Bhutan Moves 751 Bitcoins as Crypto Investors Fear Selloff 🔰

Feb-7-2025

The Bhutanese government is back in the spotlight in the crypto community thanks to a new Bitcoin move. According to Spot on Chain, the country recently moved 751 BTC worth about $74.15 million to three newly created wallets.

The move coincided with the flagship asset falling below $99,000, sparking speculation in the market. Crypto investors began talking about a possible Bitcoin sell-off . However, Spot On Chain suggested that the transfer was related to an internal movement of funds, rather than a sell-off.

Indeed, previous transfers did not result in Bitcoin being withdrawn to crypto exchanges. For example, on January 17, Bhutan transferred 633 BTC to new wallets, but no additional transactions followed. However, in December 2024, the government sold 402 BTC through an over-the-counter transaction with QCP Capital. It took place at an average price of $98,700 per coin and brought the country about $39.7 million.

Bhutan currently holds around 10,600 BTC in its Bitcoin reserves, worth around $1.05 billion, making the Kingdom the fourth-largest holder of the leading cryptocurrency.

Bhutan is getting Bitcoins from its powerful hydroelectric power plant. In April, the country entered into a strategic partnership with miner Bitdeer Technologies to increase its Bitcoin mining capacity and boost profits.

Read more

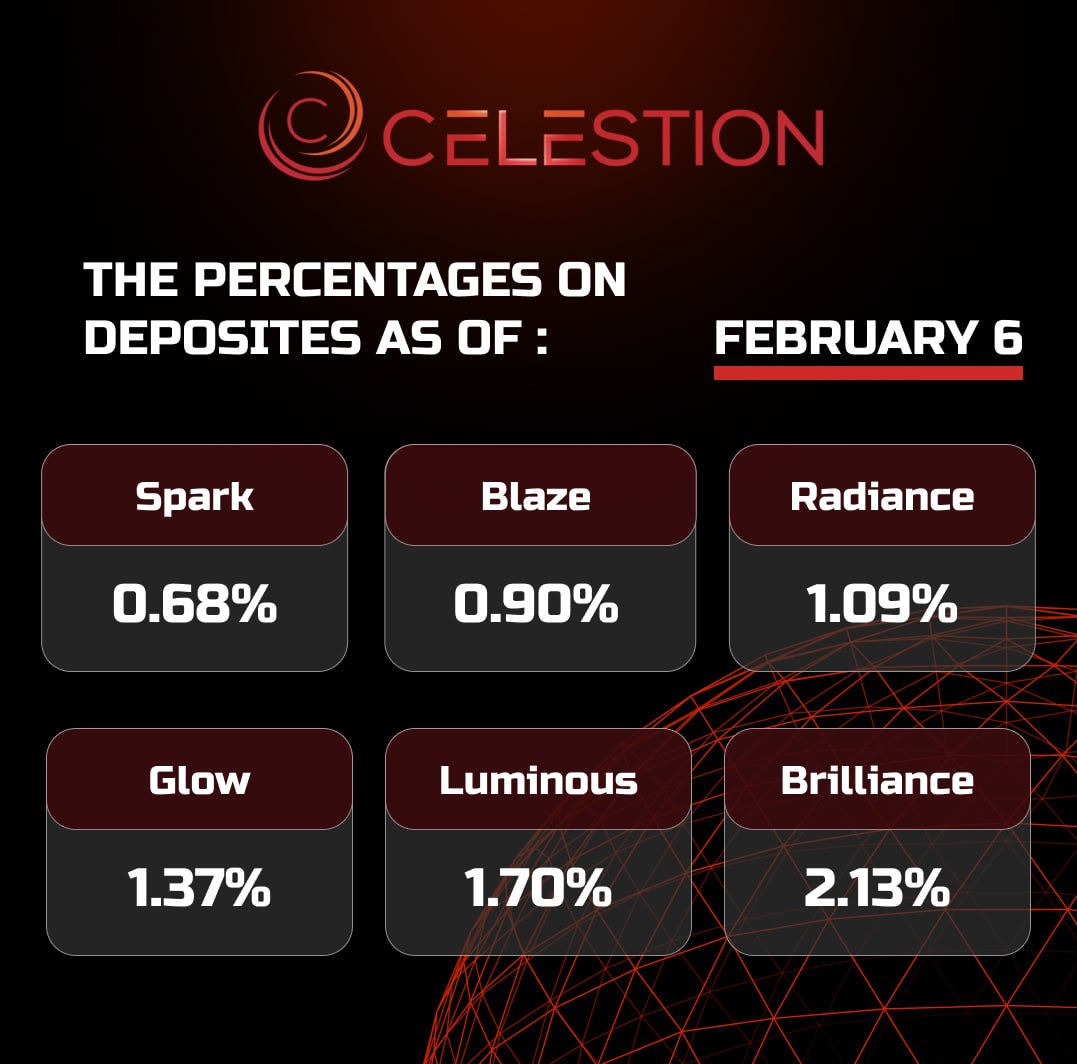

The percentages on deposits as of February 6️⃣

Feb-6-2025

Read more

BlackRock Plans to Launch Bitcoin Fund for European Market ✔️

Feb-6-2025

Following the success of its US Bitcoin fund, asset manager BlackRock is planning to launch a Bitcoin ETF for Europe, according to Bloomberg.

According to anonymous sources, whose data is cited by the American publication, the new exchange-traded product will be registered in Switzerland.

The European cryptocurrency ETP market is a hotly contested one, with more than 160 products tracking the price of Bitcoin , Ethereum and other tokens.

But its $17.3 billion size pales in comparison to the U.S. market, Bloomberg reported.

The publication's stock market analyst James Seyffarth, in turn, doubts that BlackRock's approach to launching a bitcoin fund in the US will also be suitable for the European market.

The US-based iShares Bitcoin Trust (IBIT) spot BTC ETF tracks the price of the flagship cryptocurrency. According to The Block Data Dashboard, BlackRock's Bitcoin ETF is the largest BTC-based exchange-traded product, with nearly $57 billion in assets under management.

BlackRock's IBIT Bitcoin fund once again led the way in net investor inflows on the trading day, with more than $249 million coming into the fund on Tuesday.

Read more

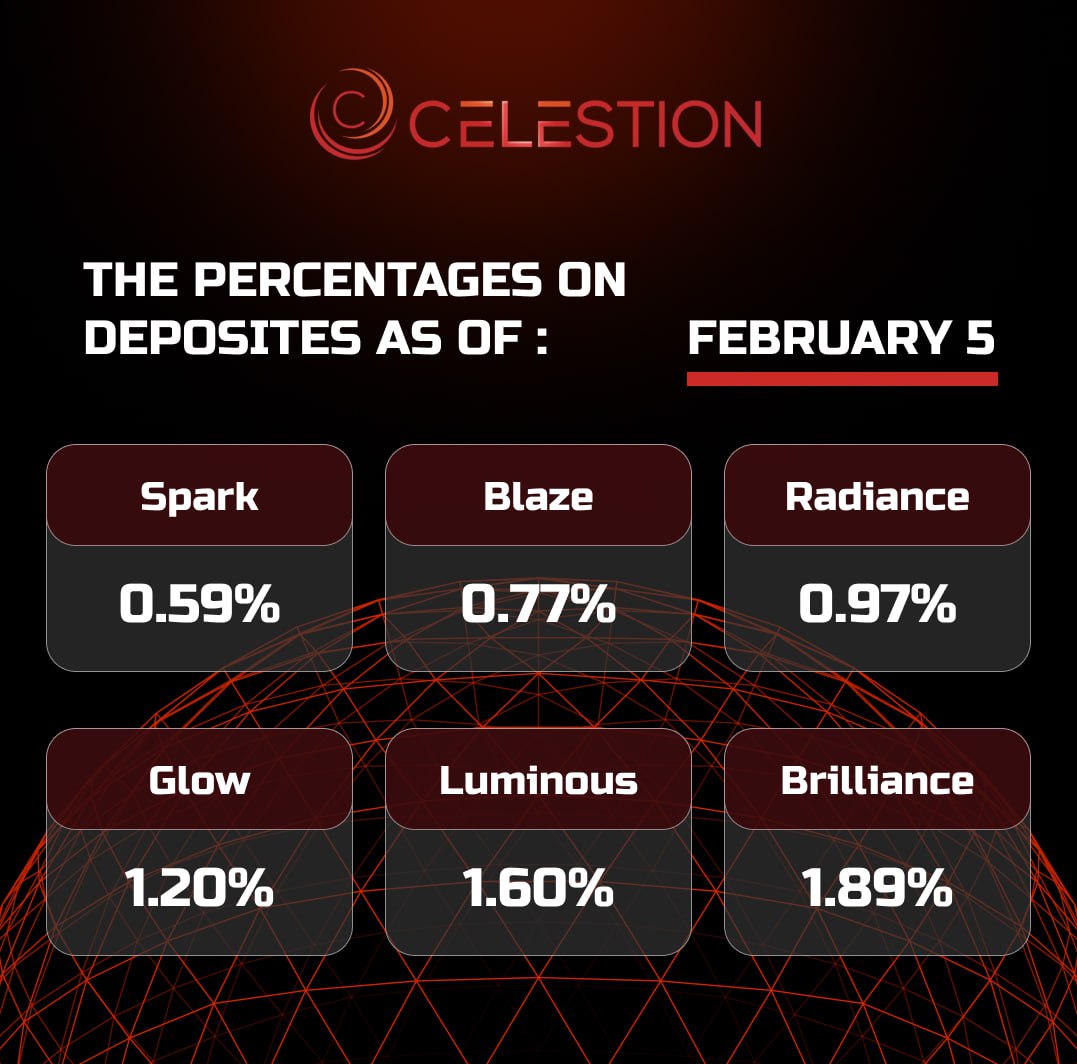

The percentages on deposits as of February 5️⃣

Feb-5-2025

Read more

US Wealth Fund Could Use XRP ✅

Feb-5-2025

Legal and financial expert Bill Morgan has spoken about the possible role of cryptocurrency in the creation of the US National Welfare Fund. In his opinion, low-cost digital assets such as XRP can help monetize US assets.

Morgan believes that the US government is likely looking to monetize the asset side of its balance sheet, viewing liquidity as essential. He noted the need for efficient bridge assets that transfer value quickly and cheaply, such as XRP.

Here Morgan explained that monetizing an asset means turning it into cash or turning it into a source of income.

To back up his point, Morgan shared an explanation of Elon Musk's artificial intelligence tool Grok, which suggests that tokenization allows assets to be digitized to increase liquidity, accessibility, and efficiency.

At the same time, AI has recognized challenges such as regulatory compliance, security risks, and the need for standardization across platforms and jurisdictions.

It is currently unclear how the US sovereign wealth fund will work, but experts believe that blockchain and tokenization could play a key role in modernizing the financial infrastructure.

Read more

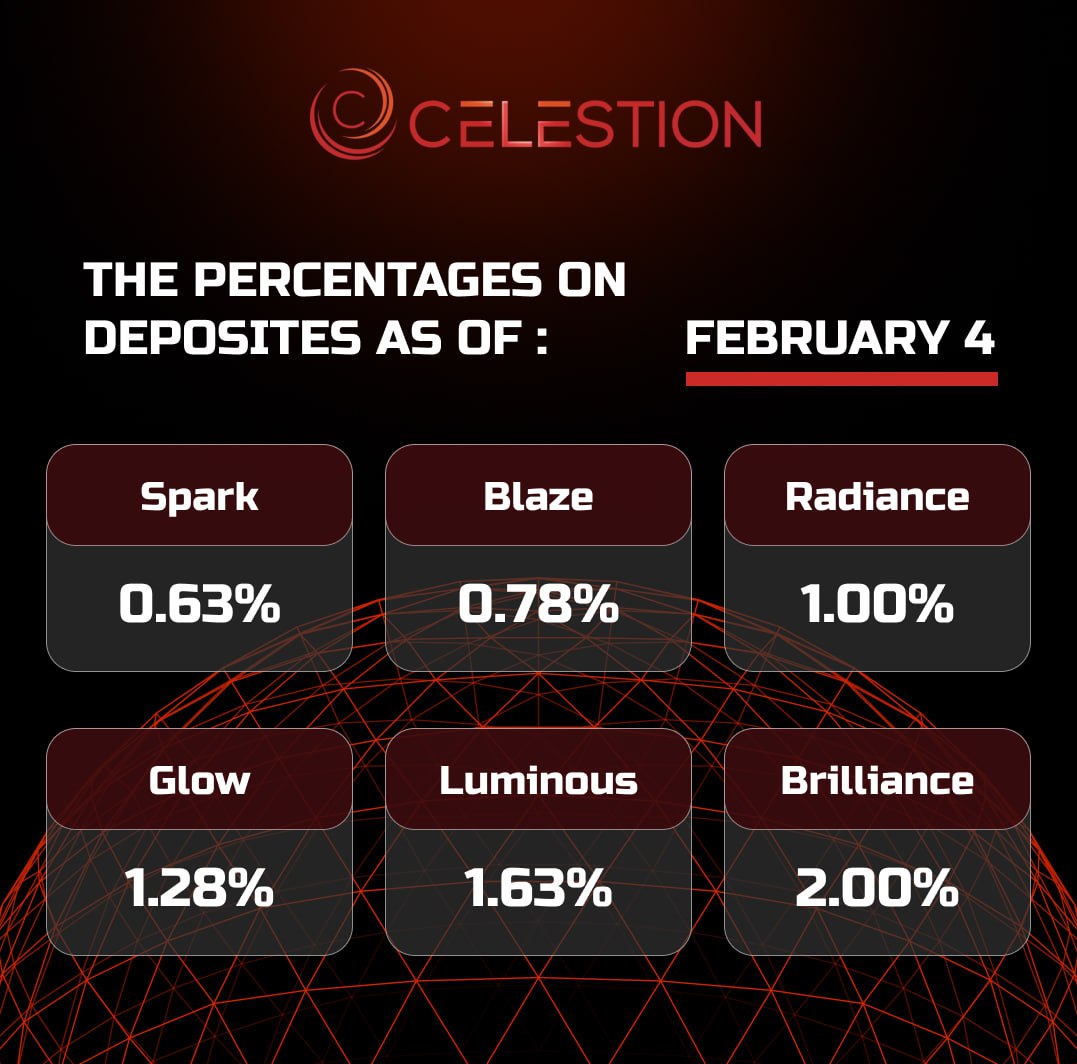

The percentages on deposits as of February 4️⃣

Feb-4-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU