Hong Kong’s largest digital bank launches retail crypto trading ✔️

Nov-25-2024

Hong Kong’s largest virtual bank, ZA Bank, launched a new service allowing retail users to buy and sell Bitcoin and Ethereum directly using fiat.

According to a Nov. 25 statement from the bank, Hong Kong residents need an account with the bank and must undergo a risk assessment before using the new crypto service linked with the bank’s app.

Users can only buy Ethereum ETH

and Bitcoin BTC.

No other cryptocurrencies were mentioned.

Read more

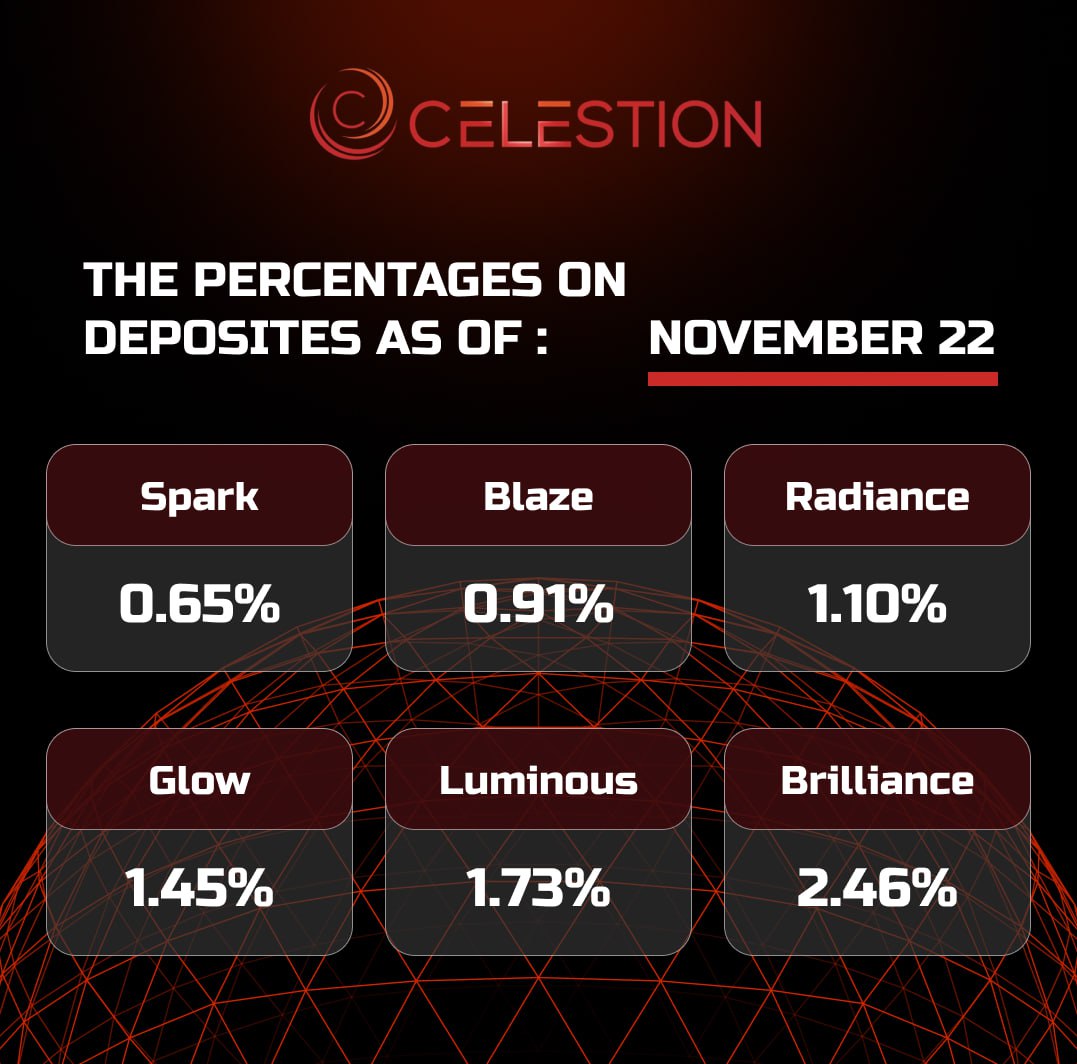

The percentages on deposits as of November 2️⃣2️⃣

Nov-22-2024

Read more

Spot Bitcoin ETF Asset Value Exceeds $100 Billion ☑️

Nov-22-2024

The combined net asset value of 12 US spot Bitcoin ETFs has reached $104 billion. This is almost 5.4% of the entire market capitalization of the flagship cryptocurrency.

If that figure continues to rise, Bitcoin funds could surpass the net asset value of gold ETFs, which were valued at $120 billion as of November 21.

The Bitcoin ETF is now 97% closer to surpassing Satoshi Nakamoto as the largest holder and 82% closer to surpassing the gold ETF , said Eric Balchunas, a stock analyst at Bloomberg Intelligence.

Comparison of Spot BTC ETFs and Gold ETFs

According to Bloomberg, BlackRock's iShares Bitcoin Trust (IBIT) has led the way in terms of net inflows since January 2024, with more than $30 billion. The second most popular bitcoin fund is the Fidelity Wise Origin Bitcoin Fund (FBTC), with investors pouring more than $11 billion into the ETF since its launch.

As data from investment giant BlackRock shows, IBIT now holds more assets than the same asset manager's gold ETF, despite the fact that the bitcoin fund was only launched in January 2024.

Read more

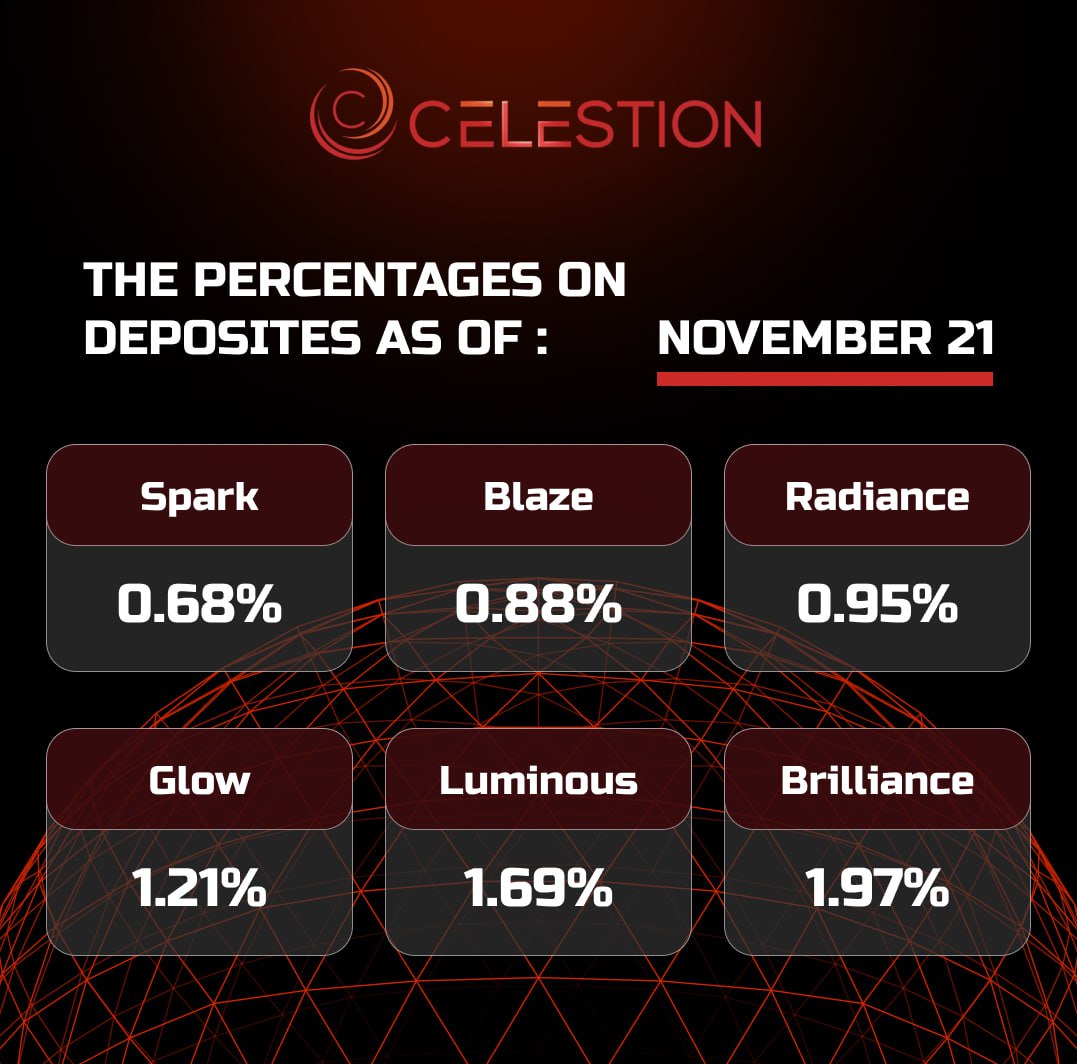

The percentages on deposits as of November 2️⃣1️⃣

Nov-21-2024

Read more

Options Traders Bet on Bitcoin Price Rising to $174,000 ✔️

Nov-21-2024

Options traders on the iShares Bitcoin Trust (IBIT) Bitcoin ETF, issued by BlackRock, are betting on the Bitcoin price rising to $174,000.

Following IBIT's listing on the Nasdaq exchange, during the first trading session, traders created:

70 million call options to purchase IBIT shares at $100 until the end of 2026;

30 million call options to purchase IBIT shares at $100 until the end of 2027.

If IBIT shares rise in price to $100, then the value of Bitcoin will reach approximately $174,000. Accordingly, it can be assumed that 70% of traders predict an increase in the price of BTC to this level within the next two years. Many analysts believe that the upward trend in the digital asset market will last until November next year at the latest. In this regard, options may be exercised much earlier than the expiration date of the contracts.

Meanwhile, the Bitcoin market has resumed its bullish rally. As expected, the BTC rate has broken through the upper line of the contracting triangle, rushed upward and is already at $96,887. Judging by the width of the figure and the place of the breakout, the value of the coin should increase to $98,730. But, most likely, the price of the cryptocurrency will reach the golden ratio at $102,000 and then begin to correct.

Possible change in the Bitcoin rate📈

Read more

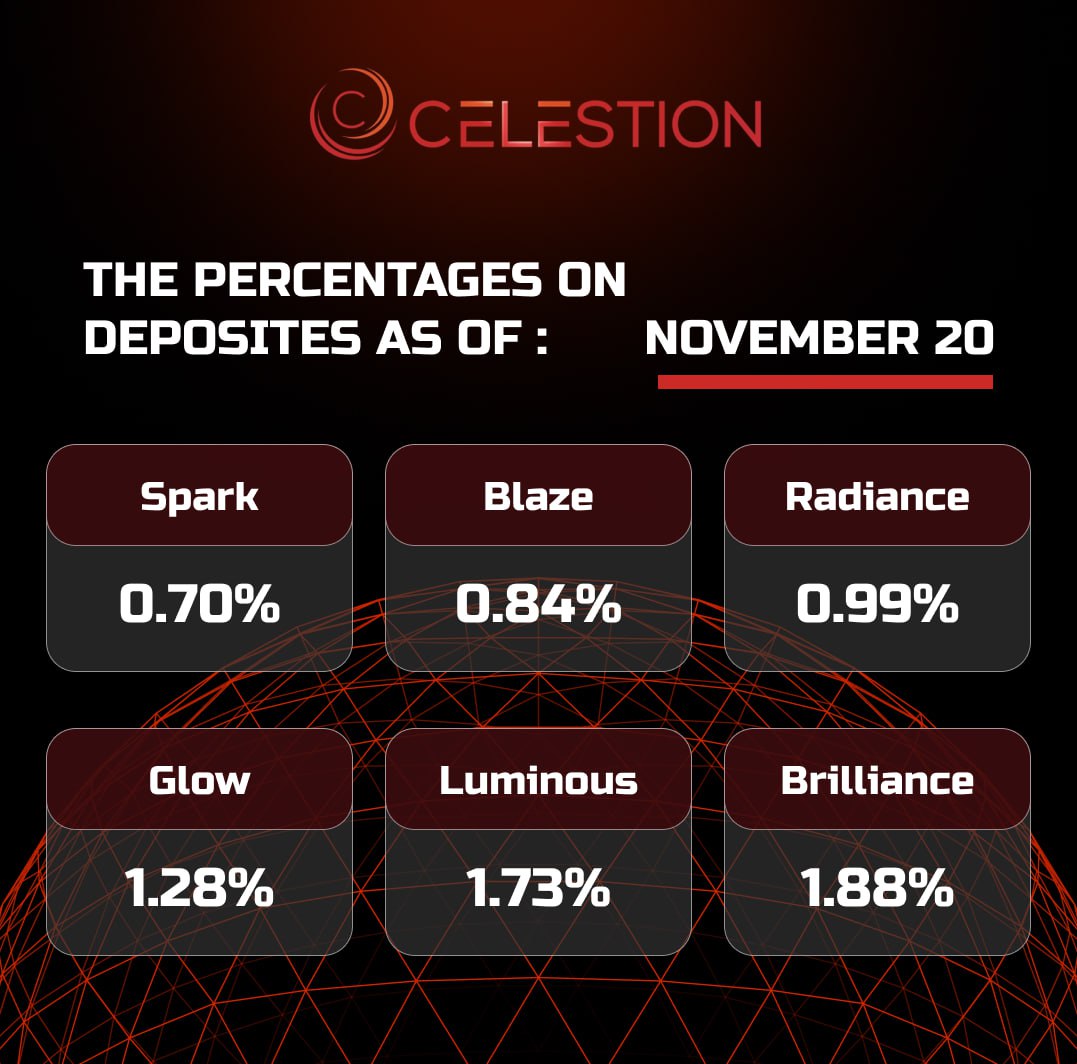

The percentages on deposits as of November 2️⃣0️⃣

Nov-20-2024

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU