Banks to Issue Stablecoins in Hopes of Repeating Tether's Success 💬

Dec-30-2024

European and American banks will soon issue stablecoins in hopes of repeating the success of USDT issuer 💵Tether .

This year, French bank Societe Generale (EPA: SOGN ) created a euro- pegged cryptocurrency, EUR CoinVertible (EURCV), while European financial conglomerate ODDO BHF, London-based Revolut, and DWS, owned by German bank Deutsche Bank (ETR: DBKGn ), are all developing their own euro-backed digital assets. More financial institutions in the U.S. and the European Union are expected to join the list.

Do I think other banks will also issue their own stablecoins? My answer is yes. It is difficult to do, so I am not sure that new stablecoins will appear in the near future, - said Jean-Marc Stenger, head of Societe Generale subsidiary SG Forge, which works in the field of digital financial products.

According to Stenger, several banks are already interested in using EUR CoinVertible stablecoins, and about 10 more organizations are in talks with Societe Generale about using the bank's software to issue their own cryptocurrencies with a stable exchange rate.

It is obvious that the management of financial institutions is jealous of Tether, which managed to hit the jackpot on USDT. This year, the company that created the most popular stablecoin should receive a profit of over $10 billion. This is possible thanks to the growth in demand for USDT, whose capitalization level increased by almost $50 billion in 2024 and exceeded $143 billion.

Read more

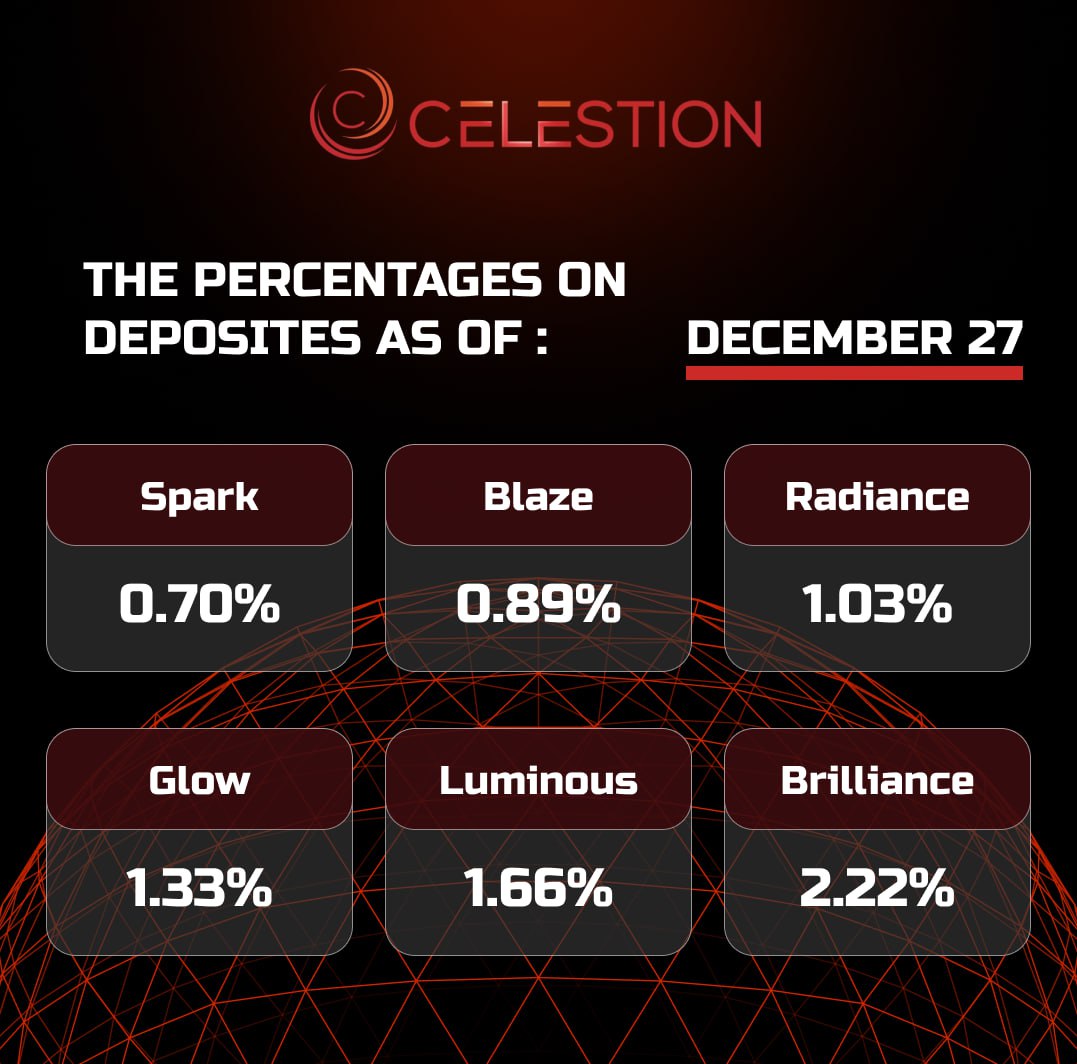

The percentages on deposits as of December 2️⃣7️⃣

Dec-27-2024

Read more

Bitwise: Bitcoin to Rise to $200,000 in 2025, Ethereum to $7,000 ↗️

Dec-27-2024

Analysts at Bitwise, the largest index of cryptocurrency funds in the US, predict that in 2025 Bitcoin will reach $200,000, while Ethereum and Solana will rise in price to $7,000 and $750, respectively.

Leading cryptocurrencies are set to hit new all-time highs next year thanks to massive investments in digital assets and a more favorable cryptocurrency regulatory regime, according to research from Bitwise.

Analysts are particularly optimistic about Bitcoin, expecting the leading cryptocurrency to grow by 109% next year compared to its current price. Their forecast is based on several factors at once - the influx of funds into spot BTC-ETFs, the coin's shortage, and the strategic BTC reserve in the United States, which Donald Trump promises to create.

Bitcoin Holder Countries 📇.

Currently, nine countries officially own Bitcoin . Bitwise predicts that number will double by next year.

This “Bitcoin arms race” could prompt the US to create a Bitcoin strategic reserve to further its dominance. In this regard, Bitwise’s head of research Ryan Rasmussen added that it could also push the flagship cryptocurrency’s value to $1 million by 2029.

Read more

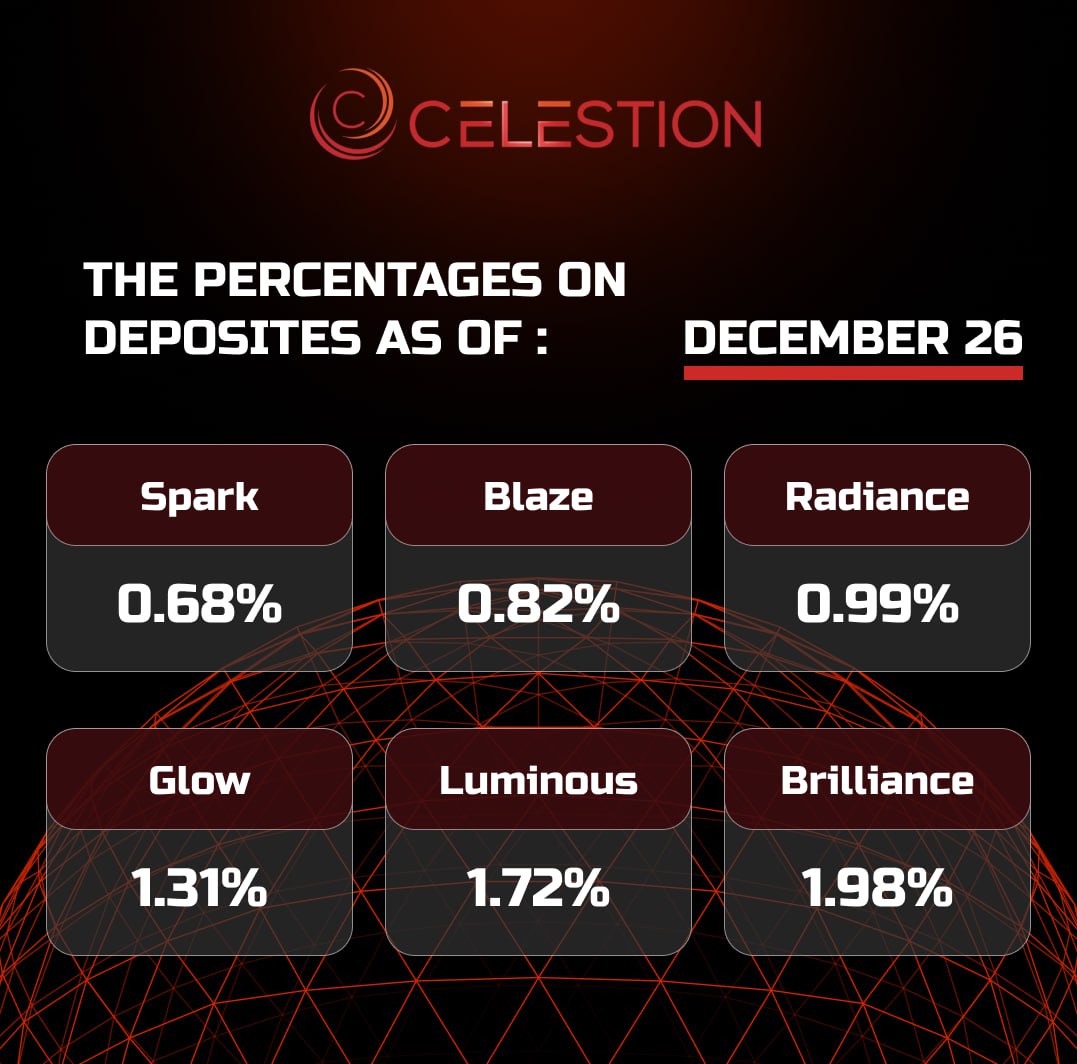

The percentages on deposits as of December 2️⃣6️⃣

Dec-26-2024

Read more

Investment company BlackRock bought $1 billion worth of BTC before the asset’s fall ✔️

Dec-26-2024

The world's largest asset manager spent $1 billion on Bitcoin just before the main cryptocurrency's sharp fall. The news was widely discussed in the crypto community.

According to the Arkham platform, the investment company purchased $1.5 billion worth of bitcoins last week. The organization spent $1 billion on almost 10,000 BTC shortly before the asset’s price fell from $107,000 to $103,000.

As of December 20, BlackRock owned more than 553,000 BTC, representing about 2.6% of the total Bitcoin supply.

According to the latest data from Fintel, BlackRock's total assets are estimated at $4.7 trillion. However, other sources estimate the company's reserves at more than $11 trillion. In any case, the share of Bitcoin in its portfolio is quite small. However, BlackRock's board of directors recently recommended increasing the share of BTC in its assets to 2%.

Interestingly, last week, market participants had another reason to discuss BlackRock's actions. On December 18, the company released a three-minute educational video about Bitcoin , which included the phrase "There is no guarantee that the 21 million BTC limit will not be changed."

Some experts have started talking about the fact that the restriction can actually be lifted with the help of a hard fork. If this happens and the flagship cryptocurrency is no longer in short supply, the price of the asset may fall significantly.

Read more

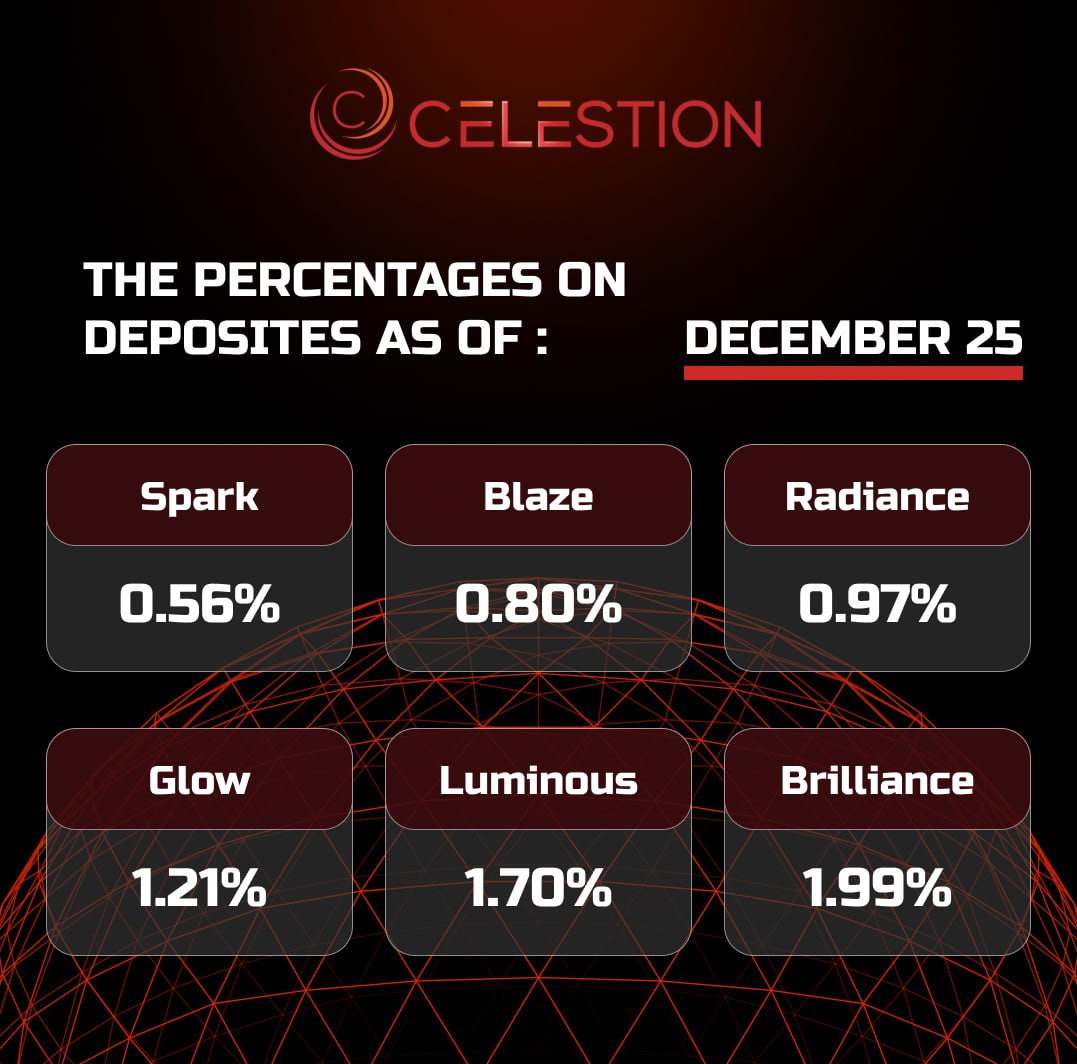

The percentages on deposits as of December 2️⃣5️⃣

Dec-25-2024

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU