Kraken Exchange to Launch Own Blockchain in 2025 ☑️

Oct-25-2024

One of the oldest cryptocurrency exchanges in the world, Kraken, plans to launch a blockchain for decentralized applications early next year that will allow trading, borrowing and lending tokens without intermediaries, similar to Base from the Coinbase (NASDAQ: COIN ) exchange.

The new network has already received the name Ink. According to the developers, the test version of the blockchain will be launched by the end of this year, and the main one in the first quarter of 2025.

By the time of the final launch, the Ink blockchain will support over 10 major applications — decentralized platforms and liquidity aggregators. According to the information provided, the network validators will be controlled only by the Kraken exchange, but later the network is planned to be decentralized. In addition, as the exchange representatives reported, the blockchain will not have a native token, at least for now.

The move marks an attempt by the crypto exchange to further expand its presence in the DeFi ecosystem and provide more decentralized services, joining its rival Coinbase, which has done the same with Base.

So, following the example of its biggest competitors like Binance and Coinbase, Kraken is releasing its blockchain — a move that should increase the number of users on the platform. A similar tactic once paid off for Binance and its BNB Chain.

Read more

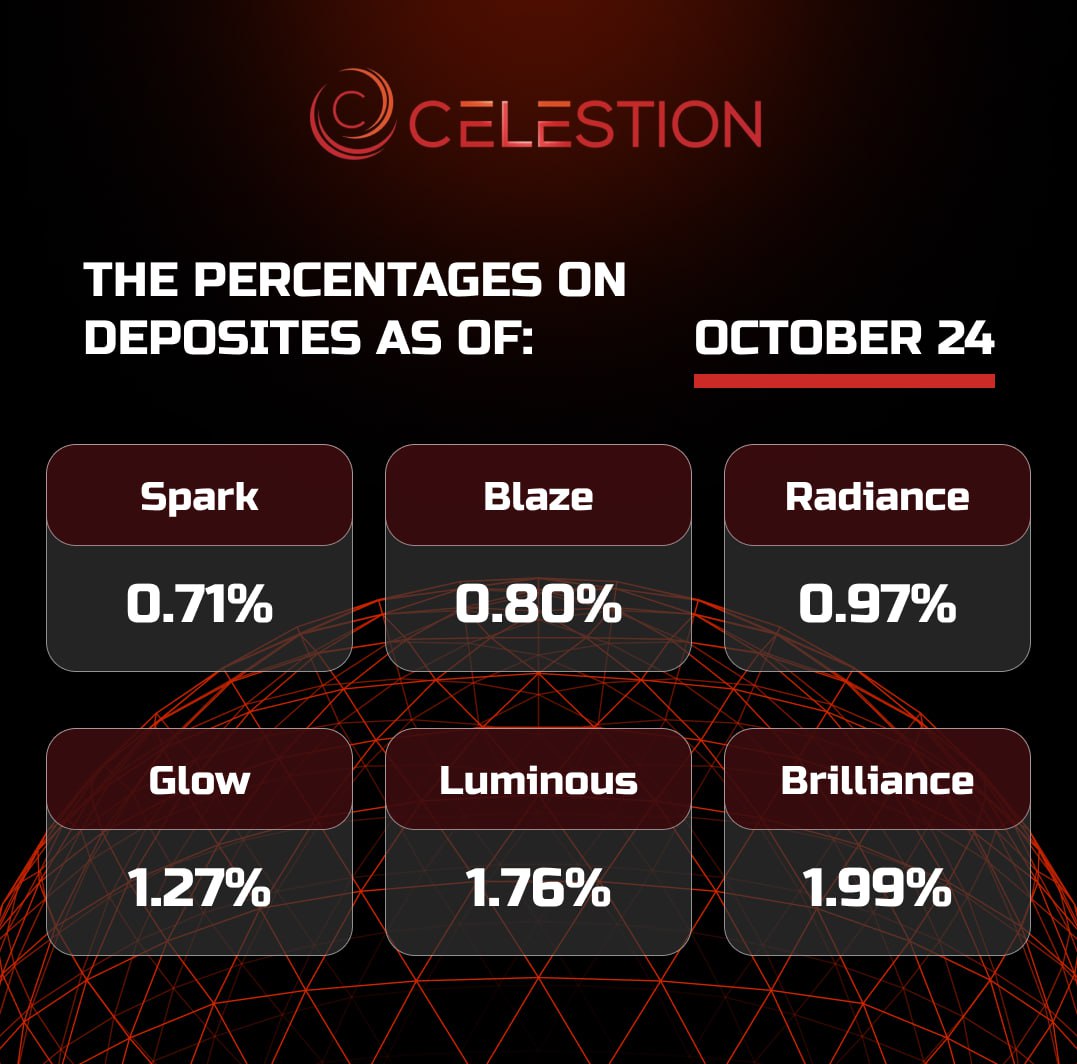

The percentages on deposits as of October 2️⃣4️⃣

Oct-24-2024

Read more

Robert Kiyosaki Tells What to Do With Bitcoin in October ☑️

Oct-24-2024

Renowned investor and author of the best-selling personal finance book “Rich Dad, Poor Dad” Robert Kiyosaki shares his opinion on what experienced investors should do during the month of “Uptober.”

Bitcoin's [expected] surge during Uptober signifies an opportunity to acquire more bitcoins, or “go ahead and say goodbye.”

Apparently, Kiyosaki believes the traditional October rise is still to come, and it will be substantial.

Bitcoin began rising on Oct. 10 after briefly falling below $59,000 earlier in the month. This has revived hopes that a rally to a new high near $100,000 is possible. Statistically, October has often been an outstanding month of strong bitcoin performance, with the impact of the bullish momentum extending into May.

Unlike other analysts and financiers, Kiyosaki is consistently optimistic about BTC and sees it, along with gold and silver, as the main safe haven from the devastating effects of the coming economic crisis.

Other experts express their confidence that despite the ups and downs, bitcoin remains in an uptrend and could rise above $85,000 by October 31.

Read more

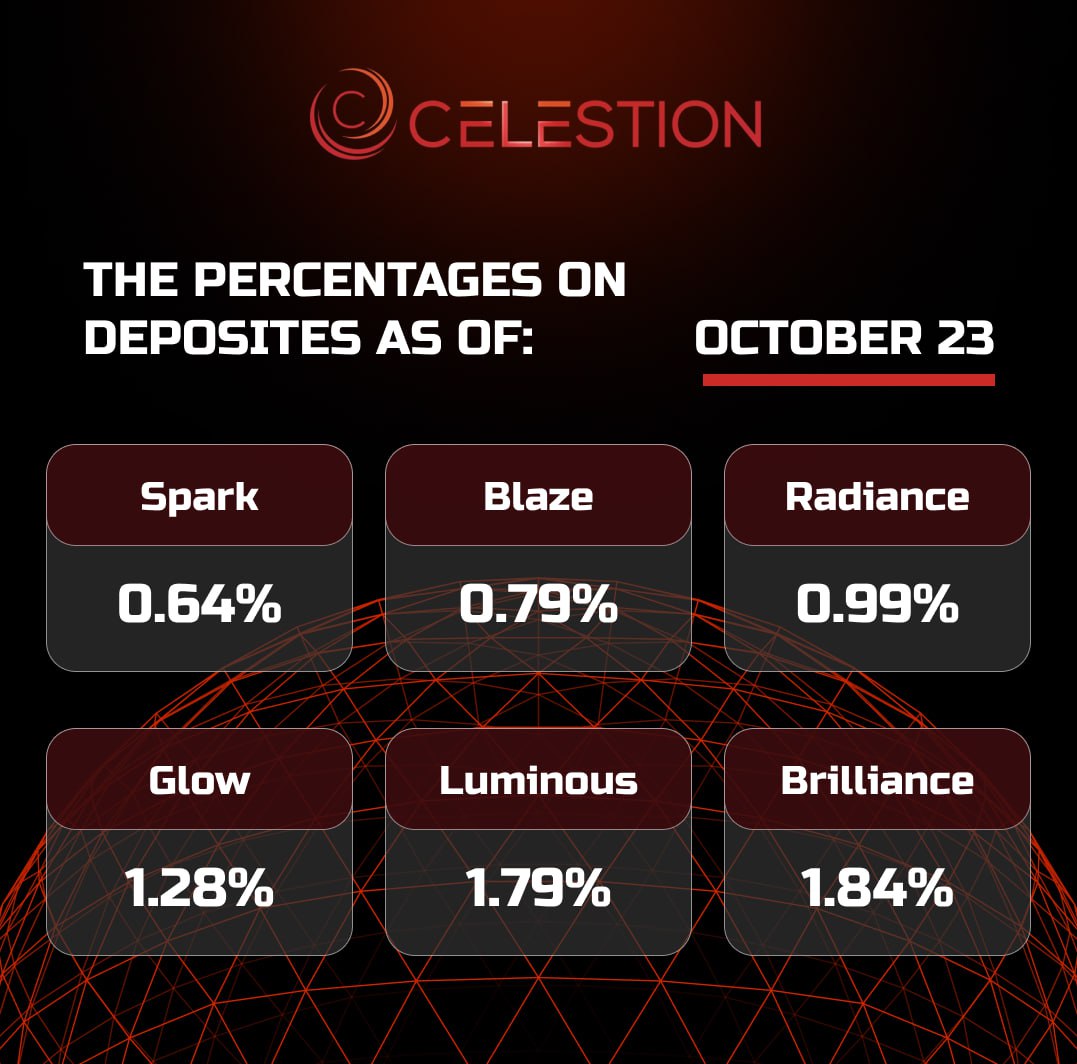

The percentages on deposits as of October 2️⃣3️⃣

Oct-23-2024

Read more

US Companies Own $13 Billion in Spot Bitcoin ETFs☑️

Oct-23-2024

Since January 2024, US corporate investors have purchased more than $13 million worth of Bitcoin- based ETFs , CryptoQuant CEO Ki Young Ju said.

Citing Form 13F, a quarterly document in which asset managers disclose information about U.S. stocks, Young Ju noted that in the 10 months since the launch of U.S. ETFs, 1,179 institutions have purchased 193,064 BTC.

Traditional financial giants like Millennium Management and Jane Street control 20% or 961,645 BTC, worth about $65 billion. These assets are spread across 11 ETFs issued by BlackRock, Bitwise, Grayscale, Fidelity and other issuers.

According to Bloomberg stock analysts Eric Balchunas and James Seyffarth, this indicates that asset managers are gradually getting used to new products based on the flagship cryptocurrency.

The most popular among institutional investors was BlackRock's IBIT. It also became the fastest-growing fund in US financial history. In a short period of time, it recorded the third-largest inflow of funds, competing with traditional ETFs that have existed for more than 20 years.

Read more

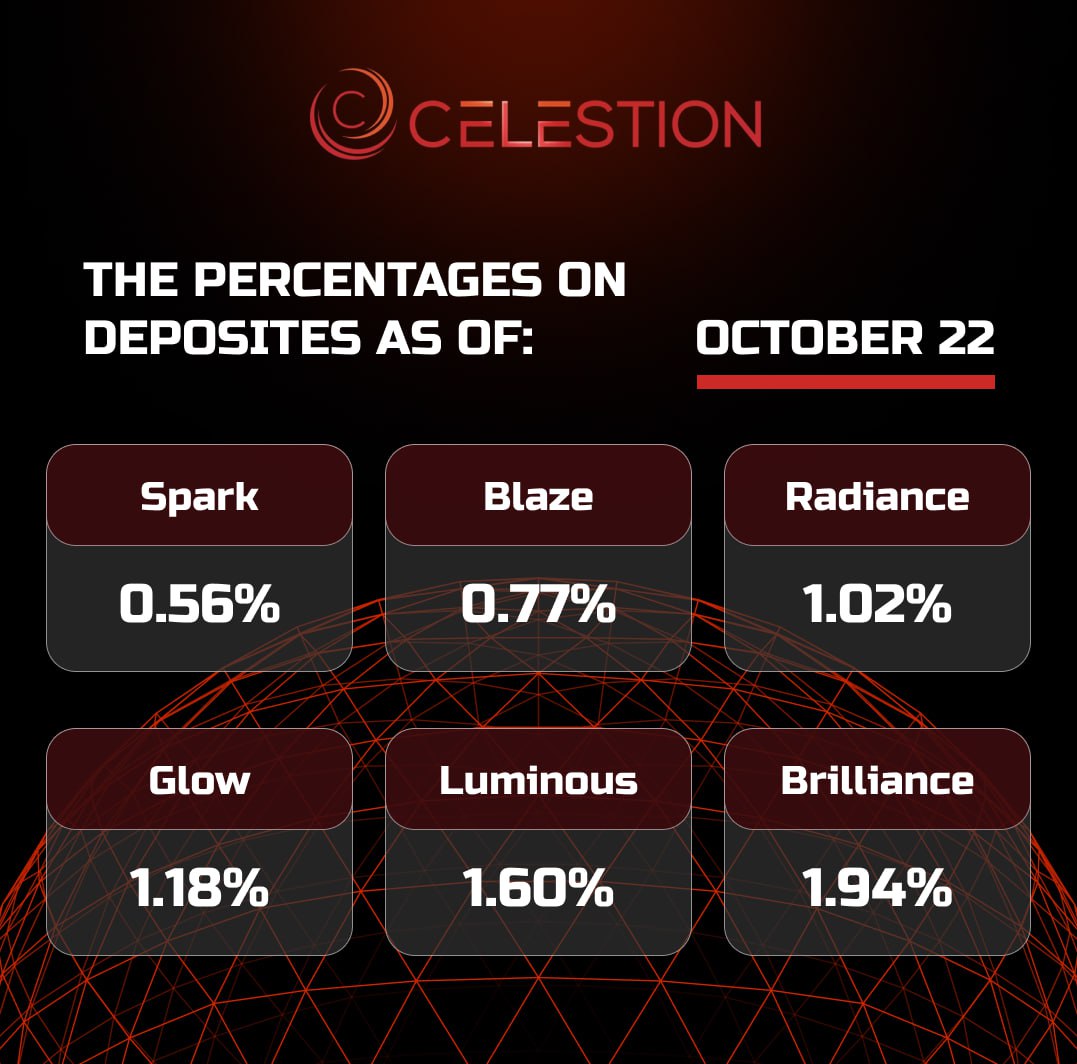

The percentages on deposits as of October 2️⃣2️⃣

Oct-22-2024

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU