Vitalik Buterin Donates 320 ETH to Human Rights Organization Coin Center

Nov-28-2024

According to SpotOnChain, Buterin initially sold four memecoins: 330 billion LEDOG for 10.96 ETH, 3.03 trillion DOGC for 10.8 ETH, 19.95 million #99 for 1.58 ETH, and 300 million VITALIK for 1.14 ETH. The total amount of ETH raised was 24.5 coins worth $81,800. After selling the memecoins, Buterin donated 320 ETH to Coin Center for $1.07 million.

Buterin's actions have sparked heated discussions among crypto enthusiasts. Some fear that Coin Center could sell off the coins it received to fund its own initiatives, thereby putting pressure on the market. Others are confident that this will, on the contrary, draw attention to Ethereum , creating a surge in trading activity.

Buterin's donation has not had a negative impact on the ETH price. On the contrary, investors remain optimistic as the coin has surpassed the $3,600 mark. Ethereum's market cap is currently $434.7 billion.

According to IntoTheBlock, November saw a large influx of funds into spot Ethereum exchange-traded funds (ETFs). Large holders of the cryptocurrency began buying more coins in anticipation of a rally in the market. Open interest (OI) in Ethereum has also increased over the past week. According to Coinglass, it has reached an all-time high of $21.22 billion. The sharp rise in OI suggests that investors are opening new positions in Ethereum while maintaining existing ones.

In October, Vitalik Buterin sold 10 billion MOODENG tokens for 308.69 ETH. Of these, 260 ETH were donated to the biotech charity platform Kanro to combat airborne diseases.

Read more

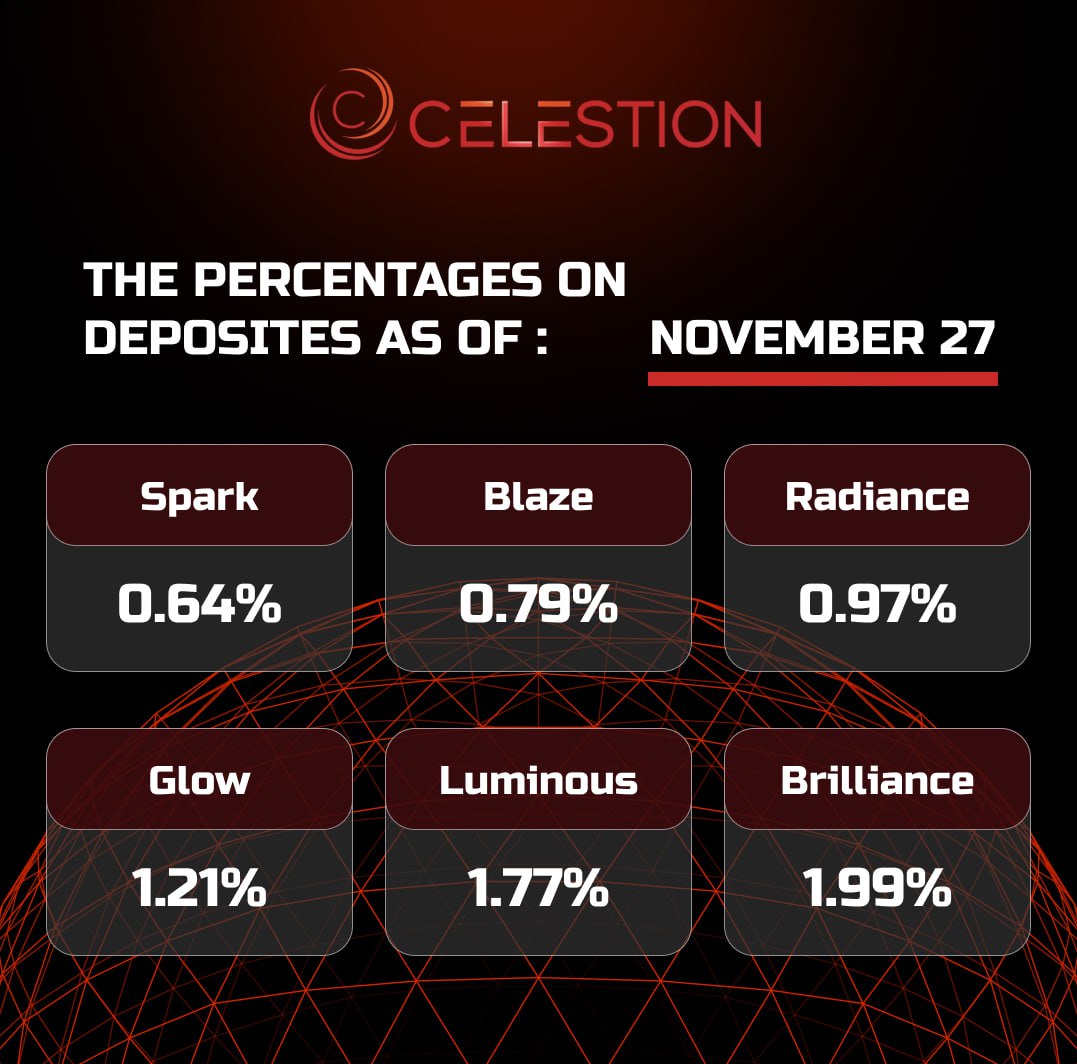

The percentages on deposits as of November 2️⃣7️⃣

Nov-27-2024

Read more

OX Business: Commodity Futures Trading Commission to Become US Cryptocurrency Regulator✔️

Nov-27-2024

The CFTC currently oversees the $20 trillion derivatives market. Once Donald Trump takes office, the agency will be able to regulate both the futures and spot markets for cryptocurrencies because Bitcoin and Ethereum will be considered commodities. According to FOX Business sources, the CFTC will oversee exchanges where these cryptocurrencies are traded.

The US Securities and Exchange Commission (SEC) will have its regulatory powers over digital assets reduced. Last week, SEC Chairman Gary Gensler already announced that he would step down on January 20, 2025, after Trump’s inauguration.

Former CFTC Chairman Chris Giancarlo has noted that with sufficient funding and the right leadership, the CFTC could begin regulating cryptocurrencies, so-called digital commodities, on Day 1 of Donald Trump’s presidency. Giancarlo has emerged as a candidate for the White House’s “crypto czar,” who would oversee federal cryptocurrency policy.

Trump's initiative is intended to provide regulatory clarity for industry companies and traders. Currently, no U.S. regulator has clear authority to regulate the spot crypto market.

CFTC Chairman Rostin Behnam, who will step down after the change in administration, said that about half of the enforcement actions last year were against cryptocurrency businesses. Behnam said that 70-80% of crypto assets are not classified as securities.

Read more

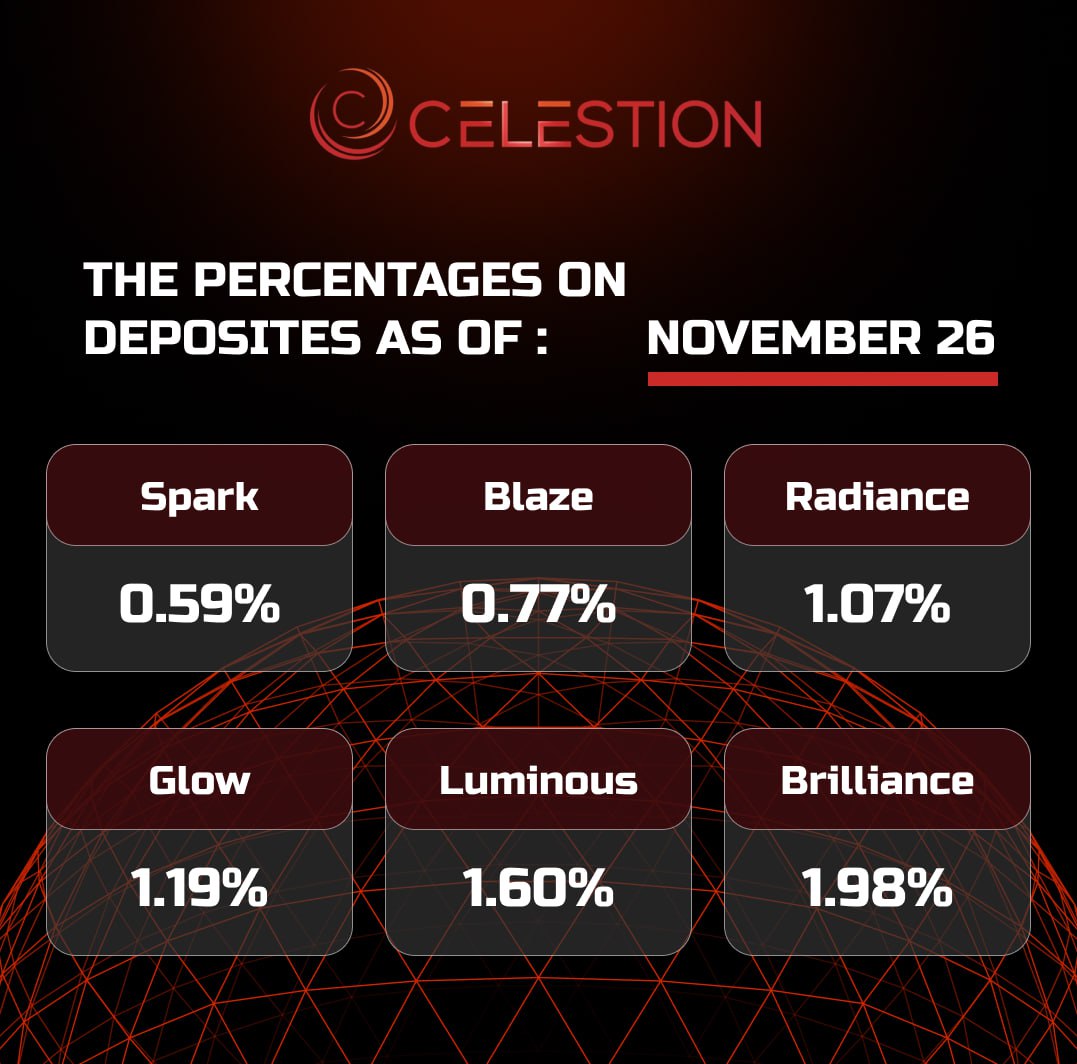

The percentages on deposits as of November 2️⃣6️⃣

Nov-26-2024

Read more

The number of crypto millionaires has grown by 95% since the beginning of the year ✔️

Nov-26-2024

Henley & Partners experts reported that the ongoing “digital gold rush” is creating a new financial elite whose wealth is based on investments in digital assets.

Henley & Partners said that in previous generations, wealth was mainly created through property and securities. However, today it is coming from Bitcoin, Ethereum, NFTs, initial coin offerings, mining and staking. And in many cases, staggering returns are being made from relatively small amounts of initial capital, Henley & Partners experts noted.

“There are now 172,300 people worldwide who own more than $1 million in crypto assets, up 95% from a year ago. The number of Bitcoin millionaires has grown by 111% to 85,400,” the report says.

The company's analysts reported that against the backdrop of an 89% increase in the capitalization of the crypto asset market, the number of crypto millionaires owning assets worth $100 million or more increased by 79%, to 325 people. The study notes a significant impact.

Bitcoin , which has become the main source of wealth growth for large investors.

“Of the six new crypto billionaires who have reached this level in the last year, five have been helped by Bitcoin, highlighting its dominance in attracting long-term investors buying large assets,” Henley & Partners explained.

In 2024, amid the public acceptance of digital assets and pressure from various government agencies, an increasing number of major crypto investors began to consider alternative options for their residence and citizenship, Henley & Partners said.

According to Henley & Partners, the top three countries in the crypto investor friendly ranking are headed by Singapore, Hong Kong, and the United Arab Emirates. None of these three countries impose capital gains tax, which is a significant advantage, especially for wealthy crypto investors.

Read more

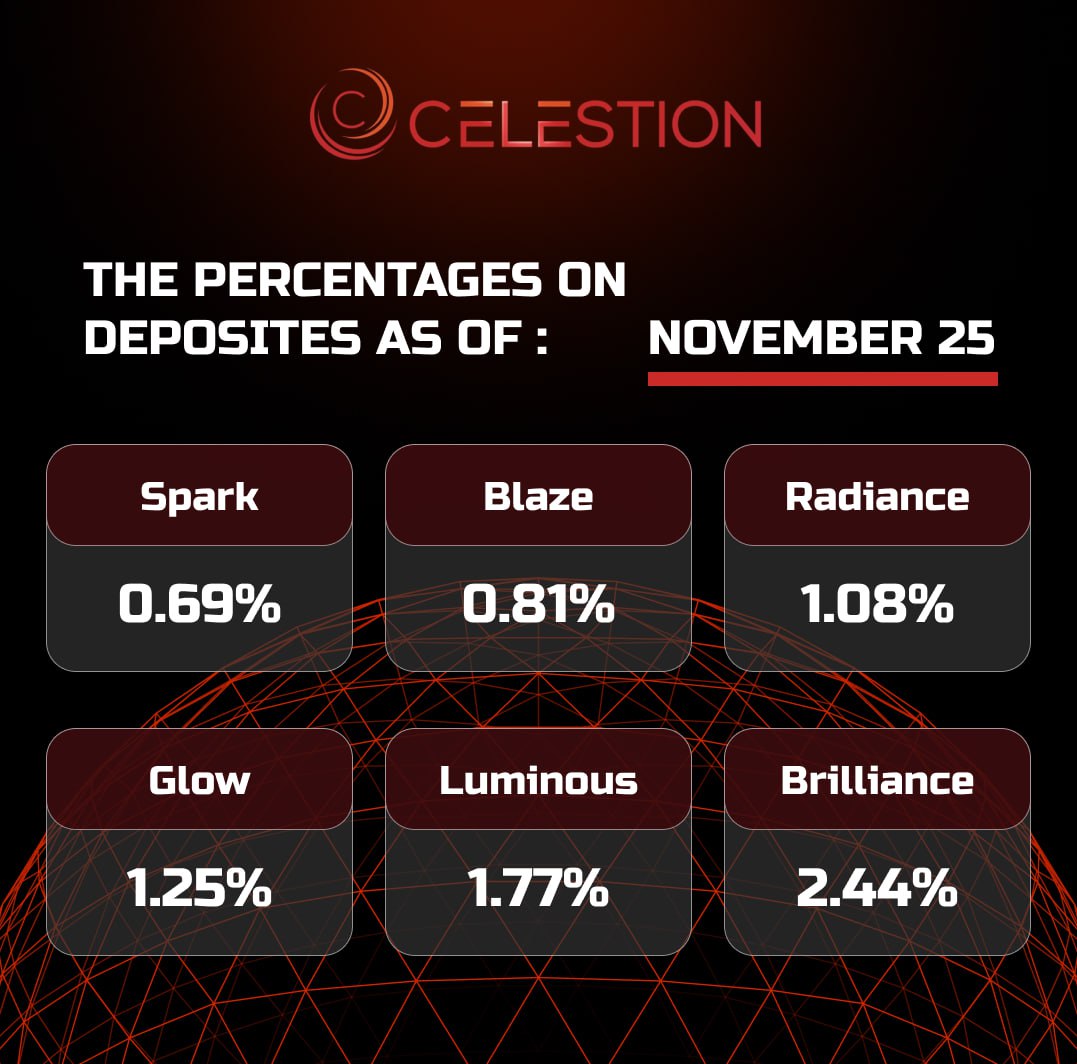

The percentages on deposits as of November 2️⃣5️⃣

Nov-25-2024

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU