BNB Chain Releases New Roadmap With AI Focus ✔️

Feb-13-2025

GetBlock Magazine - What happened? The BNB Chain blockchain team has unveiled an updated development plan for 2025, which places a special emphasis on artificial intelligence (AI). In addition, the network aims to significantly improve its performance, reducing transaction latency to fractions of a second and increasing the overall throughput to 100 million transactions daily.

Created by Binance, BNB Chain has recently introduced a number of new technologies, including AI agent solutions and a memcoin issuance platform. However, the 2025 vision shows even bolder ambitions and goals.

“In 2025, the BNB Chain team plans to implement important upgrades that will focus on improving performance and user experience, which will help accelerate the process of widespread adoption of Web3,” the ecosystem representatives said.

What else is known? In addition to improving speed, BNB Chain is introducing protective measures against maximum extractable value (MEV) attacks, focusing on vulnerabilities such as sandwich attacks. This will not only improve user security, but also contribute to the overall integrity of the network. The introduction of gas-free transactions across the board will improve usability, making transactions more accessible to users.

How did the market react? The roadmap announcement had a short-term impact on BNB’s market price, with the fifth-largest altcoin by market cap rising nearly 10%. Its daily trading volume also increased by 17%, according to CoinMarketCap.

The company plans to enhance several existing developer tools, such as the tokenization portal it launched last November. It will use AI for many of them, creating Code Copilot to help developers and new AI agent solutions.

Read more

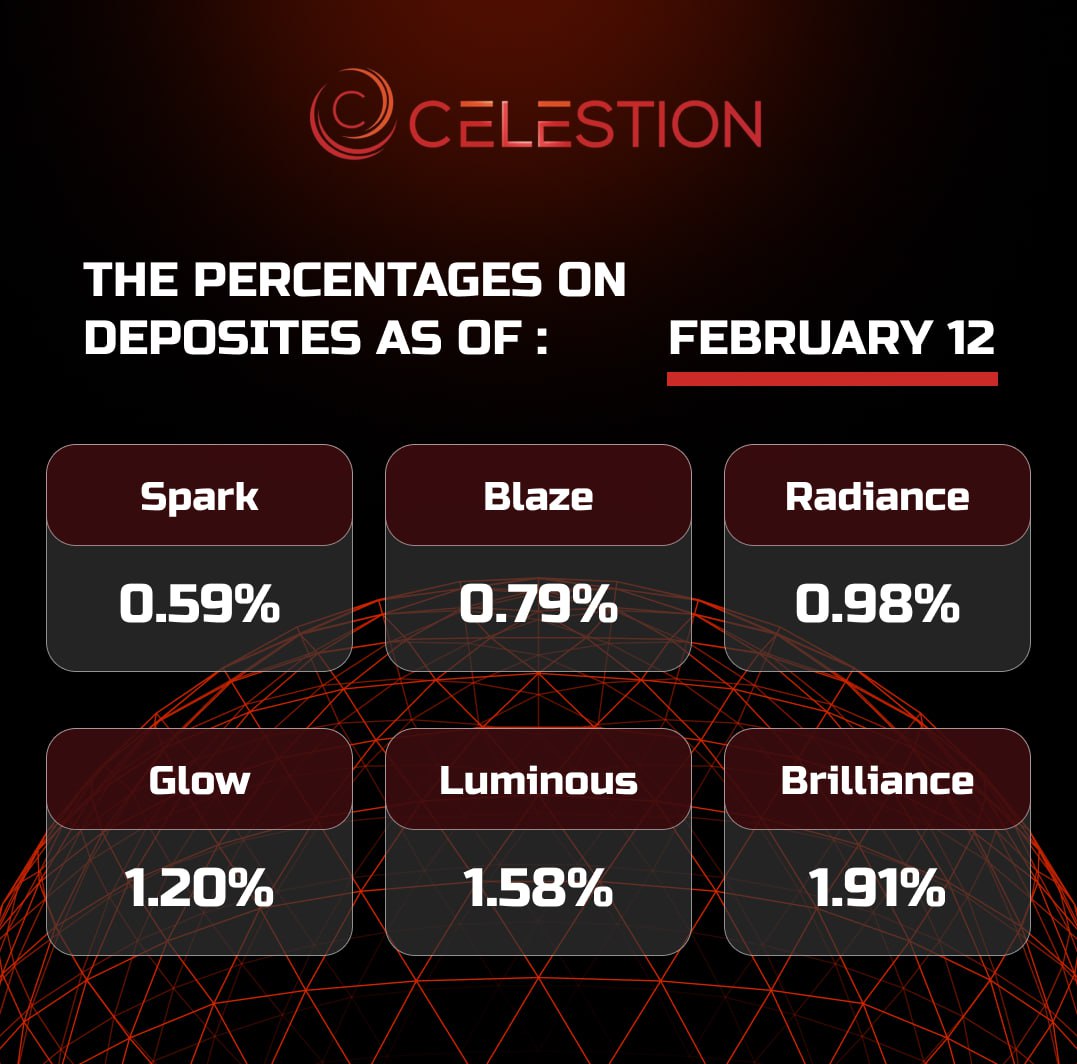

The percentages on deposits as of February 1️⃣2️⃣

Feb-12-2025

Read more

Goldman Sachs Invests $2 Billion in Bitcoin and Ethereum ETFs ✔️

Feb-12-2025

In the fourth quarter of 2024, investment bank Goldman Sachs (NYSE: GS ) invested over $2 billion in ETFs based on Bitcoin and Ethereum .

From October to December, the company acquired:

BlackRock's iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) shares worth $454 million, investing $227 million in derivatives;

Grayscale Ethereum Trust ETF (ETHE) shares worth $6.3 million;

iShares Bitcoin Trust (IBIT) shares worth $1.28 billion;

Fidelity Wise Origin Bitcoin Fund (FBTC) shares worth $288 million.

Thus, as of the end of last year, Goldman Sachs owned Ethereum ETF shares worth $476.5 million and Bitcoin ETF shares worth $2.4 billion. Obviously, the bank’s deals to buy fund shares had a positive impact on the Bitcoin and Ethereum rates, which increased by 41% and 26%, respectively, in the fourth quarter.

It is worth noting that cryptocurrency derivatives account for only 0.09% of assets under management by Goldman Sachs, whose value reaches $3.1 trillion. At the same time, judging by the rhetoric of the organization's leaders, the company does not plan to buy digital assets.

Most likely, Goldman Sachs will limit itself to investments in derivatives based on virtual currencies. However, the bank may expand the number of different cryptocurrency ETFs in its portfolio after the US authorities give the go-ahead for the issuance of exchange-traded funds based on, for example, XRP (XRP) and Solana (SOL).

"We don’t view cryptocurrency as an investment asset class. We don’t believe in cryptocurrency,” said Sharmeen. Mossavar-Rahmani, chief investment officer at Goldman Private Wealth Management.

Read more

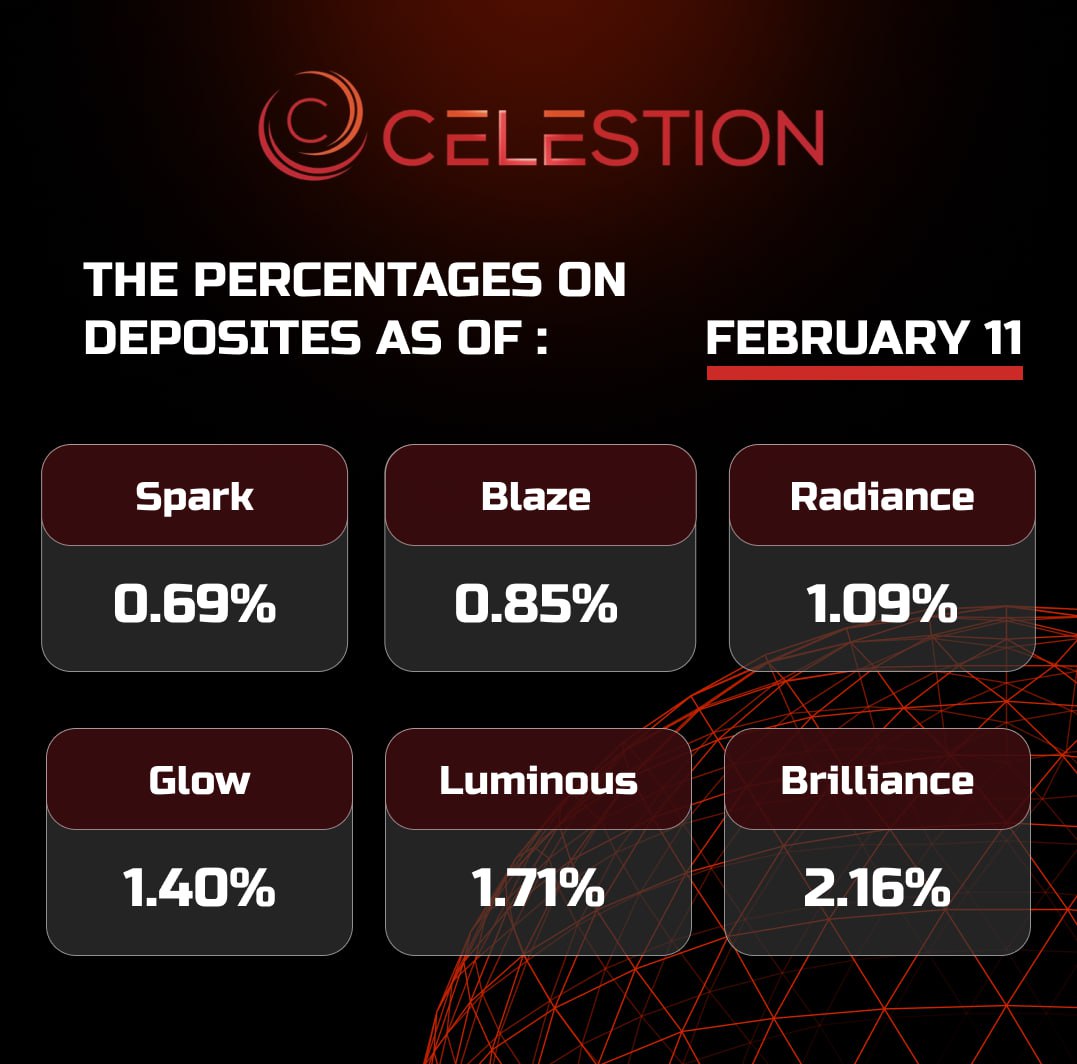

The percentages on deposits as of February 1️⃣1️⃣

Feb-11-2025

Read more

Strategy Resumes Regular Bitcoin Purchases 🚀

Feb-11-2025

Strategy CEO Michael Saylor announced that the company purchased 7,633 BTC between February 3 and February 9 at an average price of $97,255 per bitcoin. As of February 10, Strategy holds a total of 478,740 BTC on its balance sheet, acquired for around $31 billion at an average price of $65,033 per BTC.

In an interview with Bloomberg, Saylor stated that Strategy is halfway to reaching its target of raising $42 billion to continue funding bitcoin purchases. The company plans to achieve this using convertible bonds and preferred stock offerings, leveraging strong demand from hedge funds that focus on convertible arbitrage strategies—buying bonds while shorting stock to profit from Bitcoin’s volatility.

Last week, Strategy reported a $670.8 million net loss in the fourth quarter due to a $1 billion impairment on its digital assets. However, the company is optimistic about turning profitable in the current quarter, thanks to new accounting rules that will allow digital assets to be valued at fair market prices.

Read more

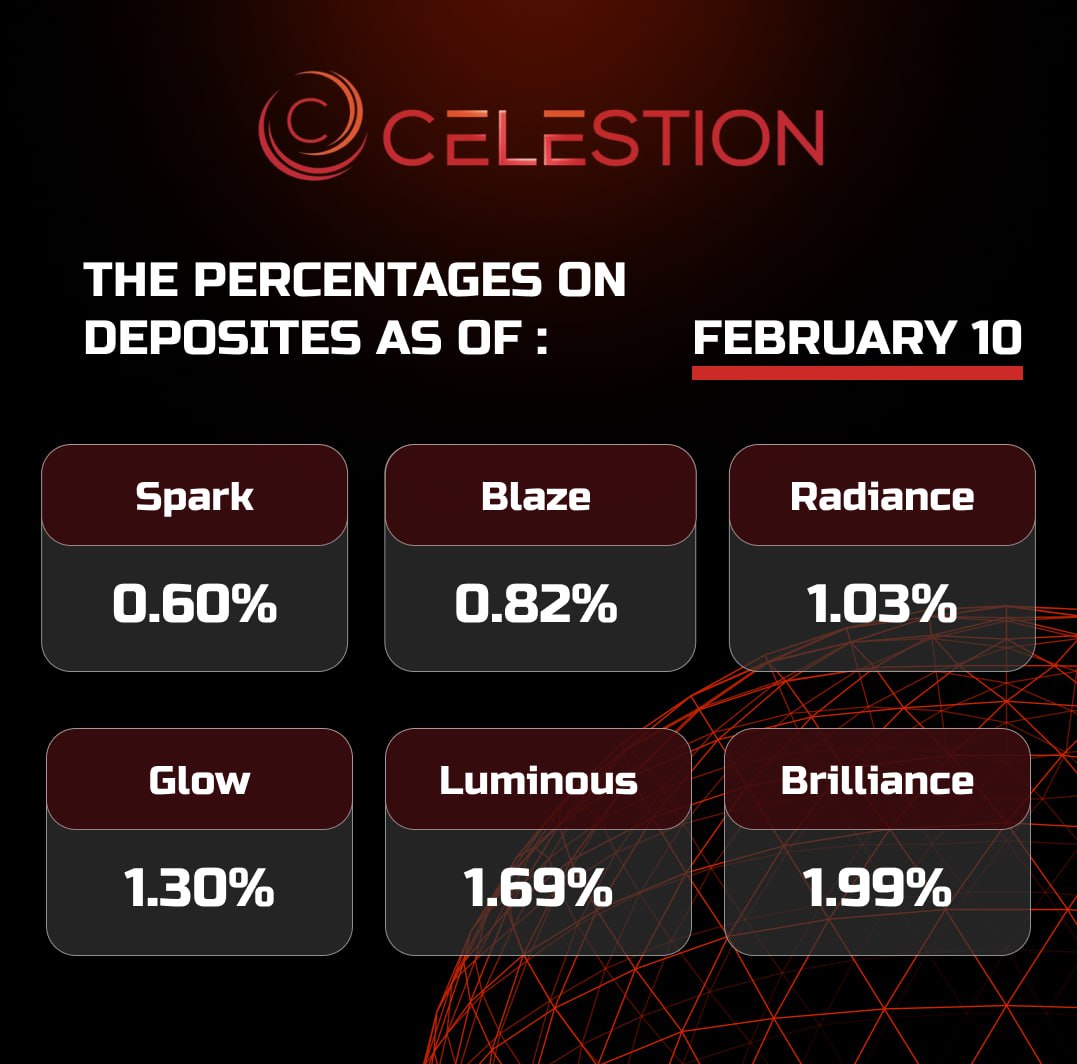

The percentages on deposits as of February 🔟

Feb-10-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU