Bitcoin Rises on Hopes of US-China Deal ✔️

May-7-2025

Bitcoin rose alongside Asian stocks after reports that the U.S. and China plan to hold trade talks, Bloomberg reports .

The world's largest digital asset gained over 3% to top $97,500 on Wednesday morning, but has since pared its gains. At the time of writing, BTC is trading around $97,000 after climbing to an intraday peak of $97,840.

The morning rally followed news that U.S. Treasury Secretary Scott Bessent and Trade Representative Jamison Greer will meet with the Chinese government this week in Switzerland, raising hopes of a deal between the world's two largest economies and an easing of trade tensions.

Meanwhile, India said early Wednesday it had carried out precision military strikes on Pakistan, which responded by reporting the downing of five Indian aircraft.

“We are seeing renewed interest in buying Bitcoin on the upside as the market is optimistic about a positive outcome to the weekend talks,” said Sean McNulty, head of Asia-Pacific derivatives at broker FalconX Ltd.

For now, traders are "completely ignoring" the conflict in Pakistan, McNulty added.

Digital asset investors will also be watching the Federal Reserve's decision, expected later Wednesday, which is expected to leave rates unchanged.

"We see broad risk appetite today, mainly due to the resumption of trade dialogue between the US and China. Global stock markets are rising, gold is retreating, and the dollar is slightly stronger. This sentiment is supported by the crypto market," said Yuan Rong Tang, a trader at QCP Capital.

Read more

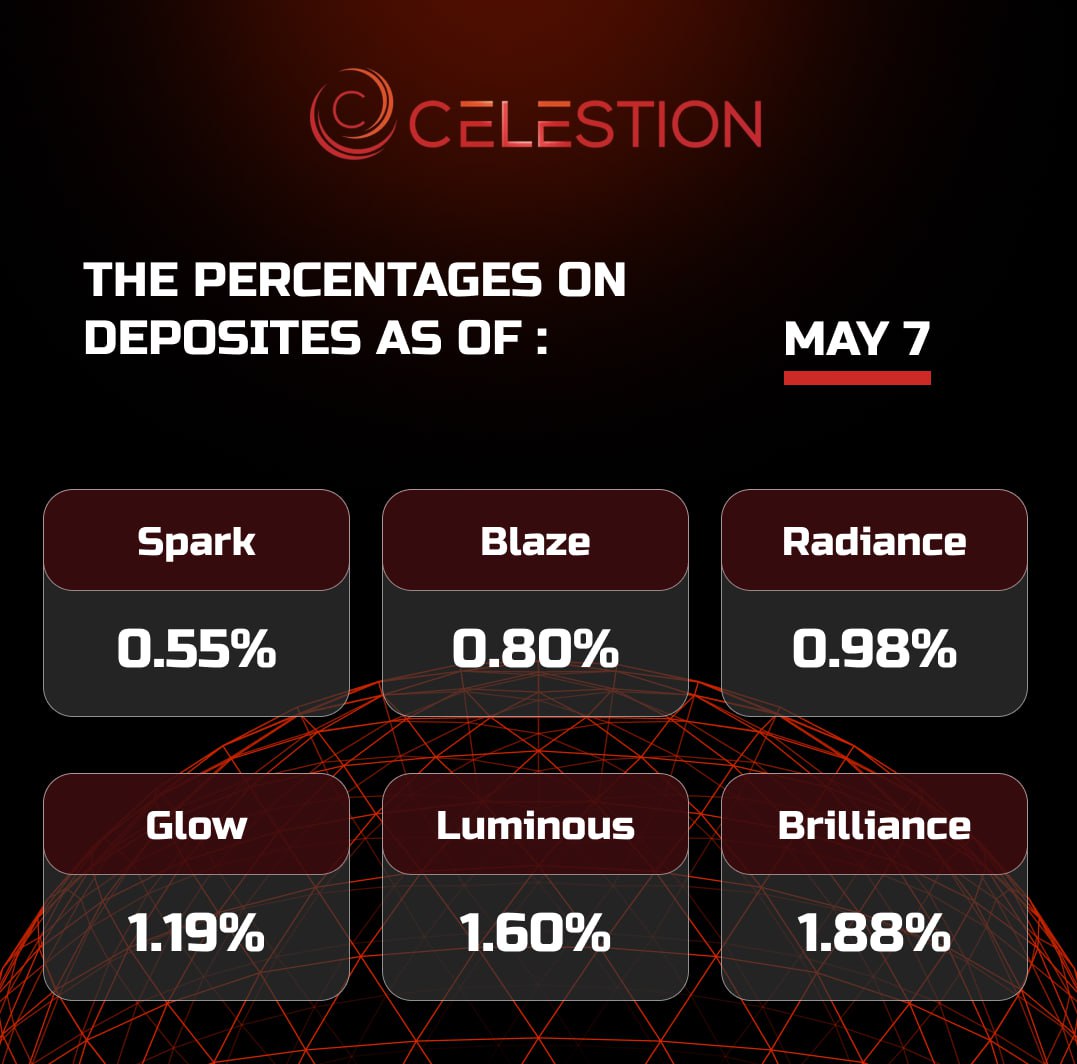

The percentages on deposits as of May 7️⃣

May-7-2025

Read more

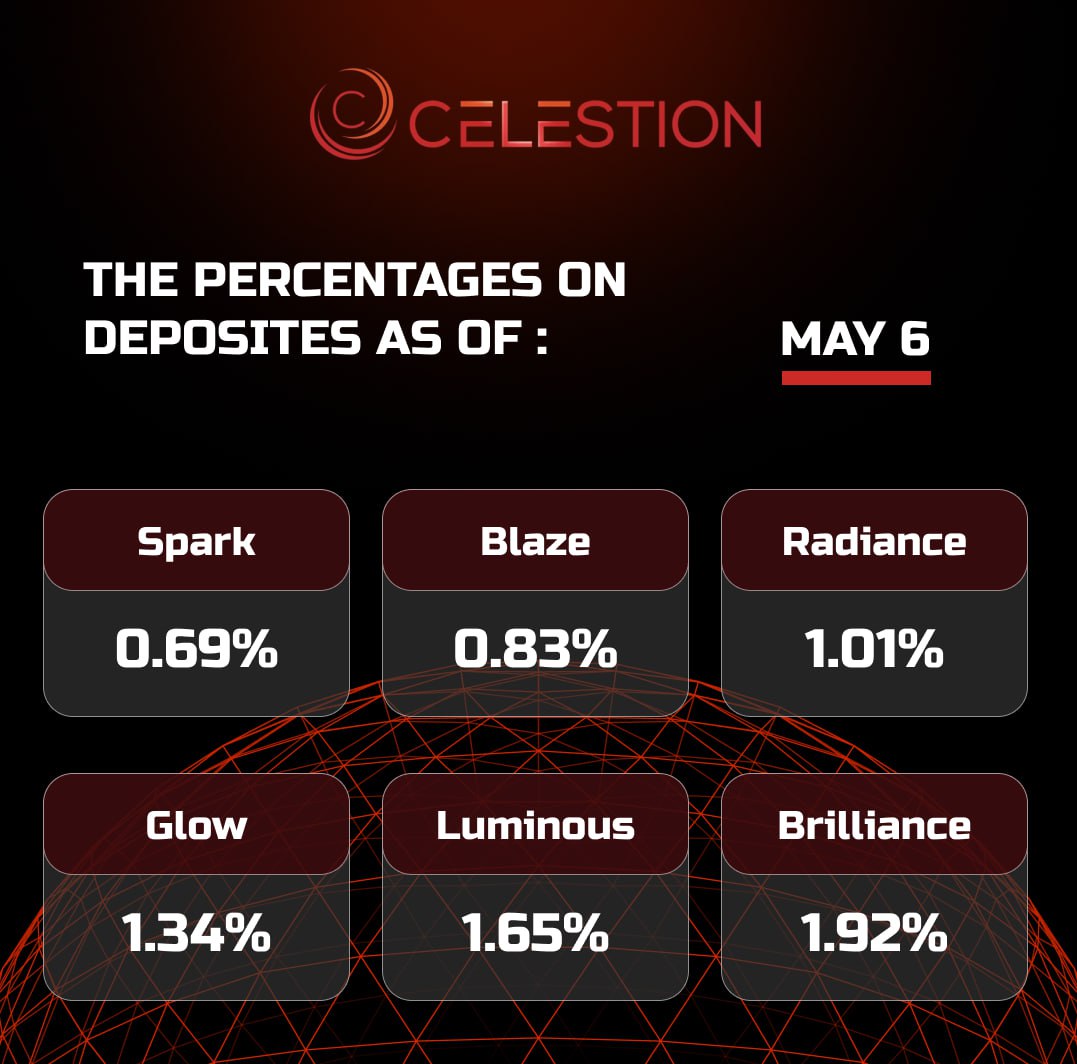

The percentages on deposits as of May 6️⃣

May-6-2025

Read more

Maldives to Build $8.8 Billion Blockchain Center ✔️

May-6-2025

The Maldives Ministry of Finance has called the creation of a blockchain center a chance to overcome the country's protracted debt crisis. Officials believe that the blockchain center will be in demand among global companies, given its geographical location and stable political situation.

According to MBS Global CEO Nadeem Hussain, the project has already secured funding in the amount of more than $4 billion. The financing is planned to be from equity capital and loans through a consortium of investors.

“We immediately assessed what was required in terms of funding, formed the necessary alliances and attracted the right partners to ensure the influx of funds,” the head of the company said.

The blockchain center is “focused on the development of financial technologies and the digital economy,” as well as the management of international financial flows, the project’s authors said.

Earlier, Malaysian Prime Minister Anwar Ibrahim met with former Binance CEO Changpeng Zhao to discuss the businessman's ability to help the state in the digital asset and blockchain market.

Read more

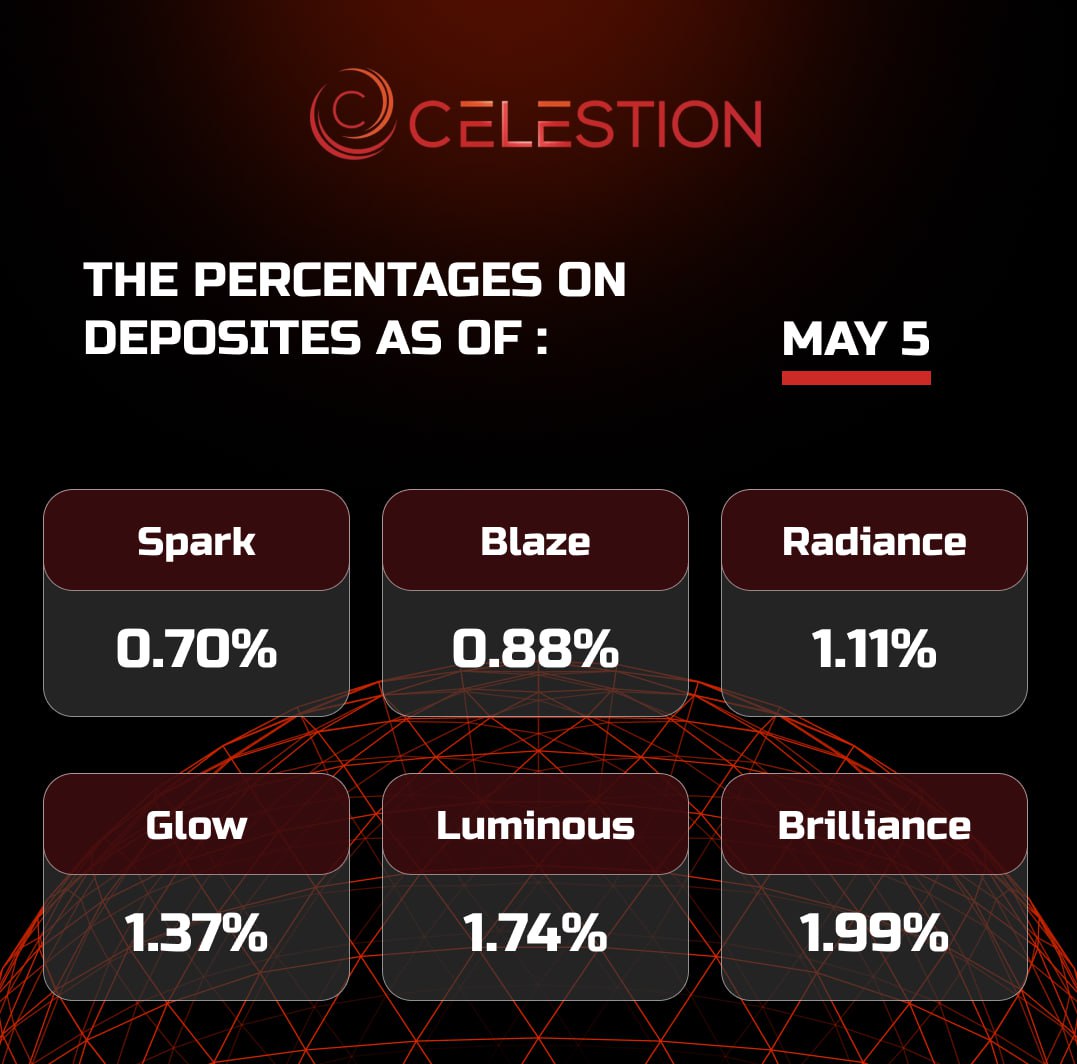

The percentages on deposits as of May 5️⃣

May-5-2025

Read more

Cardano Network to Launch AI-Powered Testnet ✔️

May-5-2025

Cardano blockchain founder Charles Hoskinson has written about his ambition to launch an AI testnet as part of the Leois Research program. He hopes the testnet will take the protocol to its highest possible speeds.

Hoskinson noted that Cardano will populate the new testnet with thousands of AI agents to trade with each other. The move will be a way to stress test the speed, security, and scalability of the newly upgraded network before its full launch. It also gives Cardano-based DApps the ability to leverage high-speed AI trading.

Analysts believe the new initiative could boost adoption of the network and increase demand for its native cryptocurrency, ADA . Given the closeness of Cardano's CEO to the US government, some analysts predict new uses for the blockchain.

Users expect that Cardano's improved performance will attract more users to the network, automatically creating opportunities for the ADA token to grow.

According to CoinGecko, ADA is still in the top 10 cryptocurrencies by market cap and is trading around $0.66861 after a 46% jump in April. For now, the most likely scenario is future sideways trading.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU

HI

HI