We are pleased to announce that the CELESTION website is now available in Thai !

Jan-15-2025

Users from Thailand can now easily explore our financial and investment services and innovations in their native language.

We are committed to making our solutions accessible to all and continue to expand internationally!

Discover the future of digital asset trading with CELESTION ☑️

Read more

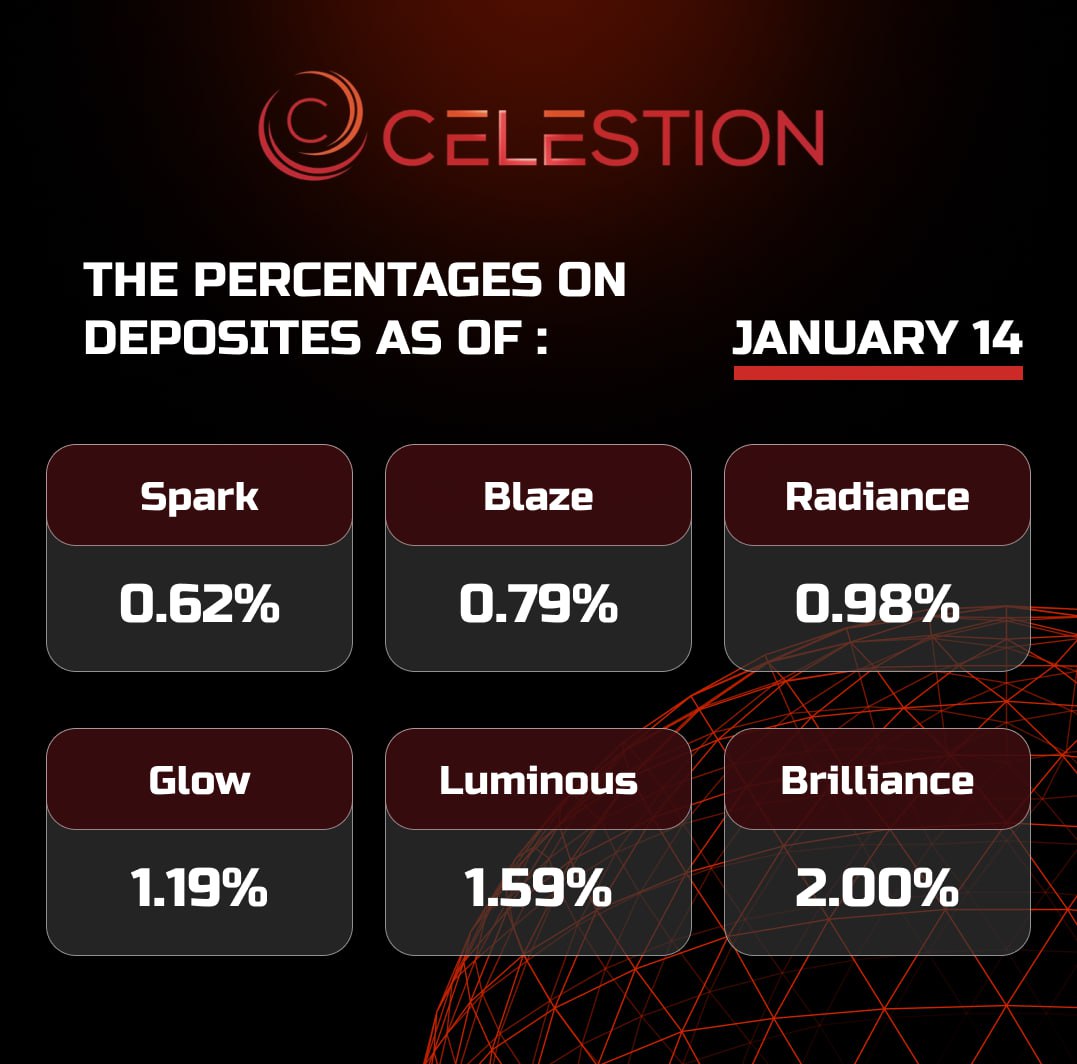

The percentages on deposits as of January 1️⃣4️⃣

Jan-14-2025

Read more

The number of bitcoins in MicroStrategy accounts has reached 450,000 ✔️

Jan-14-2025

According to a report filed by MicroStrategy with the U.S. Securities and Exchange Commission (SEC), the company spent about $243 million to buy bitcoin at an average price of $95,972 per coin between January 6 and January 12.

MicroStrategy Executive Chairman Michael Saylor wrote on social media X that the company holds 450,000 BTC as of January 13. That's about 2.1% of Bitcoin's total supply of 21 million coins. The company's average price for its total crypto assets was $62,691, and its expenses related to purchasing Bitcoin reached $28.2 billion.

MicroStrategy has been buying the top cryptocurrency for the tenth week in a row. Last week, the company announced the purchase of 1,070 BTC for $101 million in cash, at an average price of $94,004 per coin. These transactions were made after the company sold 710,425 of its shares.

In late October, MicroStrategy unveiled its ambitious “21/21” plan, which aims to raise $42 billion by 2027 through stock sales and convertible debt offerings. The funds will be used to continue buying Bitcoin.

In the fall, Michael Saylor promised to leave his accumulated bitcoins to humanity, since he has no children. However, a few months later, he announced that he would not leave his bitcoins to anyone - after his death, all the coins belonging to him will be burned.

Read more

The percentages on deposits as of January 1️⃣3️⃣

Jan-13-2025

Read more

10 Hot Tasks That Haven't Received Evaluation in the Crypto Community ✔️

Jan-13-2025

Generative AI is being actively discussed in the crypto community, often using the word "agent", whose work is coordinated using smart contracts. In addition, quantum computing is fashionable, focusing on post-quantum encryption and "future-proof" crypto protocols.

Meanwhile, there are tasks that have long been urgently needed to be completed. The author of the CryptoSlate publication listed ten of them.

1. Social Consensus . If there was ever an anachronism in the crypto ecosystem, the concept of “social consensus” is an example of it. It’s basically how so-called community leaders govern their clans. Well, it has no place in a crypto protocol in 2025.

2. On-chain governance . What happened to on-chain governance after social consensus? Too complicated? Have we simply given up? Do we still believe we can govern AI agents on-chain?

3. Value Extracted by Miners - Is it now acceptable for miners and block creators to make money by manipulating how transactions are prioritized, excluded, reordered, or changed in blocks?

4. The Oracle Problem . Is it now common knowledge that the Oracle Problem is an economic problem rather than a technical one? Is this collateral damage from the move to Proof-of-Stake? And are we heading back towards pseudo-centralization?

5. Centralized Stablecoins . Aren't centralized stablecoins essentially a version of CBDC? Why do we see two-faced resistance to (private) central banks when the use of cryptocurrencies is driven by (private) centralized stablecoin issuers?

6. Settlement Layers: L1 vs. L2 . There is no such thing as a settlement layer, just as there is no L1 vs. L2. Any network (including so-called L1s and alternative L1s) can become an L2 of another network by hosting ledger data and deploying a bridge contract. We need to stop confusing ourselves and get our terminology straight.

7. Privacy . Along the way, we've lost the cypherpunk spirit and the imperative of privacy. Perhaps the concept of privacy pools is how crypto protocols will eventually balance compliance and privacy.

8. Rollups - In practical terms, Rollups done right are mini-blockchains. Unfortunately, they have gone unnoticed and unassociated with issues like multi-signature rug pulling and centralized MEV and CR sequencers. A full-scale re-evaluation of the terminology and attitudes towards rollups is needed.

9. Centralized staking and block production . With the transition to Proof-of-Stake, we are faced with increasing consolidation (centralization) of both staking and block production. This significantly weakens censorship resistance and brings us back to the question of the need for trust, or lack thereof.

10. Funding for public goods . This topic continues to be at the forefront of crypto protocols. We need to remind ourselves that this is the highest priority task of all.

Read more

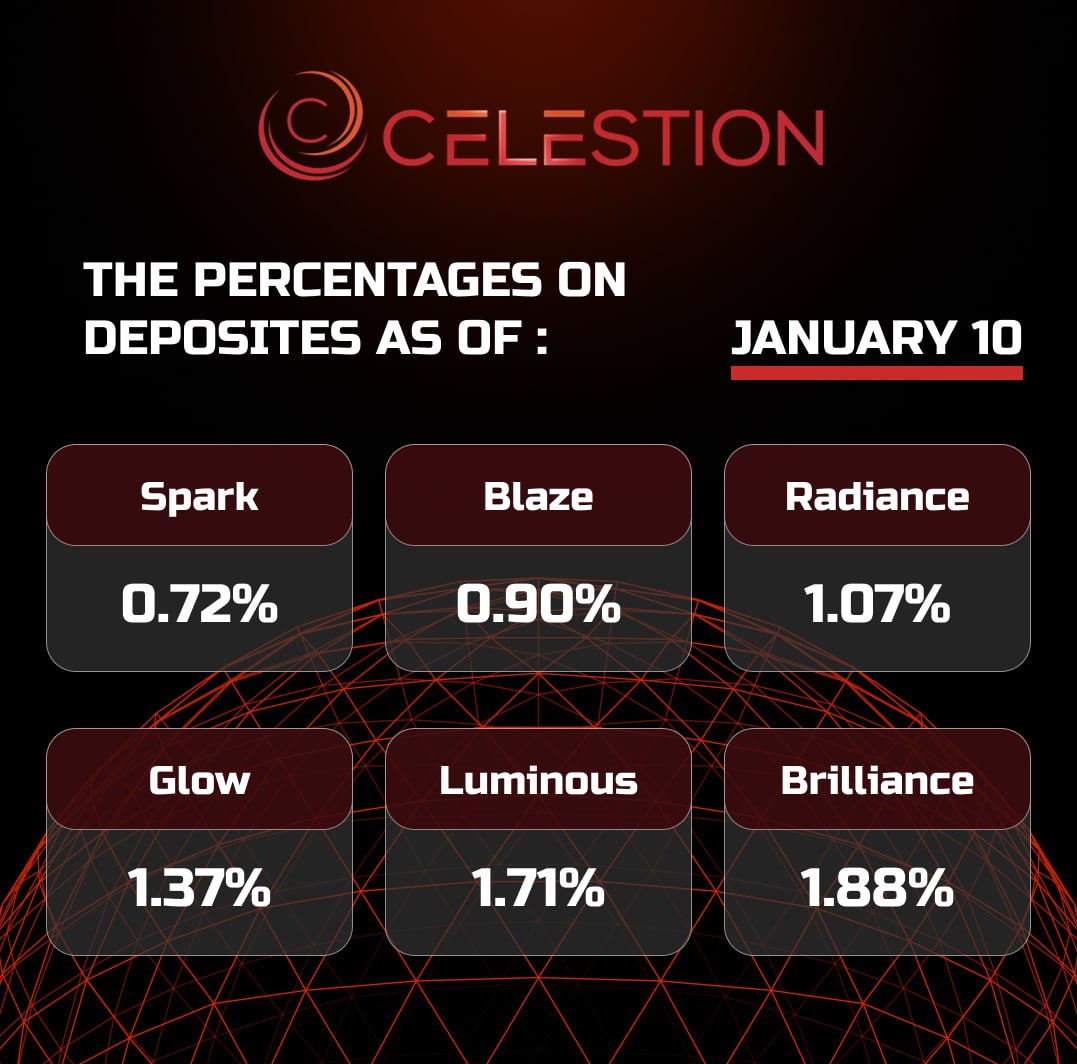

The percentages on deposits as of January 🔟

Jan-10-2025

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU