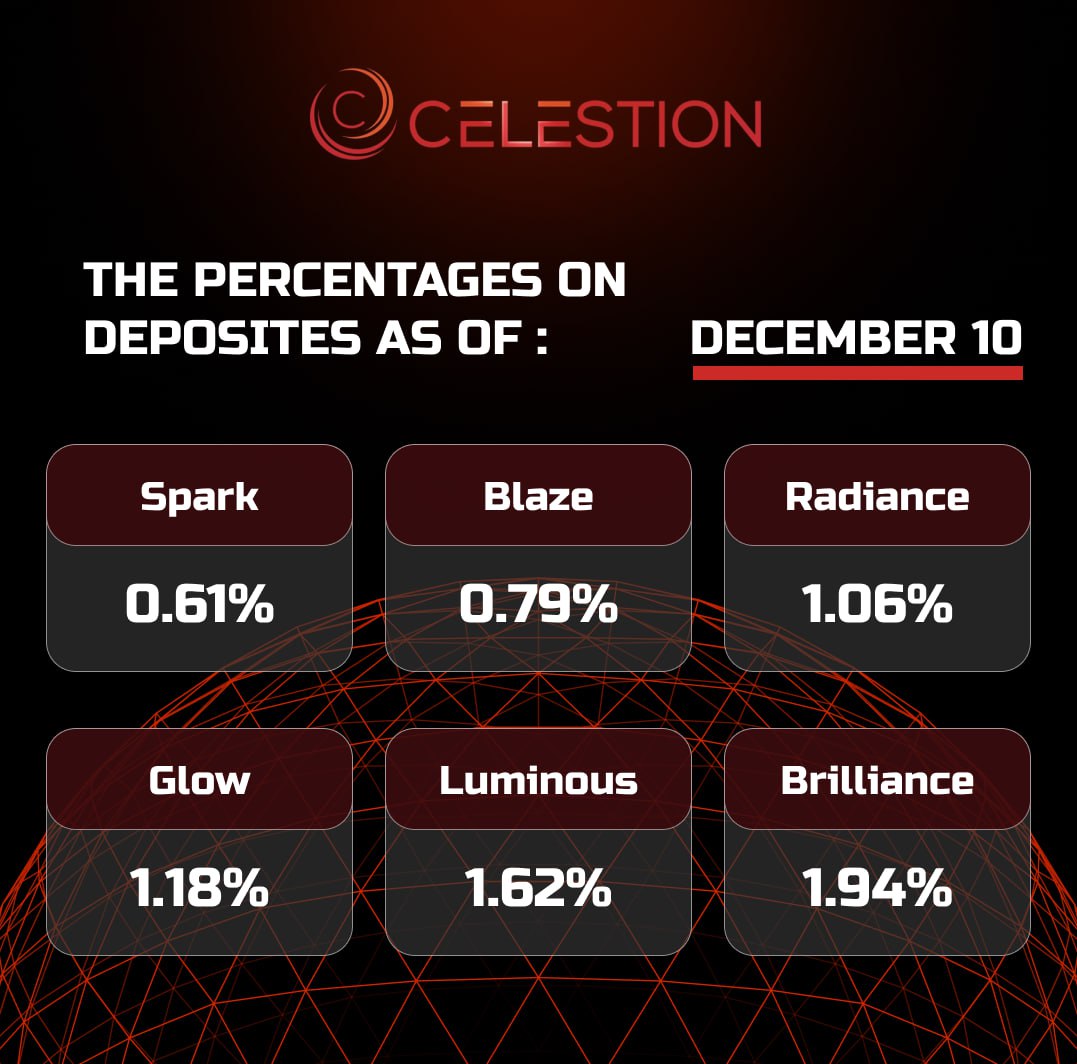

The percentages on deposits as of December 1️⃣0️⃣

Dec-10-2024

Read more

Changpeng Zhao: "China Will Inevitably Create a State Reserve in Bitcoin" ✔️

Dec-10-2024

Speaking at the Bitcoin MENA conference in Abu Dhabi, Changpeng Zhao noted that Trump has not yet taken office as president, so the task of creating a reserve of bitcoins has yet to be completed. Once this happens, other countries will follow suit.

According to Zhao, small countries will be the first to create state reserves in bitcoins, and this will happen gradually. Later, large countries, including China, will follow suit. Zhao noted that China's position on cryptocurrencies is more difficult to predict, given the lack of transparency from the government. Cryptocurrency trading and mining are currently prohibited in the country.

However, Zhao believes that China will inevitably have to create a state reserve in bitcoin, since it is the only “hard asset.” Moreover, this could happen without prior notice - China will announce the existence of such a reserve after the fact, Zhao reasons.

"I would be shocked if the Chinese government announced something first and then did it. I wouldn't be surprised if China hoarded bitcoins first and then announced them. The government can act very quickly if they want to," Zhao said.

The former Binance executive recently expressed disappointment with memecoins, calling the hype around them “a little weird.” In November, Zhao suggested that Bitcoin’s bull run would continue for a long time.

Read more

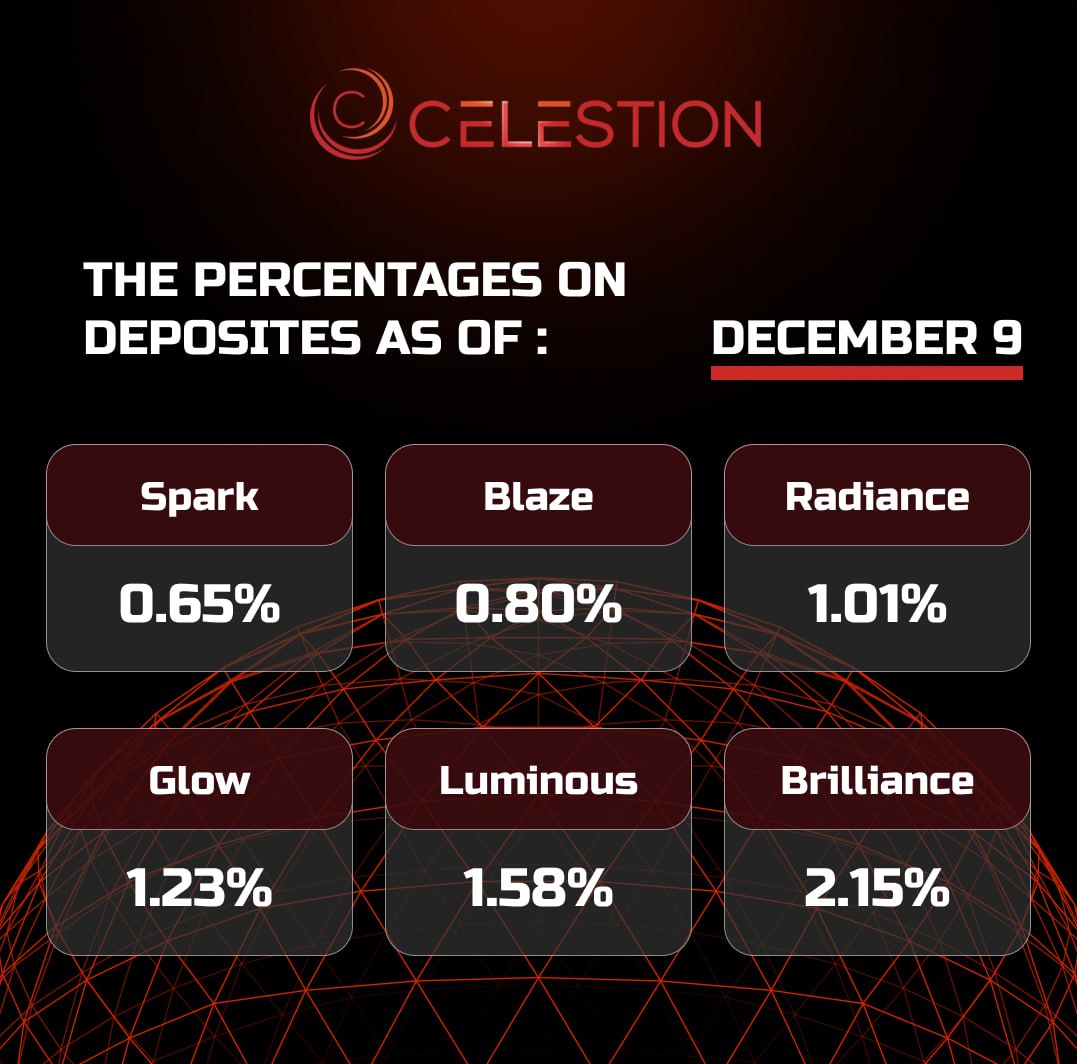

The percentages on deposits as of December 9️⃣

Dec-9-2024

Read more

Vitalik Buterin: Decentralized Committees Could Break the Concept of Ethereum ✔️

Dec-9-2024

Buterin made this statement in response to a tweet from Celestia blockchain partner Nick White, who wrote on social media X that the main purpose of any blockchain is to be verifiable, regardless of the method.

He suggested that transactions be verified by decentralized committees.

However, Buterin disagreed with this idea, saying that even such committees could make Ethereum centralized and dependent on them.

Buterin added that blockchains should be open to anyone running nodes. This approach would ensure that governance remains distributed and not concentrated among a select few.

"If Ethereum abandons verifiability and then implements committees and centralized intermediaries, it will cease to be Ethereum to me . Decentralization is necessary for blockchain to thrive," Buterin wrote.

In August, the Ethereum co-founder said he prefers to use applications that do not sacrifice the principles of decentralization.

In particular, Buterin singled out the stablecoin RAI and the forecasting platform Polymarket. Buterin recently criticized OpenAI for moving to a closed-source model, accusing it of not prioritizing user safety.

Read more

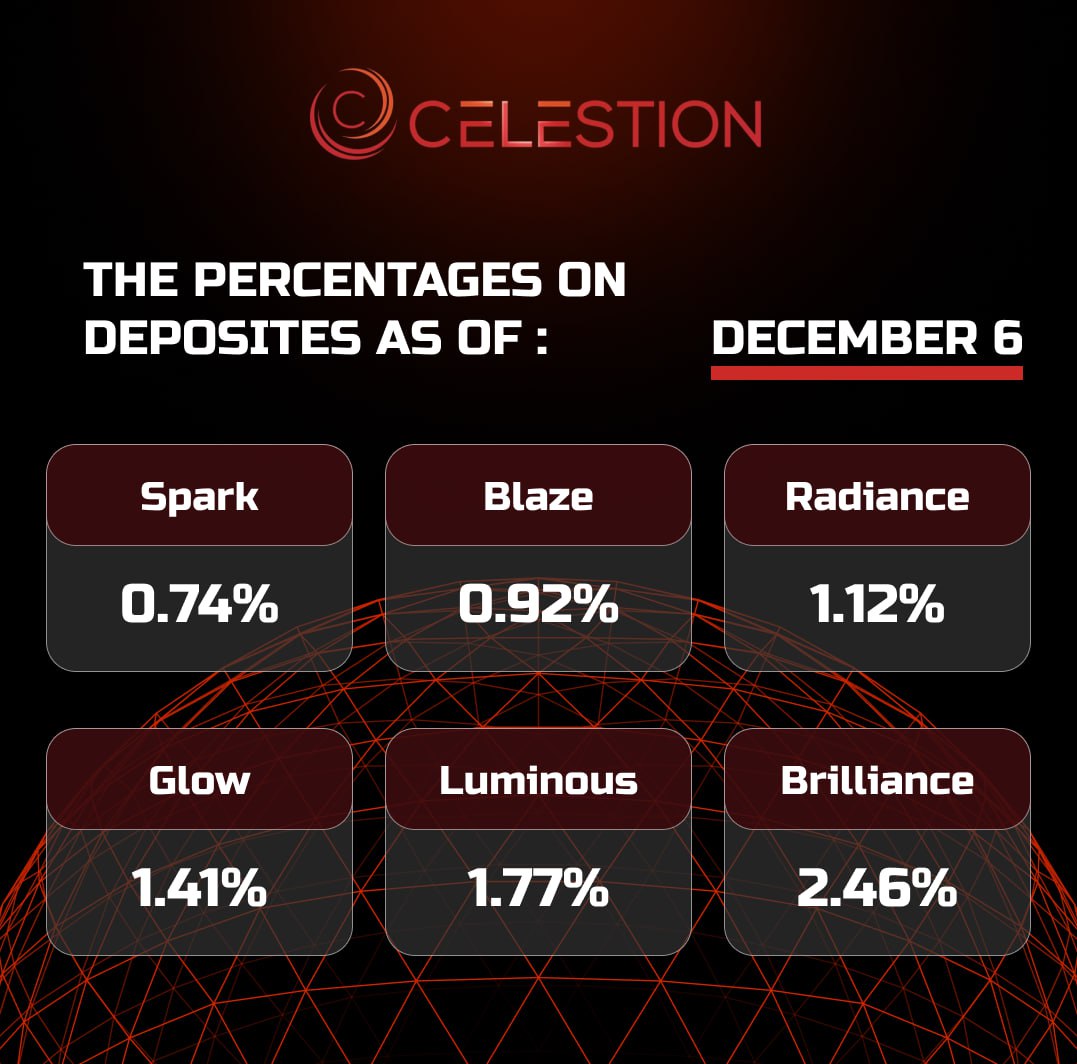

The percentages on deposits as of December 6️⃣

Dec-6-2024

Read more

Australia's Financial Reporting and Analysis Centre to step up oversight of cryptocurrency ATMs in the country ☑️

Dec-6-2024

AUSTRAC CEO Brendan Thomas acknowledged that crypto ATMs can be used to conduct quick cryptocurrency transactions. However, this makes them attractive tools for criminals laundering money. Thomas noted that crypto ATMs are easy to find in retail outlets and other public places, so AUSTRAC will continue to monitor the installation of new devices to reduce the illegal use of cryptocurrencies in Australia.

There are currently 680 Coinflip ATMs, 465 Localcoin ATMs, 75 Cryptolink ATMs and 30 Nova ATMs installed in Australia.

Thomas said AUSTRAC plans to set up a special department to monitor whether crypto ATM operators comply with regulations. Operators must register with AUSTRAC and obtain a license to operate, verify the identity of their customers, and monitor transactions. They must also report any suspicious activity if the amount of cash withdrawn or deposited exceeds A$10,000 (about $6,500). Violators face large fines, Thomas warned.

"As digital assets and crypto ATMs become more popular, there may be an increase in the number of cases where these devices are used for criminal purposes. The new taskforce will work to stop illegal activity in cryptocurrencies," the AUSTRAC CEO said.

According to Coin ATM Radar, the number of crypto ATMs in Australia has skyrocketed 16-fold from September 2022 to the end of 2023. This has made the country the third-largest country in the world for crypto ATMs, behind the US and Canada.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU