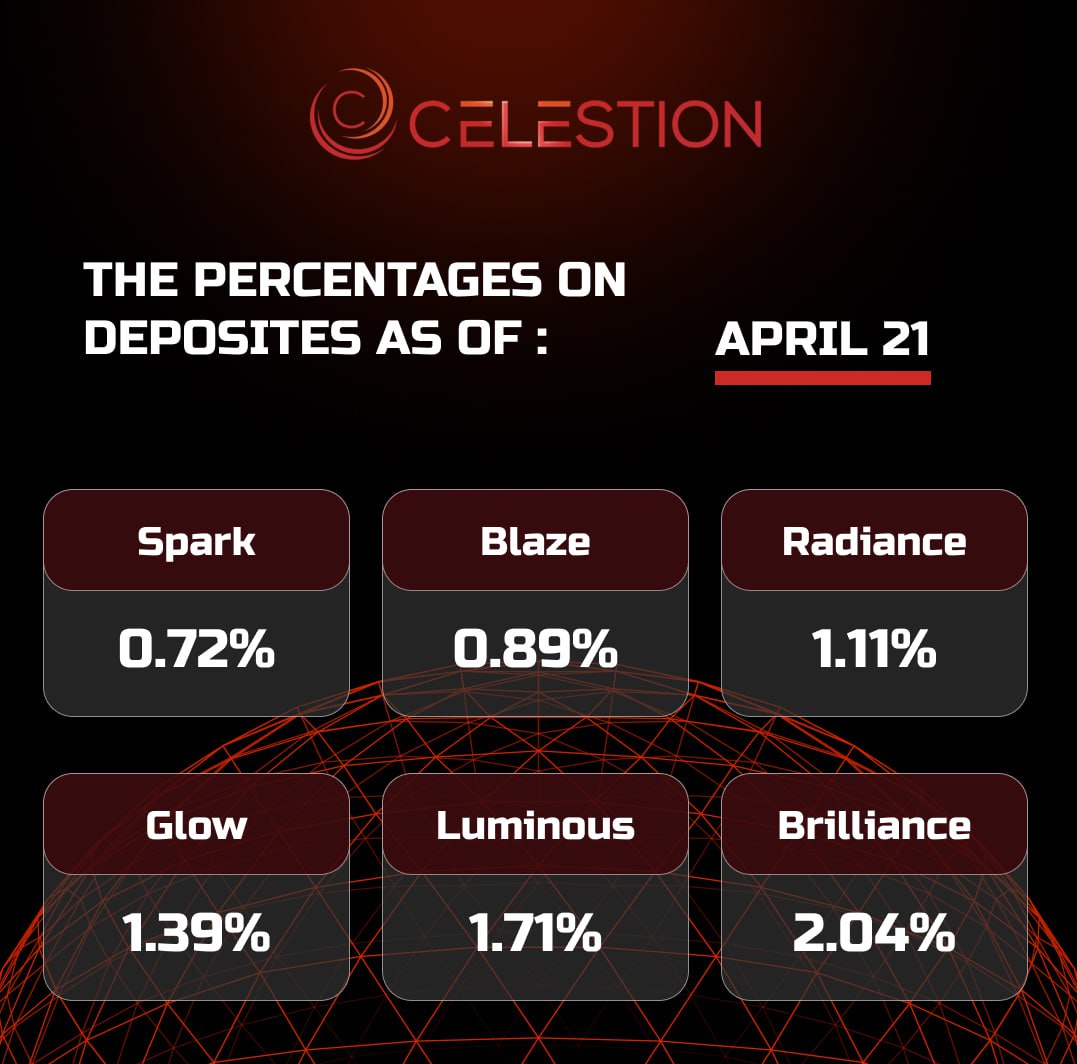

The percentages on deposits as of April 2️⃣1️⃣

Apr-21-2025

Read more

Announcement

Apr-21-2025

Good afternoon, dear Celestion partners.

On behalf of the company I would like to thank you for your trust and successful work. I would like to give you some good news.

Firstly, we have successfully passed our due diligence and financial audit and the Australian Securities and Investments Commission “ ASIC ” has renewed our license for another year.

You can follow the updates on our website and social media.

In addition, we will soon announce token launch and a play-and-earn game.

Also in the near future we will show you tokenomics and all the stages of development in this new direction.

We are working hard with the whole team to create new offers and improve the quality of our service.

So stay with us, we are building a bright future together.

Sincerely yours Celestion CEO - George Kidman!

Read more

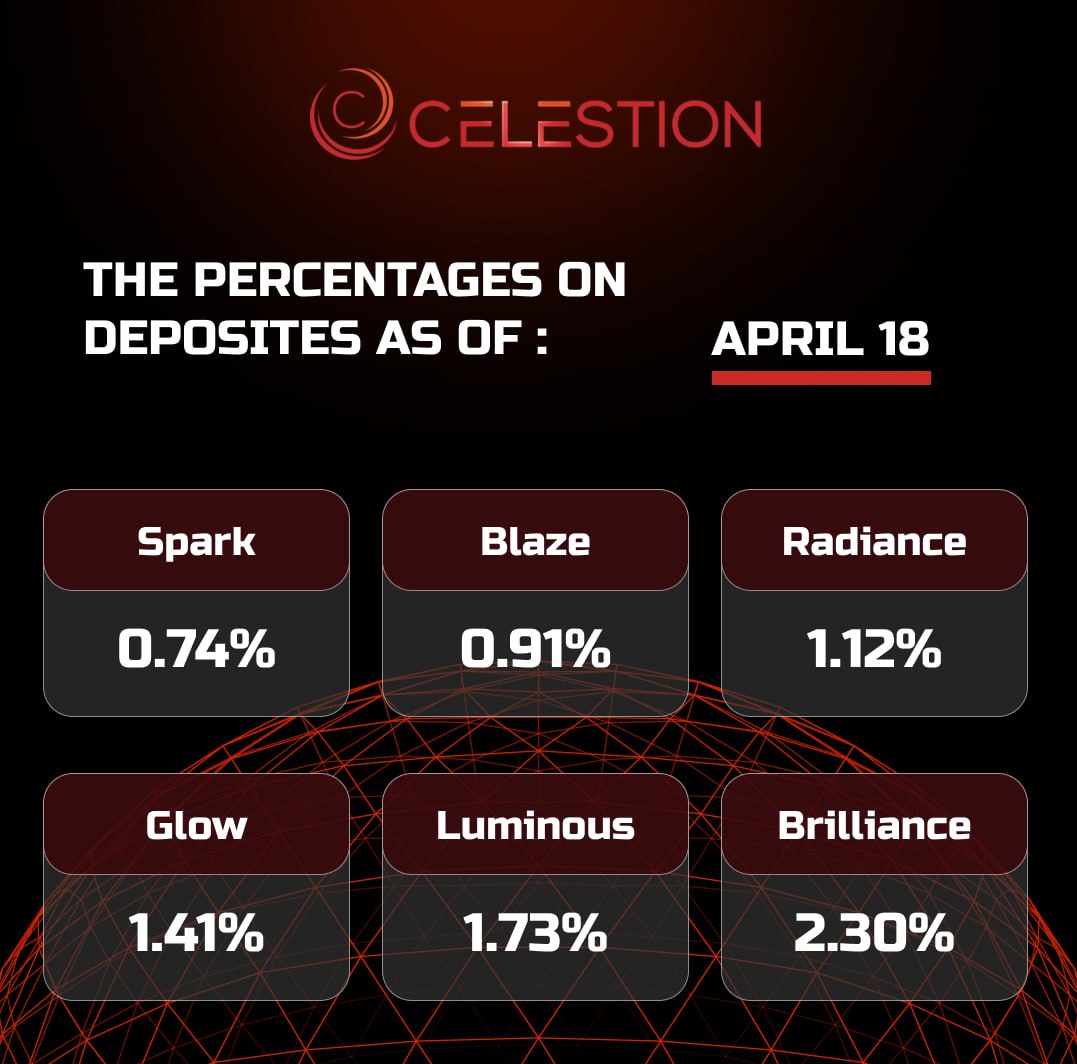

The percentages on deposits as of April 1️⃣8️⃣

Apr-18-2025

Read more

Ethereum Blockchain Fees Drop to Five-Year Low ✔️

Apr-18-2025

Santiment experts suggested that the drop in commission fees in the Ethereum ecosystem could be a consequence of a general decrease in trader activity caused by economic uncertainty in the world.

Santiment's chief marketing officer, Brian Quinlivan, wrote in the company's blog that the level of fees on the Ethereum network is governed by the market principle of supply and demand.

"When the network is heavily used, traders raise fees to get their transactions confirmed faster. This increased the average cost of a transaction. Now, with low activity, there is no need for high rates, and fees are falling," he explained.

The drop in fees reflects not only low interest, but also weakness in the second-largest cryptocurrency by market cap, whose market value has fallen 15% over the past month and nearly 37% over the past year.

At the same time, Santiment experts see potential for recovery in the market situation.

First, lower fees and lower asset prices together make it easier for new entrants to enter the crypto market, which could spur demand, activity, and drive Ether's price higher with minimal resistance.

Secondly, from a developer perspective, the fee level may be an ideal time to test applications and conduct transactions at minimal cost, which may stimulate the development of new DeFi protocols and NFT projects.

Earlier, Ethereum co-founder Vitalik Buterin stated that the key problem with applications created on the network's ecosystem is not their infrastructure, but their weakly expressed social value.

Read more

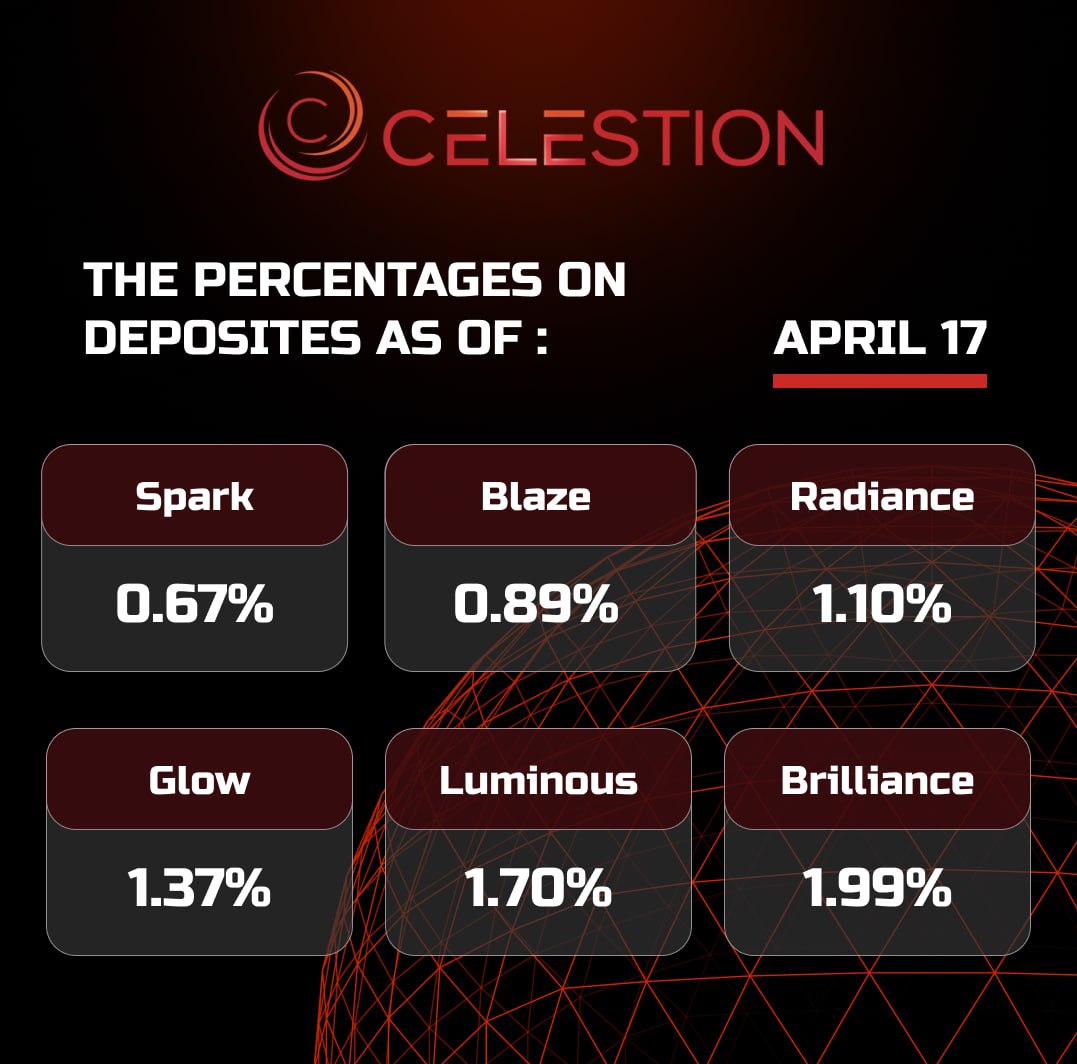

The percentages on deposits as of April 1️⃣7️⃣

Apr-17-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI