Bitcoin Reaches Record High on Trump's Instigation ✔️

Nov-20-2024

Bitcoin rose to a fresh record high in trading on Tuesday, responding to reports that Donald Trump's social network is in talks to buy cryptocurrency trading firm Bakkt, Reuters reports .

This has raised hopes for a crypto-friendly regime under the new administration.

Having surpassed the high seen last week, BTC has now touched a new record at $93,751. On Wednesday, the digital currency was trading around $92,350.

Bitcoin, the largest and most famous cryptocurrency, has more than doubled this year.

The Financial Times, citing people familiar with the matter, reported that Trump Media & Technology Group , which runs Truth Social, is close to a full share purchase of Bakkt , which is backed by the NYSE owner.

IG market analyst Tony Sycamore noted that Bitcoin's rise to a record high was supported by reports of Trump's deal, as well as traders taking advantage of the first day of trading in Nasdaq options on BlackRock 's Bitcoin ETF .

Read more

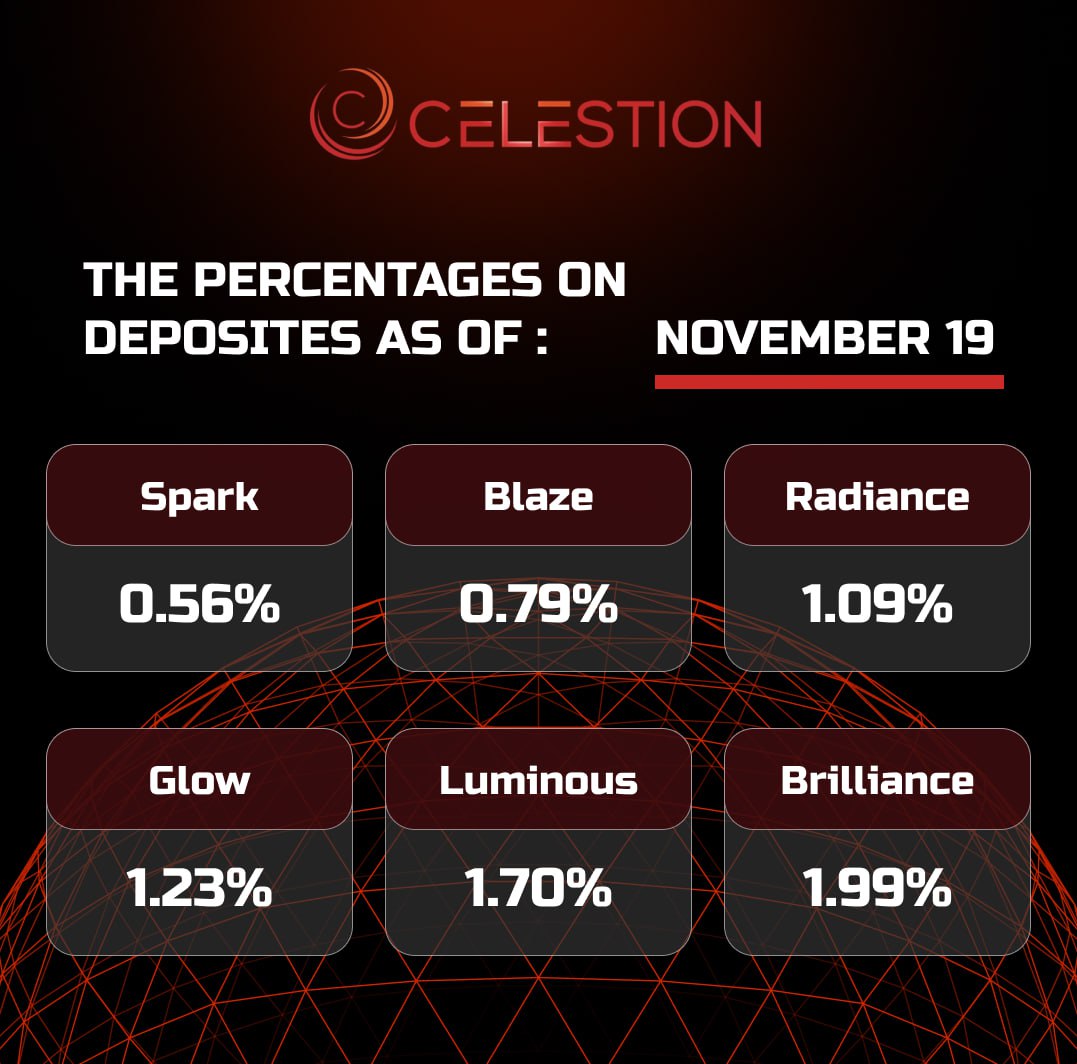

The percentages on deposits as of November 1️⃣9️⃣

Nov-19-2024

Read more

MicroStrategy Acquires Another 51,780 BTC for $4.6 Billion ☑️

Nov-19-2024

In a report filed with the U.S. Securities and Exchange Commission (SEC), MicroStrategy reported purchasing 51,780 bitcoins at an average price of $88,627 per BTC . As a result, the volume of the first cryptocurrency in the company's accounts amounted to 331,200 coins. The purchase was made using the proceeds from the sale of MicroStrategy shares between November 11 and November 17, which brought the company more than $4 billion.

A week earlier, MicroStrategy notified investors that it had purchased a batch of 27,200 bitcoins, bringing its corporate holdings to 279,420 BTC. MicroStrategy said it spent more than $2 billion to acquire the first cryptocurrency.

Read more

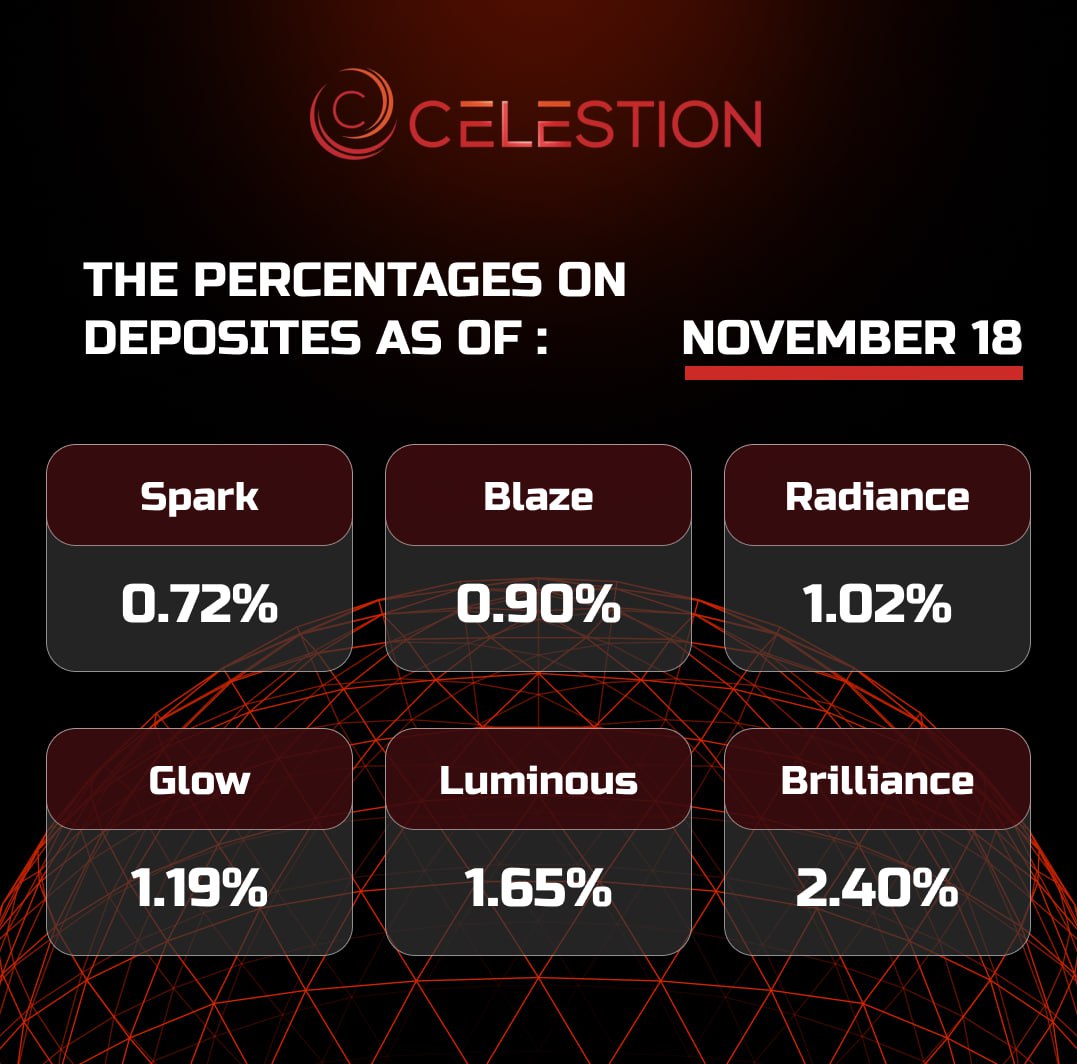

The percentages on deposits as of November 1️⃣8️⃣

Nov-18-2024

Read more

Bitcoin Back Above $92,000 After 3% Drop ☑️

Nov-18-2024

Bitcoin posted its biggest two-day pullback since the U.S. election over the weekend, Bloomberg reports .

Global markets have gone into caution mode as they assess the potential impact of President-elect Donald Trump's political agenda on asset movements, including cryptocurrencies.

The main digital coin fell by almost 3% over Saturday and Sunday, after which it returned to growth and as of 10:02 Moscow time on Monday was trading at $92,145.

Among the uncertainties is the timing of Trump's promises to support cryptocurrencies, as well as their implementation.

In the US stock market, euphoria over Trump's business-friendly stance is tempered by inflation risks from the prospect of trade tariffs and budget deficits to finance tax cuts.

Investors are reconsidering expectations of interest rate cuts by the Federal Reserve amid a robust U.S. economy, which could be a headwind for cryptocurrencies as liquidity conditions could impact speculative demand for digital tokens.

Bitcoin has "overheated" after a record rally since the November 5 election, and "a lot of good news has been priced in," IG Australia Pty market analyst Tony Sycamore wrote in a note.

Trump has promised to create a crypto-friendly regulatory environment, create a strategic reserve of bitcoin, and make the U.S. a global hub for the industry. A former cryptocurrency skeptic, the president-elect changed his tune after digital asset firms spent heavily on advancing their interests during the campaign.

Cryptocurrency legislation could be approved soon under the Trump administration, shifting regulation away from enforcement to a more collaborative approach, JPMorgan Chase & Co strategists led by Nikolaos Panigirtzoglou wrote in a note.

Read more

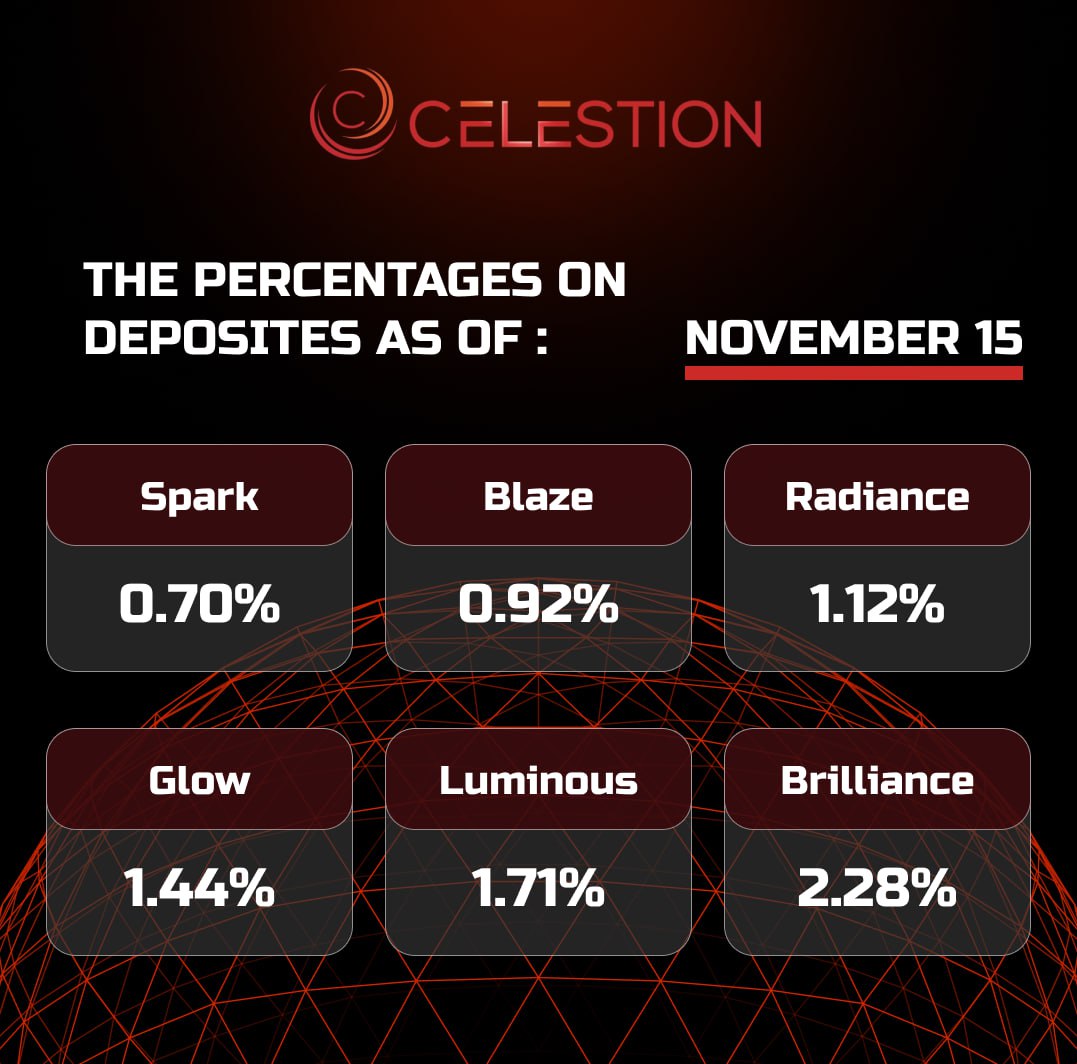

The percentages on deposits as of November 1️⃣5️⃣

Nov-15-2024

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU