The 31st quarterly burn of 1.58 million BNB worth $916 million took place ✔️

Apr-17-2025

Binance-backed BNB Chain has completed its 31st quarterly token burn using its proprietary Auto-Burn mechanism, removing 1.58 million BNB worth approximately $916 million from circulation.

According to the BNB Foundation's strategy, an additional 40.88 million BNB needs to be burned in order to reach the 100 million BNB supply goal.

The automatic burning process is quite transparent: every quarter, the amount of coins burned is adjusted depending on the price of BNB and the number of blocks produced on the Binance Smart Chain. Destroyed tokens are sent to a “dead wallet” (0x00…00dEaD), which ensures that they cannot be recovered.

These measures are aimed at managing inflation on the network and creating a more efficient token economy, while maintaining long-term stability in the value of BNB.

Despite the large dollar value of the tokens destroyed, the price of BNB has remained virtually unchanged. BNB is currently trading around $584, down a mere 0.1% on the day.

Read more

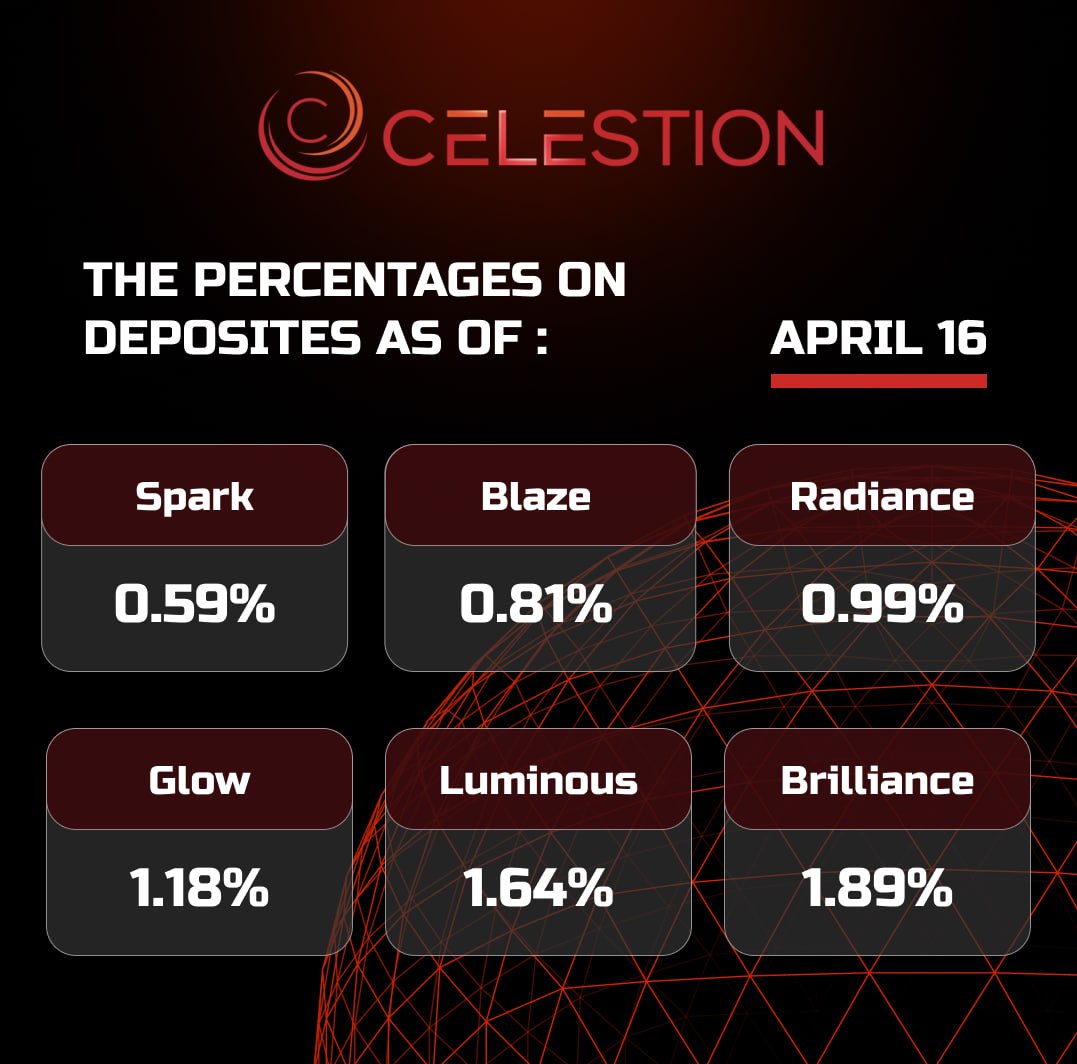

The percentages on deposits as of April 1️⃣6️⃣

Apr-16-2025

Read more

Canada Launches World's First Spot ETF on Solana ✔️

Apr-16-2025

Canada is set to launch the world's first spot Solana ETFs this week, leapfrogging the U.S. in the race for altcoin ETFs. The Ontario Securities Commission has approved applications from several issuers, including Purpose, Evolve, CI, and 3iQ, to trade the ETFs, Bloomberg analyst Eric Balchunas originally reported.

The ETF will offer direct spot access to Solana, the sixth-largest cryptocurrency by market cap, currently valued at $68.2 billion, according to CoinGecko. Solana is also the blockchain that powers several memecoins, such as the Trump MAGA coin.

One of the approved issuers, Purpose Investments, announced the upcoming launch of the Purpose Solana ETF on the Toronto Stock Exchange on April 16. In addition to providing direct spot access to Solana, the product is designed to provide attractive staking rewards.

These ETFs will also feature staking, a first for the industry. Staking is the process of contributing cryptocurrency assets to support the security and operations of a blockchain network, for which participants are rewarded.

This development could potentially impact numerous similar Solana spot ETF applications in the US that are currently awaiting SEC approval.

Read more

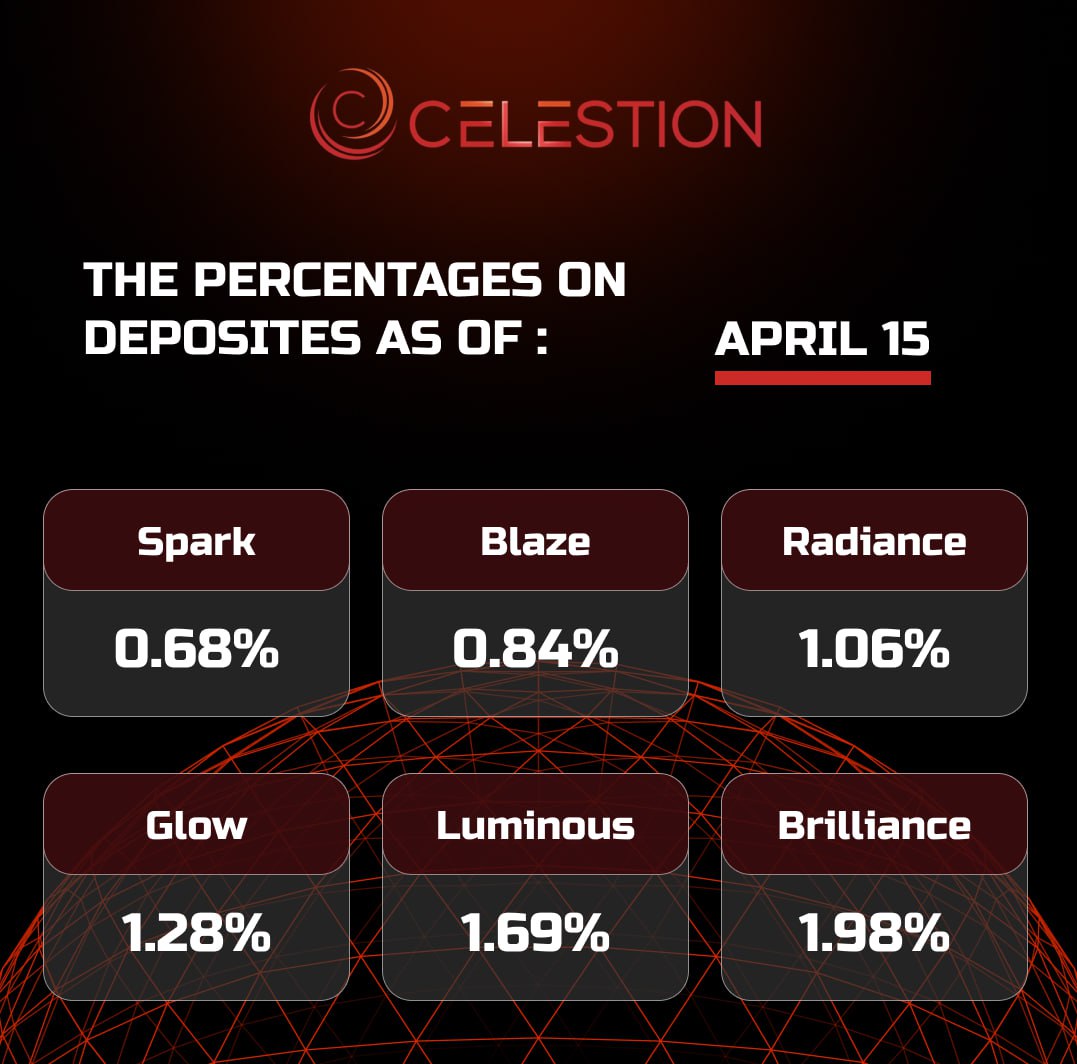

The percentages on deposits as of April 1️⃣5️⃣

Apr-15-2025

Read more

Strategy bought 3,459 more bitcoins for $285.8 million ✔️

Apr-15-2025

According to the data provided by the company itself, on April 13, there were 531,644 bitcoins on the balance (almost 2.52% of the entire current issue of the asset). Strategy spent a total of approximately $35.92 billion on the purchase of coins with an average price of $67,556 per 1 BTC.

The company primarily finances its Bitcoin purchases by issuing convertible bonds with a low or zero coupon rate. These can be exchanged for Strategy shares (ticker MSTR). The funds raised are used to purchase more of the first cryptocurrency.

This model is effective when Bitcoin quotes grow, as it allows you to attract funds on favorable terms. The key risk of the model is a rapid and prolonged fall in the cryptocurrency rate, which can reduce investor interest in MSTR shares and complicate the placement of new bonds.

Strategy previously announced unrealized losses of $5.91 billion, caused by a decline in the price of bitcoin amid falling global financial markets and fears of a recession in the United States.

Read more

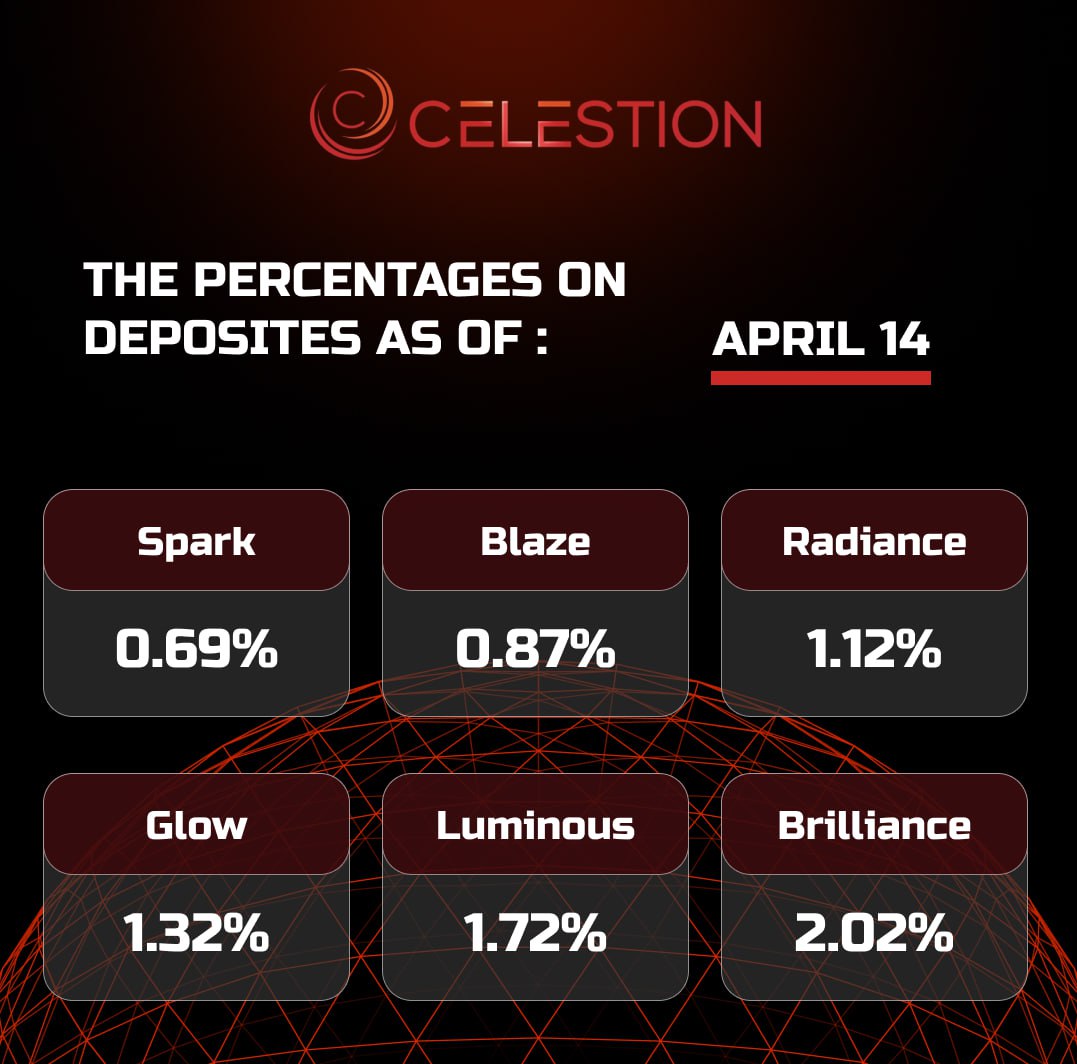

The percentages on deposits as of April 1️⃣4️⃣

Apr-14-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI