Bitfinex Analysts Plot Bitcoin Bull Cycle Peak in 2025 ☑️

Dec-17-2024

Bitfinex emphasized that the minimum price of bitcoin by the third quarter will approach the $145,000 mark due to the presence of a large number of institutional investors.

💬“2025 represents a cautiously optimistic economic environment characterized by sustained crypto growth, ongoing structural challenges, and strategic adjustments. While normalization across various sectors provides stability, external risks and inflationary pressures will remain critical factors preventing the momentum from continuing,” Bitfinex said.

According to experts, the asset’s price will grow due to the inflow of funds into spot Bitcoin ETFs, as well as demand from institutional investors and the growing popularity of the first cryptocurrency as a global asset among market participants. At the same time, analysts urged investors to remain vigilant for signs of overbought conditions as Bitcoin approaches the top of its cycle.

Additionally, Bitfinex stated that the US economy is gradually normalizing in key sectors. According to analysts, this is one of the factors contributing to positive sentiment in financial markets in 2025, which will also have a positive impact on the crypto industry.

Earlier, Bitfinex's derivatives department said that Bitcoin had broken through and was holding the $100,000 mark thanks to monetary easing by two major central banks, the European Central Bank and the People's Bank of China.

Read more

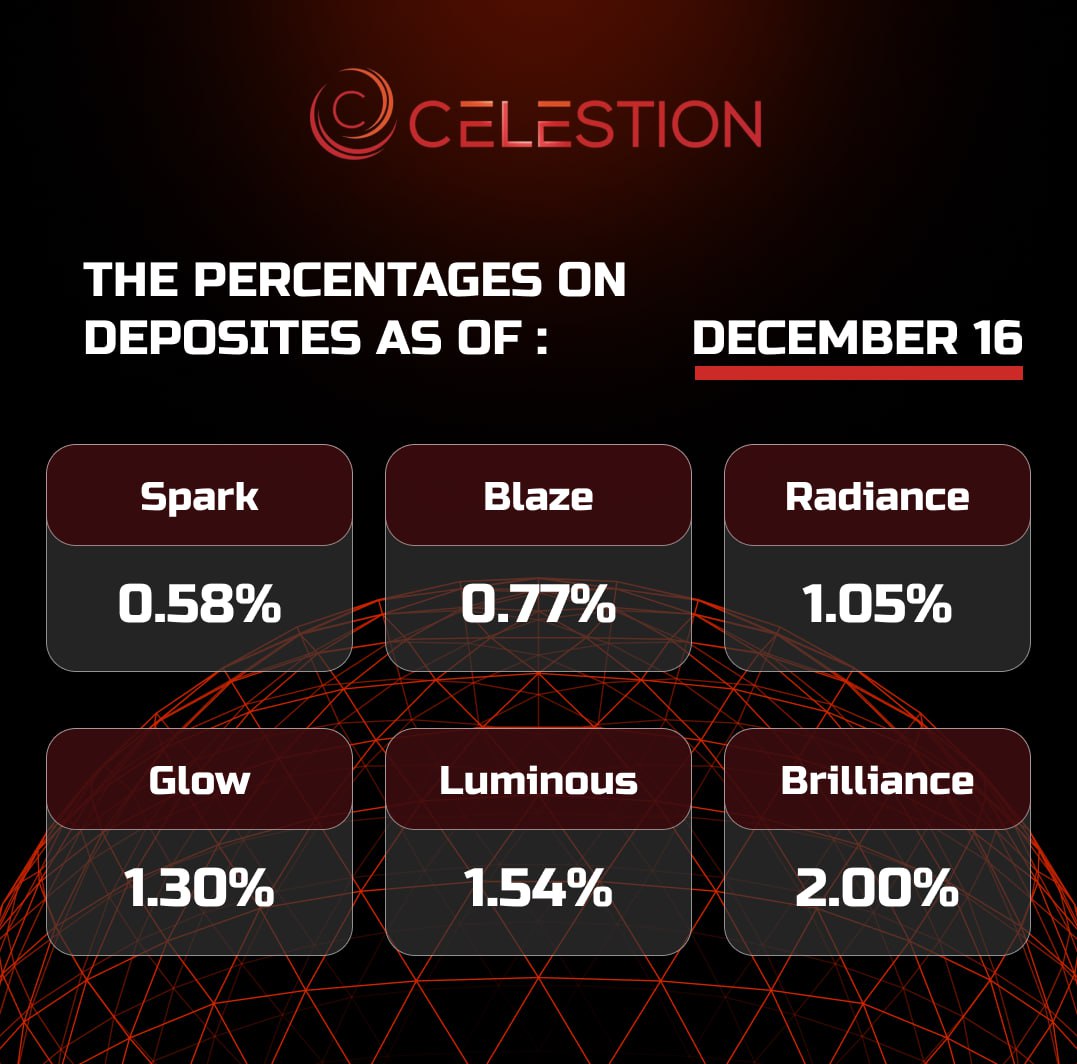

The percentages on deposits as of December 1️⃣6️⃣

Dec-16-2024

Read more

Bitcoin Surges $106,000 After Longest Gain Streak Since 2021 ✔️

Dec-16-2024

Bitcoin has risen to a fresh record high, extending a rally fueled by President-elect Donald Trump's embrace of digital assets and his plan to make the U.S. the dominant force in the sector, Bloomberg reports .

The largest token surged more than 3% in Asia on Monday to hit an all-time high of $106,460, surpassing its previous peak on Dec. 5.

Trump is aiming to create a favorable regulatory environment for digital assets, reversing the harsh measures put in place by the outgoing Biden administration. The Republican has also backed the idea of a strategic national reserve of bitcoin, although many doubt the feasibility of the proposal.

“A lot of people are pinning their hopes on a much more favorable administration,” Aya Kantorovich, co-founder of institutional cryptocurrency platform August, said on Bloomberg Television.

This optimism is reflected in demand for exchange-traded funds that invest in digital assets, she said.

Nasdaq Global Indexes said Friday that bitcoin accumulator MicroStrategy Inc. will join the Nasdaq 100 Index . The software maker’s transformation into a major bet on bitcoin has caught the attention of Wall Street, where the company is raising capital to put billions of dollars into the digital asset.

"Now that MicroStrategy is listed on Nasdaq, index funds can buy its shares, which will help the company raise more capital to buy more bitcoin," said Sean McNulty, director of trading at Arbelos Markets.

Smaller tokens such as the second-largest coin ETH and meme-fan favorite Dogecoin also rose.

Bitcoin ended its seventh of the last eight weeks higher on Sunday, putting it on its longest bull run since 2021.

Read more

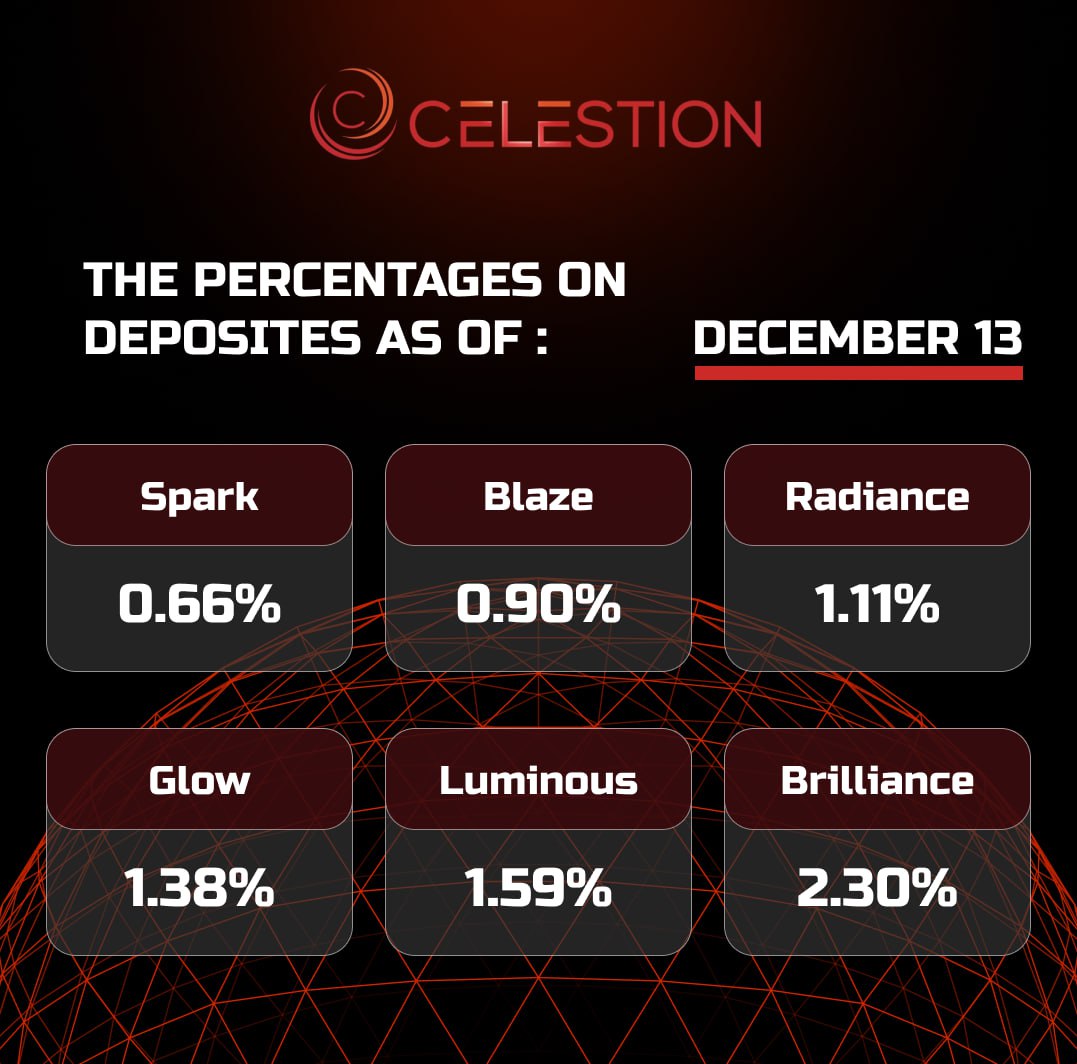

The percentages on deposits as of December 1️⃣3️⃣

Dec-13-2024

Read more

Coinbase to Delist USDT Stablecoin in Europe ✔️

Dec-13-2024

From December 13, several stablecoins will become unavailable on Coinbase (NASDAQ: COIN ) Europe, Coinbase Germany and Coinbase Custody International.

We will have to restrict access to USDT, PAX, PYUSD, GUSD , GYEN and DAI. We regularly review the assets we make available to clients on our platform to ensure that they are in compliance with regulatory requirements.

We will re-evaluate the possibility of re-listing stablecoins that comply with MiCA rules at a later date, Coinbase representatives said.

The delisting of the listed stablecoins is due to the launch of new MiCa rules, which will come into force in EU countries on December 30, 2024. The exchange has already offered its clients to convert the listed stablecoins into USDC and EURC from the issuer Circle, which will remain available in the future.

Coinbase is the third-largest cryptocurrency in the world by trading volume, with the USDT stablecoin accounting for more than 12% of all transactions on the platform.

Interestingly, European regulators have not directly stated that USDT is not compliant with MiCA. Tether CEO Paolo Ardoino has openly criticized some aspects of the new rules and the actions of a number of exchanges.

Tether does not agree with the hasty actions of some exchanges, which decide to delist the stablecoin either out of selfish motives, since they own a significant share of the competitor, or simply after a superficial analysis of the situation, - Ardonio said.

At the same time, he reported that the company is actively working on a technological solution adapted for the European market.

Read more

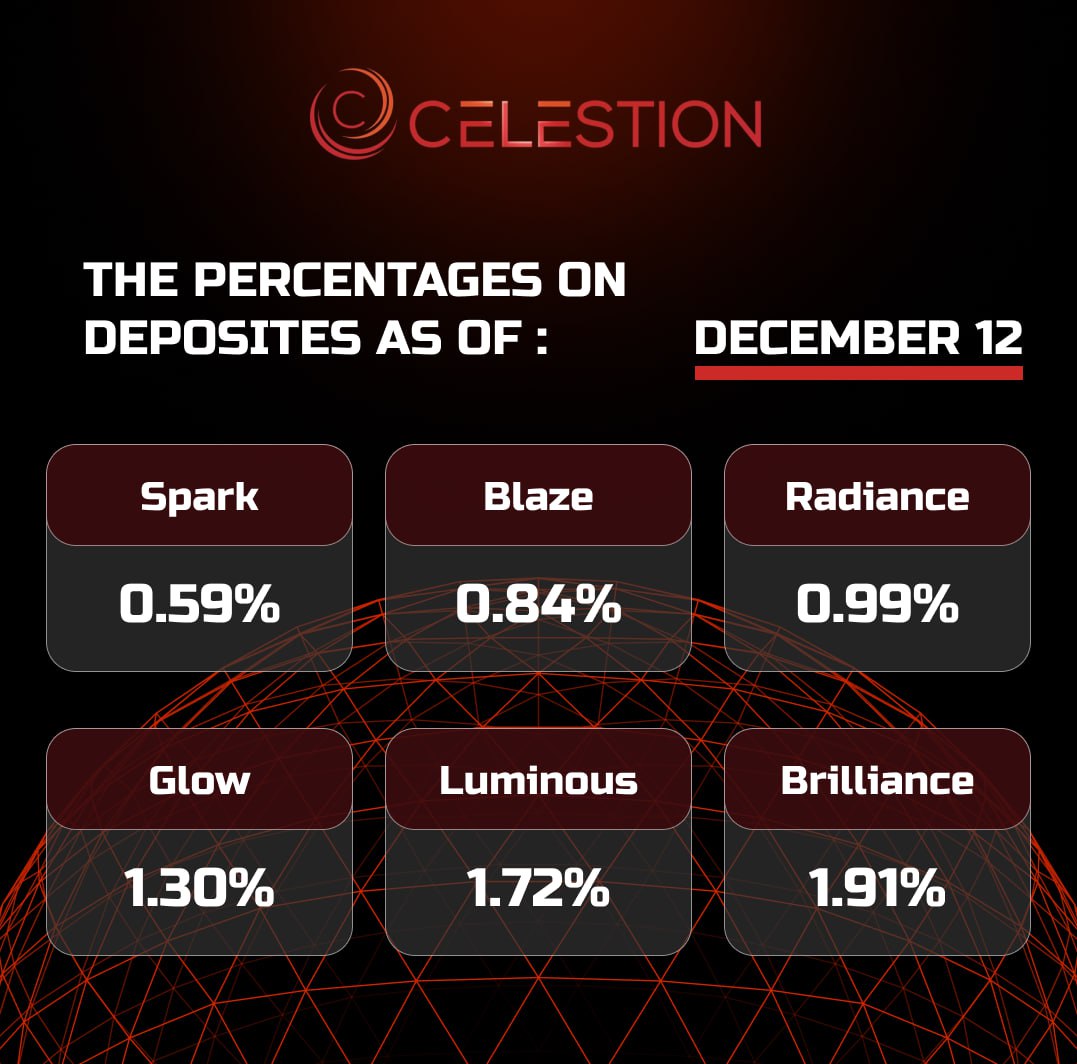

The percentages on deposits as of December 1️⃣2️⃣

Dec-12-2024

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU