Robert Kiyosaki: Bitcoin Will Save the World from Financial Catastrophe 🔰

Apr-14-2025

Kiyosaki's statements came amid trade wars between the United States and other countries. Despite the market turmoil, Kiyosaki said people can still save their savings if they buy Bitcoin . The entrepreneur called the current market situation a "well-planned crash": the value of stocks, bonds, mutual funds and exchange-traded funds is falling rapidly, so many people are losing their savings.

Kiyosaki blamed the crisis on the US Federal Reserve (Fed), the Bank for International Settlements (BIS), the Bank of England, the Bank of Japan and the European Central Bank (ECB). As the investor put it, this “international banking cartel” is stealing people’s wealth while “the corrupt, fraudulent US dollar is being destroyed.”

"Those who act and buy real gold , silver, and bitcoin may emerge from this man-made disaster rich and the new leaders of the world. What are you going to do? Go back to college, get another degree, get deeper into debt, and never learn anything about money?" Kiyosaki wrote.

The writer previously said that he prefers to buy the first cryptocurrency on a decline, and advised investors to do the same. Kiyosaki recently tried to dissuade investors from transferring their savings from pension funds to bitcoin.

Read more

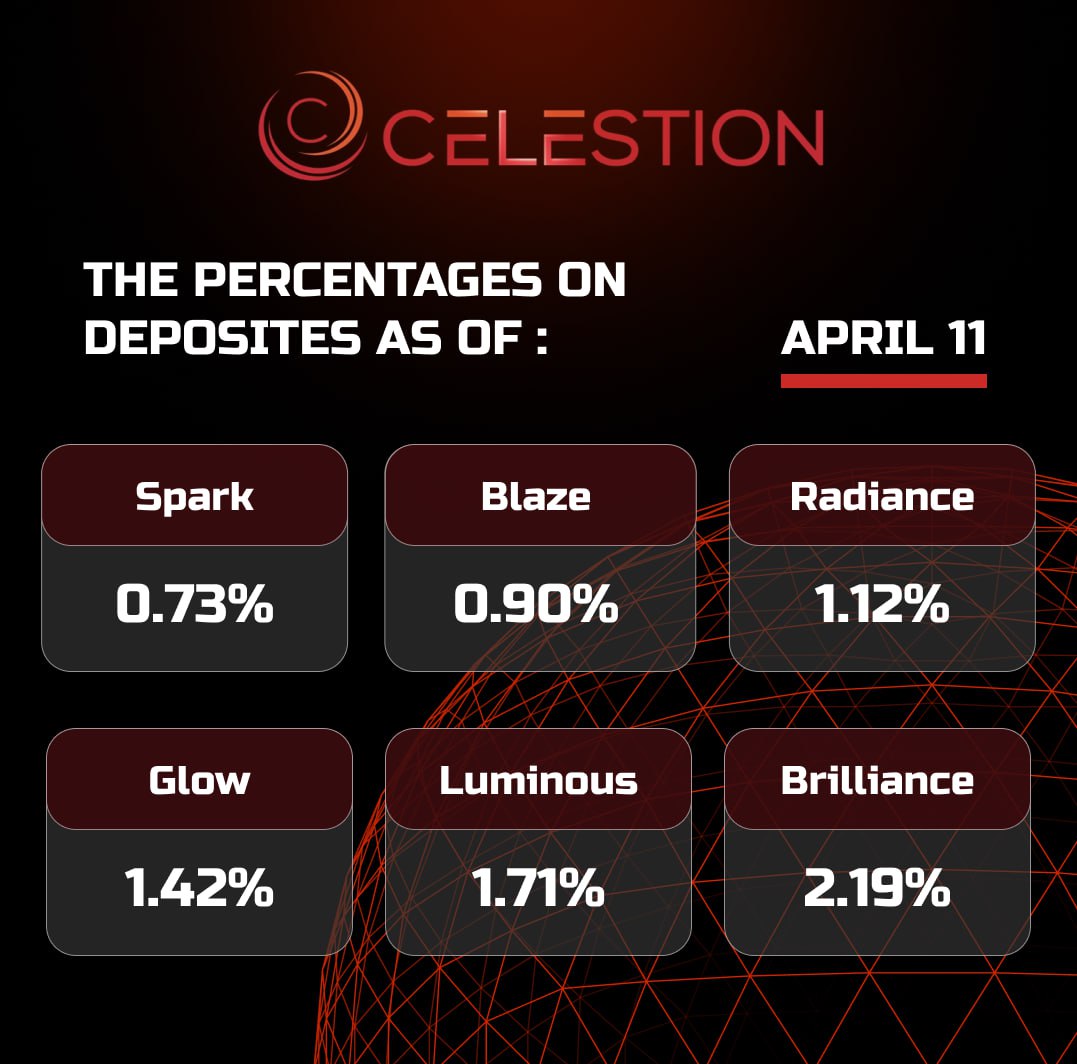

The percentages on deposits as of April 1️⃣1️⃣

Apr-11-2025

Read more

In the first quarter of 2025, miners mined 9,700 bitcoins worth $800 million ✔️

Apr-11-2025

In the first quarter of this year, the largest public mining companies mined more than 9,700 bitcoins worth about $800 million.

The leader of the sector was the miner Marathon Digital. In the first three months of 2025, the largest company by market capitalization mined 2,285 BTC worth almost $186 million. On April 3, Marathon announced that 829 BTC were mined in March. This is 17.4% more than in February and 10.5% more than in January.

In Q1, CleanSpark mined 1,950 BTC worth about $160 million. In March, the organization's performance increased by 13.4% compared to the previous month.

Iren (formerly Iris Energy) was the third-largest miner for the quarter. The miner reported mining 1,513 BTC worth nearly $124 million. Iren mined 533 BTC in March, up 16.1% from February.

Riot Blockchain, which is second only to Marathon Digital in market cap, mined 1,428 BTC (around $117 million) in the quarter. Like Iren, Riot mined 533 BTC in March, up 13.4% from February.

Hut 8 showed the highest growth rate. The company mined 199 BTC worth about $16 million, including 88 coins in March. This is 91% more than the 46 BTC mined in February.

Read more

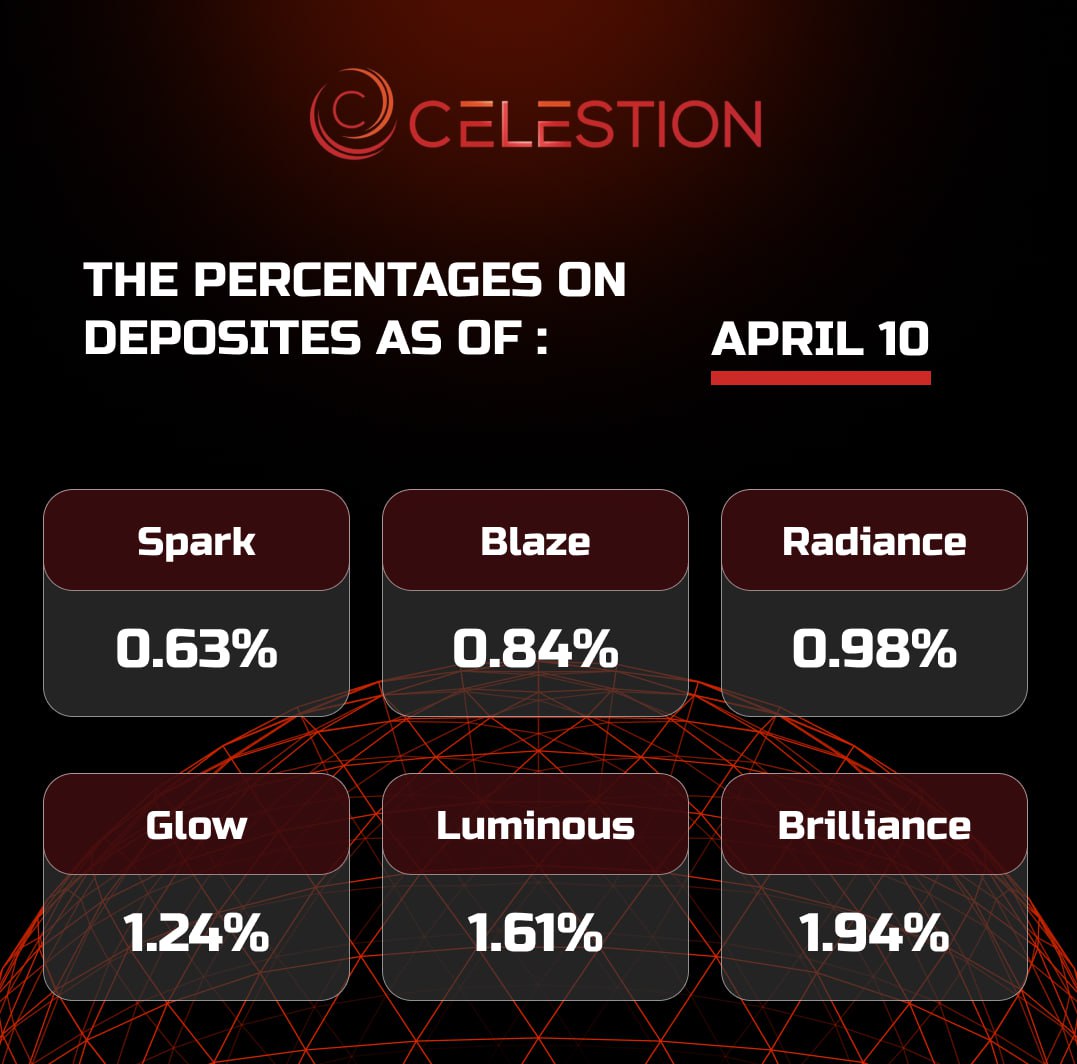

The percentages on deposits as of April 🔟

Apr-10-2025

Read more

US Tariff Delay Sends Bitcoin Above $82,000 ✔️

Apr-10-2025

After US President Donald Trump announced a 90-day tariff deferral, Bitcoin rose in price above $82,000, adding more than $5,000 in a day.

The S&P 500 jumped more than 7.6%, the Dow Jones Industrial Average jumped 6.5% and the Nasdaq Composite jumped 9.5%, ending a four-day losing streak.

"I have authorized a 90-day pause and a substantially reduced reciprocal tariff for that period of 10%, effective immediately," Trump wrote on Truth Social.

Bitcoin, which fell to $74,500 earlier this week, has maintained a reassuring degree of stability throughout the market turmoil despite the downturn. Its decline in price has been less than expected.

While markets have responded positively to the pause, volatility will persist and even increase if trade talks stall. Trump’s 90-day reprieve provides short-term clarity, but overall global trade policy remains uncertain.

Read more

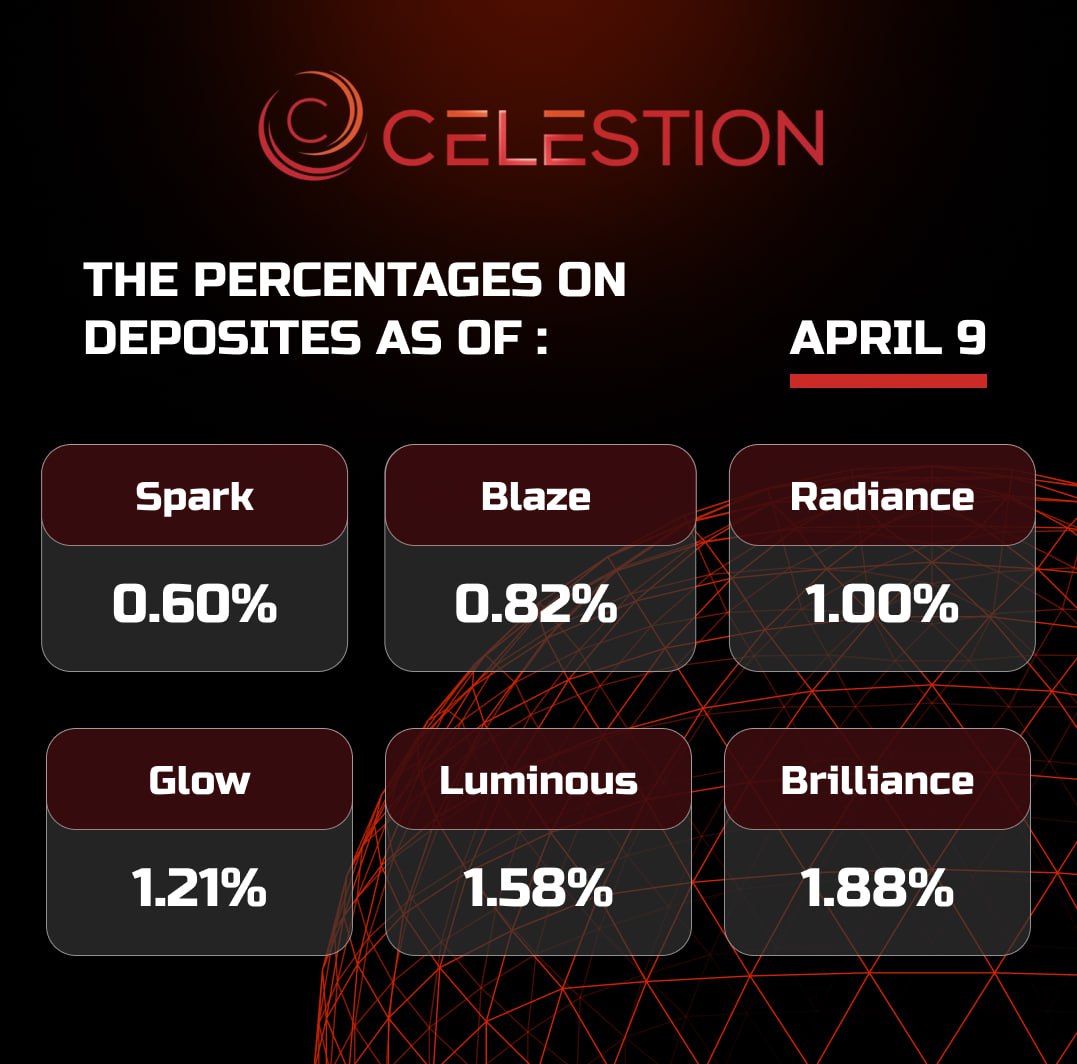

The percentages on deposits as of April 9️⃣

Apr-9-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI