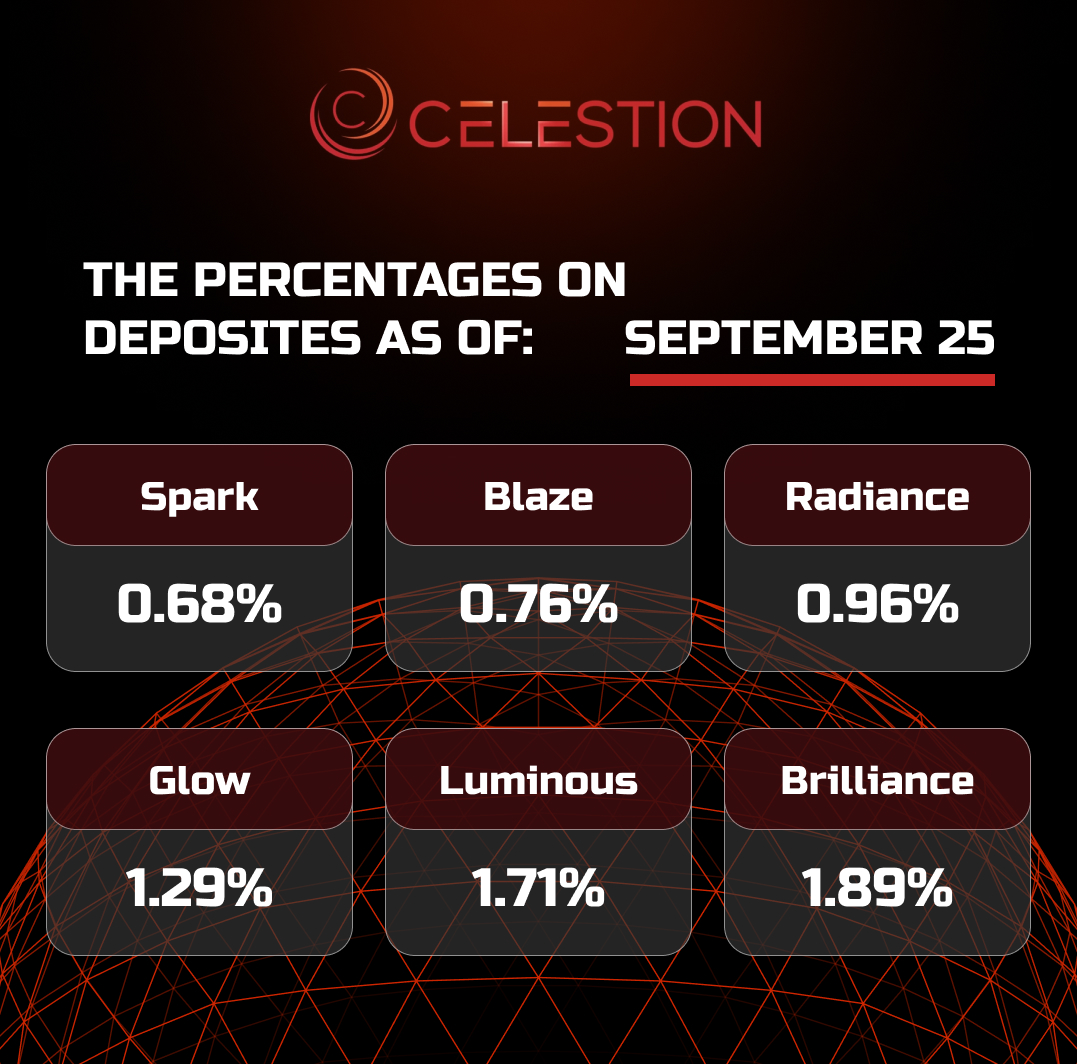

The percentages on deposits as of September 2️⃣5️⃣

Sep-25-2024

Read more

Celestion is an innovative online platform focused on cryptocurrency dividends.

Sep-25-2024

Celestion allows users to invest cryptocurrencies and receive dividends based on their digital assets.

The platform automates the income distribution process, offering users transparent and regular payouts.

Here are a few key features of the platform:

Ease of use: Celestion aims to make the process of managing cryptocurrency assets as easy as possible for users by offering a user-friendly interface and dividend analytics.

Integration with different blockchains: Support for popular cryptocurrencies, making the platform versatile for different types of investors.

Security and transparency: All transactions are recorded on the blockchain, providing a high degree of trust and security.

Read more

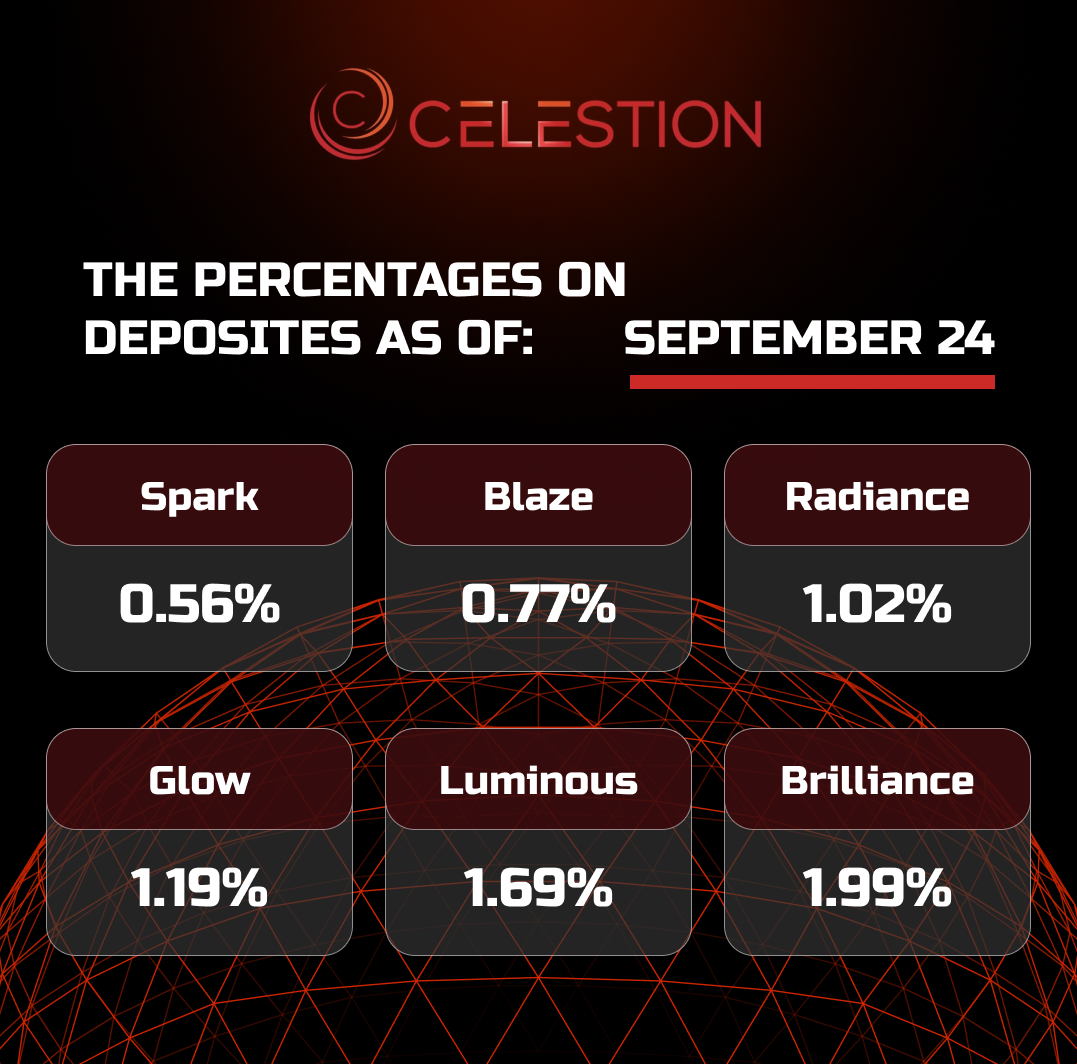

The percentages on deposits as of September 2️⃣4️⃣

Sep-24-2024

Read more

THE CELESTION ECOSYSTEM PROVIDES A WIDE RANGE OF DIGITAL OPPORTUNITIES AND TRUSTED CRYPTOCURRENCY SOLUTIONS ✅.

Sep-24-2024

Our platform provides exclusive tools to maximize your cryptocurrency investment returns, ensuring your financial security and empowering you.

Celestion is a trusted online cryptocurrency investment platform designed to maximize returns and provide financial security.

Our mission is to provide you with exclusive tools and resources to help you unlock the full potential of cryptocurrency investments.

At Celestion, you'll find a range of investment offers, affiliate and bonus systems, as well as advanced analytical tools and an intuitive interface to help you navigate the world of digital assets with confidence.

We understand that security is a priority. That's why the Celestion platform incorporates the latest data and transaction protection technologies, so you can focus on your investments without fear for your financial information.

By joining Celestion you will discover new opportunities to grow and achieve your financial purposes.

Start investing with confidence and expand your horizons of opportunity in the world of cryptocurrencies.

Read more

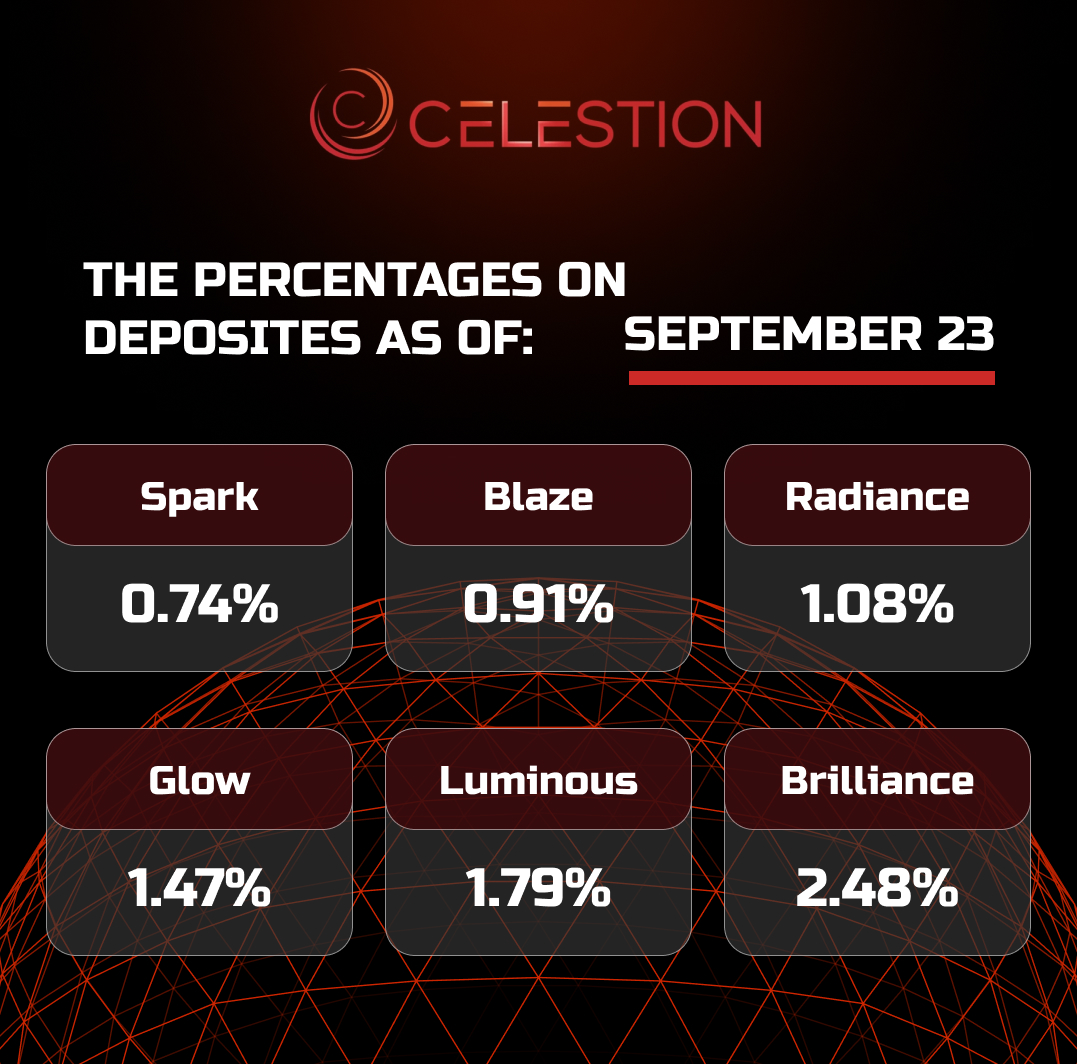

The percentages on deposits as of September 2️⃣3️⃣

Sep-23-2024

Read more

BNB Chain blockchain integrated with Telegram messenger ✅.

Sep-23-2024

The wallets will act as a gateway to access decentralized messenger apps and at the same time a portal of entry into the BNB Chain ecosystem, allowing assets to be managed without having to switch between multiple apps, the developers said.

“BNB Chain's main goal is to connect the next billion users to Web3. Telegram is used by millions of people around the world, and by providing seamless access to BNB Chain through bot wallets and simple authentication processes, our network positions itself as a key player in accomplishing this mission,” the release said.

Developers will be able to connect customers to their projects via Telegram using the Privy toolkit (an interface that collects and manages user data).

The registration and authorization process is done through a Telegram account, which increases the popularity of projects, BNB Chain representatives stressed.

Read more

EN

EN

CN

CN

DE

DE

TR

TR

GE

GE

KR

KR

ES

ES

VI

VI

FR

FR

JA

JA

IT

IT

TH

TH

KM

KM

LA

LA

HY

HY

RU

RU

UZ

UZ

HU

HU